The adjusted trial balance of North Bay Corporation is provided in the following work sheet for the

Question:

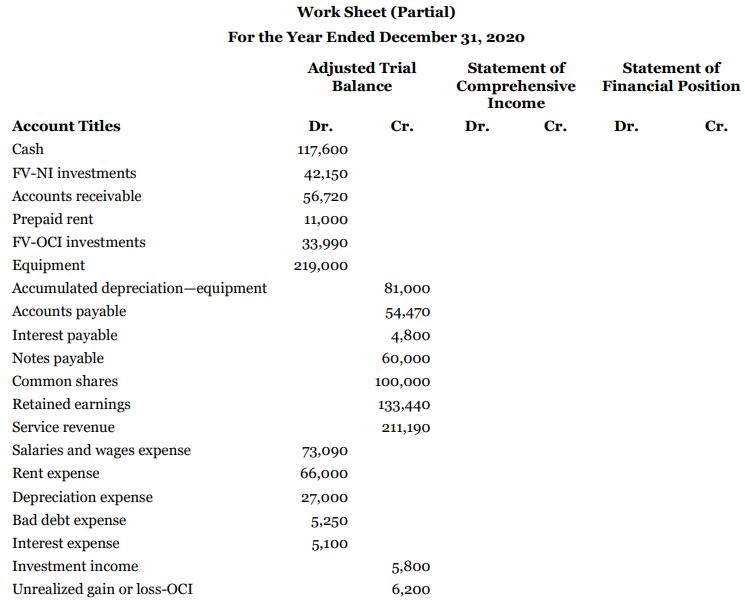

The adjusted trial balance of North Bay Corporation is provided in the following work sheet for the year ended December 31, 2020.

Instructions

The note payable is due in four months. Complete the work sheet and prepare a statement of financial position as illustrated in this appendix.

Work Sheet (Partial) For the Year Ended December 31, 2020 Adjusted Trial Balance Statement of Statement of Comprehensive Financial Position Income Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Cash 117,600 FV-NI investments 42,150 Accounts receivable 56,720 Prepaid rent 11,000 FV-OCI investments 33,990 Equipment 219,000 Accumulated depreciation-equipment 81,000 Accounts payable 54,470 Interest payable 4,800 Notes payable 60,000 Common shares 100,000 Retained earnings 133,440 Service revenue 211,190 Salaries and wages expense 73,090 Rent expense 66,000 Depreciation expense 27,000 Bad debt expense 5,250 Interest expense 5,100 Investment income 5,800 Unrealized gain or loss-OCI 6,200

Step by Step Answer:

From the adjusted trial balance we can easily prepare the income statement to calculate the Ne...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance of Bradley Irrigation System at December 31, 2018, follows: Requirements 1. Prepare the company's income statement for the year ended December 31, 2018. 2. Prepare the...

-

The adjusted trial balance of Blume Irrigation System at December 31, 2016, follows: Requirements 1. Prepare the companys income statement for the year ended December 31, 2016. 2. Prepare the...

-

The adjusted trial balance of Erickson Real Estate Appraisal at June 30, 2018, follows: Requirements 1. Prepare the company's income statement for the year ended June 30, 2018. 2. Prepare the...

-

Troy Engines, Ltd., manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An...

-

Nickel carbonyl, Ni (CO)4, is one of the most toxic substances known. The present maximum allowable concentration in laboratory air during an 8-hr workday is 1 ppb (parts per billion) by volume,...

-

Which of the following graphs best illustrates fixed costs per unit as the activ ity base changes?AppendixLO1 Costs per Unit (a) 0 Activity Base 0 Costs per Unit (b) Activity Base

-

Describe simplification, standardization, and specialization. Why are they important and why are they interrelated? LO.1

-

Do some reading in periodicals and/or on the Internet to find out more about the Sarbanes-Oxley Acts provisions for companies. Select one of those provisions, and indicate why you think financial...

-

Question # 1 Barhoms Cellular (BC) is a distributor and sells phones for $1250. BC gets the phones for $900 each. BC pays the sales staff a commission of 10% for each phone sold. BCs fixed selling,...

-

You are the owner of a small business that manages the program, food, and merchandise sales at the Excel Center, where the local professional basketball team plays. In addition to basketball games,...

-

On December 31, adjusting information for Big & Rich Corporation is as follows: 1. Estimated depreciation on equipment is $3,400. 2. Property taxes amounting to $2,525 have been incurred but are...

-

Pew Research published a study on Americans satisfaction with their current job (www .pewsocialtrends.org/2016/10/06/3-how-americans-viewtheir- jobs/). They found that 49% of American workers say...

-

Following is a schedule of the current assets and current liabilities of the Lewis Company: The Lewis Company operated at a loss during 1979. a Calculate the current ratio for each date. b Explain...

-

What work trait differences are similar in chart 1 and chart 2? Provide a comment for each of the 4 generations from each chart. Which work trait differences vary from those identified in chart 1 and...

-

Given the ALU design illustrated below, without changing the circuit design, please use the ALU to perform a logic NAND operation. Find out what the control signals should be (i.e. the values of...

-

Problem #5: Using the method of joints, determine the force in each member. State whether each member is in compression or tension. If the largest force each member can support is 4kN tension and 3kN...

-

Your cultural/social background and that of your family. What language, policies/structures and customs are relevant to your own culture? How do you think your own background impacts on people from...

-

In this second Case Assignment, the assignment is going to test your understanding of how successful teams operate efficiently through teamwork. Teamwork relies upon individuals to work together to...

-

The National Football League (NFL) is considering four cities for expansion: San Antonio (S), Portland (P), Honolulu (H), and Toronto (T). The 32 current owners rank the four candidates according to...

-

Find the image of x = k = const under w = 1/z. Use formulas similar to those in Example 1. y| y = 0 -21 -2 -1 -1, /1 12 T -1 -1 y= -2 x =0

-

The following is selected information from the accounting records of Slow Inc. for 20X9 its first year of operations: In determining pre-tax accounting earnings, the following deductions were made:...

-

The financial statements of Dakar Corp. for a four-year period reflected the following pre-tax amounts: Dakar has a tax rate of 40% each year and claimed CCA for income tax purposes as follows: 20X4,...

-

Consider the following independent scenarios: Scenario A Tomkin Inc. sells 6% convertible bonds for $1,080,000 that are due in 10 years. The market interest rate is 8%. Each $1,000 bond is...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App