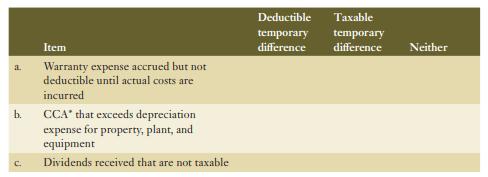

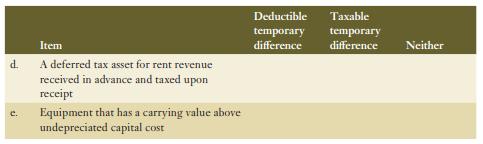

Identify whether the following items relate to a deductible temporary difference, a taxable temporary difference, or neither.

Question:

Identify whether the following items relate to a deductible temporary difference, a taxable temporary difference, or neither.

CCA = capital cost allowance

CCA = capital cost allowance

Transcribed Image Text:

a. b. Item Warranty expense accrued but not deductible until actual costs are incurred CCA* that exceeds depreciation expense for property, plant, and equipment Dividends received that are not taxable Deductible Taxable temporary difference temporary difference Neither

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (14 reviews)

a Deductible temporary difference This is because the expense is recorded in the financial statement...View the full answer

Answered By

Teresa ochieng

I have had several years of experience working as a tutor, both in person and online. I have worked with students of all ages and abilities, and have consistently received positive feedback from students and their parents.

As a tutor, I have honed my skills in breaking down complex concepts and explaining them in a way that is easily understood by my students. I am patient and understanding, and I am always willing to go the extra mile to help my students succeed.

I have a strong track record of helping my students improve their grades and test scores, and I have a passion for helping students reach their full potential. I have experience tutoring a wide range of subjects, including math, science, English, and history, and I am comfortable working with students at all levels.

Overall, I believe that my hands-on experience and proficiency as a tutor make me an excellent candidate for the SolutionInn Online Tutoring Platform. I am confident that I can provide valuable support and guidance to students who are looking to improve their academic performance.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Identify whether the following items are intangible assets according to the definition under IFRS: ItemIntangible asset (Yes/No) a. Cash b. Costs of research and development c. Computer software...

-

The following items relate to the activities of Schmidt Company for 2011: (a) Cash dividends declared and paid on common stock during the year totaled $90,000. In addition, on January 15, 2011,...

-

Identify whether the following items increase, decrease, or have no impact on cash flows: increase in raw materials decrease in accounts payable decrease in accounts receivable increase in finished...

-

In Exercises 1126, determine whether each equation defines y as a function of x. x + y = 25

-

Explain the terms in this equation: X = T + e. You might use a specific example; for instance, suppose that X represents your score on a measure of life satisfaction and T represents your true level...

-

The acceptance rate for a random sample of 15 medical schools in the United States was taken. The mean acceptance rate for this sample was 5.77 with a standard error of 0.56. Assume the distribution...

-

11. Describe two methods for measuring the effectiveness of your proposal efforts.

-

Larissa Company has a unit selling price of $250, variable costs per unit of $170, and fixed costs of $140,000. Compute the break-even point in units using (a) The mathematical equation and (b)...

-

Imperial Jewelers manufactures and sells a gold bracelet for $405.00. The company's accounting system says that the unit product cost for this bracelet is $261.00 as shown below: Direct materials...

-

Jackie Wong was an enthusiastic employee when she began working in the accounting department at Steelfab Corp. In particular, she prided herself in discovering better ways of handling invoice and...

-

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes, compute the effect of each difference on deferred taxes balances on...

-

Identify whether each of the following items would cause income taxes payable to be higher or lower than income tax expense. CCA = capital cost allowance b. C d. c. Item Rent revenue collected in...

-

How do you explain Stuarts attitude toward expenses? LO8

-

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt...

-

TBTF Incorporated purchased equipment on May 1, 2021. The company depreciates its equipment using the double-declining balance method. Other information pertaining to the equipment purchased by TBTF...

-

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark...

-

Data related to 2018 operations for Constaga Products, a manufacturer of sewing machines: Sales volume 5,000 units Sales price $300.00 per unit Variable production costs Direct materials 75.00 per...

-

6. (20 points) Sections 3.1-3.5, 3.7 Differentiate the following functions, state the regions where the functions are analytic. a. cos(e*) b. 1 ez +1 c. Log (z+1) (Hint: To find where it is analytic,...

-

Matchstix was started on January 1, Year 1. Year 1 Transactions 1. Acquired $50,000 cash by issuing common stock. 2. Earned $24,000 of revenue on account. 3. On October 1, Year 1, borrowed $22,000...

-

You are standing on the top of a building and throw a ball vertically upward. After 2 seconds, the ball passes you on the way down, and 2 seconds after that, it hits the ground below. a. What is the...

-

The trial balance for Hanna Resort Limited on August 31 is as follows: Additional information: 1. The balance in Prepaid Insurance includes the cost of four months premiums for an insurance policy...

-

On December 31, adjusting information for Big & Rich Corporation is as follows: 1. Estimated depreciation on equipment is $3,400. 2. Property taxes amounting to $2,525 have been incurred but are...

-

The adjusted trial balance of North Bay Corporation is provided in the following work sheet for the year ended December 31, 2020. Instructions The note payable is due in four months. Complete the...

-

Oct. 31: Paid salaries, $45,000 ( 75% selling, 25% administrtive). Data table Data table them to retail stores. The company has three inventory items: and floor lamps. RLC uses a perpetual inventory...

-

question 1- You borrow a simple loan of SR 500,000, interest rate is 20%, it matures in one year. what's the yied to maturity? question 2- calculate_i for One-Year Discount Bond with price(p) =...

-

Taste of Muscat is a reputed chain of restaurants operating in Oman. Assume You are working as a management accountant for this restaurant chain which is specialized in all types of Arabic food. Your...

Study smarter with the SolutionInn App