The financial statements of Dakar Corp. for a four-year period reflected the following pre-tax amounts: Dakar has

Question:

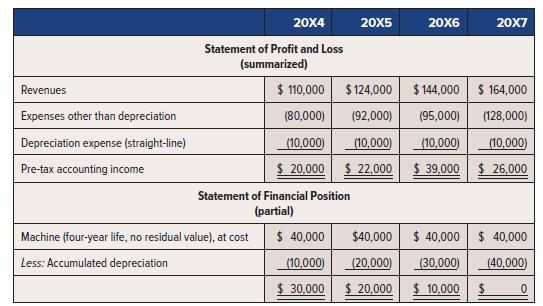

The financial statements of Dakar Corp. for a four-year period reflected the following pre-tax amounts:

Dakar has a tax rate of 40% each year and claimed CCA for income tax purposes as follows: 20X4, $16,000; 20X5, $12,000; 20X6, $8,000; and 20X7, $4,000. There were no deferred income tax balances at 1 January 20X4.

Required:

For each year, calculate the deferred income tax balance on the statement of financial position at the end of the year, and also net income.

Transcribed Image Text:

Revenues Expenses other than depreciation Depreciation expense (straight-line) Pre-tax accounting income 20X4 Statement of Profit and Loss (summarized) Statement of Financial Position (partial) $ 40,000 Machine (four-year life, no residual value), at cost Less: Accumulated depreciation $ 110,000 $ 124,000 (80,000) (92,000) (10,000) (10,000) $ 20,000 $ 22,000 20X5 (10,000) $ 30,000 20X6 20X7 $144,000 $164,000 (95,000) (128,000) (10,000) (10,000) $39,000 $26,000 $40,000 (20,000) (30,000) $ 20,000 $10,000 $ $ 40,000 $40,000 (40,000) 0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

A table can also be used for calculations Income tax expense liability method of tax al...View the full answer

Answered By

Parvesh Kumar

I am an experienced Mathematics and Statistics tutor with 10 years of experience teaching students and working professionals. I love teaching students who are passionate to learn subjects or wants to understand any mathematics and statistics concept at graduation or master’s level. I have worked with thousands of students in my teaching career. I have helped students deal with difficult topics and subjects like Calculus, Algebra, Discrete Mathematics, Complex analysis, Graph theory, Hypothesis testing, Probability, Statistical Inference and more. After learning from me, students have found Mathematics and Statistics not dull but a fun subject. I can handle almost all curriculum of mathematics. I did B.Sc (mathematics), M.Sc (mathematics), M.Tech (IT) and am also Gate (CS) qualified. I have worked in various college and school and also provided online tutoring to American and Canadian students. I look forward to discussing with you and make learning a meaningful and purposeful

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

On 1 January 2020, P Ltd acquired 90% of ownership of S Ltd. Fair value of non-controlling interests at the date of acquisition was $600,000. The financial statements of P Lid and S Ltd for the year...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following are the financial statements of Post Corporation and its subsidiary, Sage Company, as at December 31, Year 3: Additional Information ¢ Post purchased 70% of the outstanding shares...

-

When developing cost functions, which of the following statements is FALSE? A. Personal observations of costs and activities provide the best evidence of a plausible relationship between a cost and...

-

Using the results in Table 4.2 (page 165), estimate the probability that a randomly selected 21- to 49- year- old consumer would: a. Give the phrase a rating of 4 or 5 given that the consumer is...

-

hello, I am working through a question around identifying the contribution margin and break even point and I am stuck. would you help me by working through this problem and explaining your process? 0...

-

Describe how various combinations of price, fixed cost, and unit variable cost affect a firms break-even point.

-

You are the sales manager of a two-year-old electronics firm. At times, the firm has seemed to be on the brink of failure but recently has begun to be profitable. In large part, the profitability is...

-

Poseidon Electronics operates 10 stores in Washington, Oregon, and California, selling consumer electronics including home theater systems. The following financial information is available for 2021...

-

The following is selected information from the accounting records of Slow Inc. for 20X9 its first year of operations: In determining pre-tax accounting earnings, the following deductions were made:...

-

Consider the following independent scenarios: Scenario A Tomkin Inc. sells 6% convertible bonds for $1,080,000 that are due in 10 years. The market interest rate is 8%. Each $1,000 bond is...

-

Companies that are publicly traded may engage in "earnings management" by manipulating their financial numbers in order to meet Wall Street estimates and present more favorable results. Discuss how a...

-

Sunland Corp. exchanged Building 24, which has an appraised value of $1,815,000, a cost of $2,842,000, and accumulated depreciation of $1,272,000, for Building M which belongs to Oriole Ltd. Building...

-

Conlon Chemicals manufactures paint thinner. Information on the work in process follows: -Beginning Inventory, 43,000 partially complete gallons -Transferred out, 211300 gallons -Ending inventory...

-

Mr . Nikola Tesla launched Tesla Supermart on December 1 , 2 0 x 1 with a cash investment of 1 5 0 , 0 0 0 . The following are additional transactions for the month: 2 Equipment valued at 2 0 , 0...

-

The Robots: Stealing Our Jobs or Solving Labour Shortages? As the coronavirus pandemic enveloped the world, businesses increasingly turned to automation in order to address rapidly changing...

-

Aquazona Pool Company is a custom pool builder. The company recently completed a pool for the Drayna family ( Job 1 3 2 4 ) as summarized on the incomplete job cost sheet below. Assume the company...

-

The resistivity of a metal increases slightly with increased temperature. This can be expressed as = 0 [1 + (T - T 0 )], where T 0 is a reference temperature, usually 20C, and is the temperature...

-

What are the key dimensions of critical thinking 2. Watch the NBC Learn video on Diet Scams. What types of claims are made in this video Are they valid Elaborate on your responses. Discuss this video...

-

Lalonde Ltd., a public company following IFRS, recently signed a lease for equipment from Costner Ltd. The lease term is five years and requires equal rental payments of $25,173 at the beginning of...

-

Use the information for Lalonde and Costner from BE202. Explain, using numbers, how Costner determined the amount of the lease payment of $25,173. In BE Lalonde Ltd., a public company following IFRS,...

-

Crown Inc. (CI) is a private company that manufactures a special type of cap that fits on a bottle. At present, it is the only manufacturer of this cap and therefore enjoys market security. The...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

-

Kirk and Spock formed the Enterprise Company in 2010 as equal owners. Kirk contributed land held an investment ($50,000 basis; $100,000 FMV), and Spock contributed $100,000 cash. The land was used in...

Study smarter with the SolutionInn App