The following is selected information from the accounting records of Slow Inc. for 20X9 its first year

Question:

The following is selected information from the accounting records of Slow Inc. for 20X9 its first year of operations:

![]()

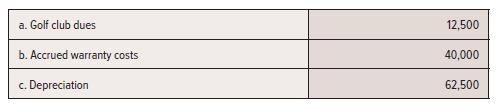

In determining pre-tax accounting earnings, the following deductions were made:

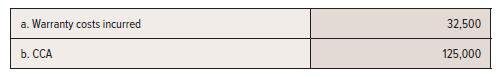

For tax purposes, the following deductions were made:

The capital assets, originally costing $625,000, are depreciated on a straight-line basis over 10 years, zero residual value, with a full year of depreciation taken in 20X9 as the assets were purchased at the start of the year. The tax rate is 36%.

Required:

Slow Inc. is a public company. Prepare the journal entry to record income tax at the end of 20X9.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: