On 1 January 2020, P Ltd acquired 90% of ownership of S Ltd. Fair value of non-controlling interests at the date of acquisition was

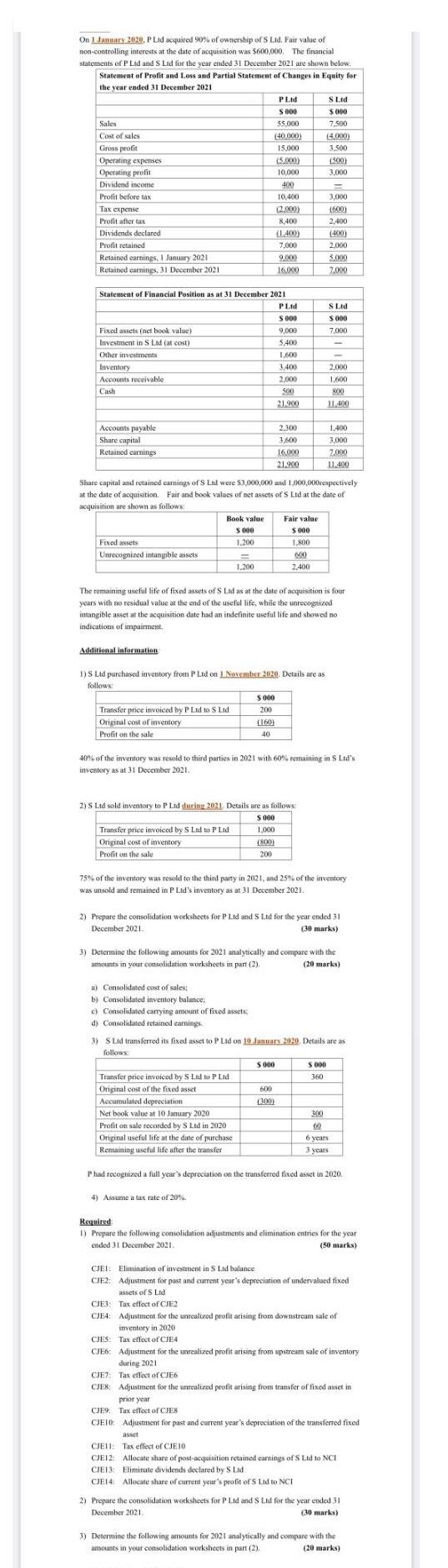

On 1 January 2020, P Ltd acquired 90% of ownership of S Ltd. Fair value of non-controlling interests at the date of acquisition was $600,000. The financial statements of P Lid and S Ltd for the year ended 31 December 2021 are shown below. Statement of Profit and Loss and Partial Statement of Changes in Equity for the year ended 31 December 2021 Sales Cost of sales Gross profit Operating expenses Operating profit Dividend income Profit before tax Tax expense Profit after tas Dividends declared Profit retained Retained earnings, 1 January 2021 Retained earnings, 31 December 2021 Fixed assets (net book value) Investment in S Ltd (at cost). Other investments Inventory Accounts receivable. Cash Accounts payable Share capital Retained earnings Statement of Financial Position as at 31 December 2021 PLtd S000 9,000 5.400 1,600 Fixed assets Unrecognized intangible assets Additional information Book value S 000 1,200 Transfer price invoiced by P Ltd to S Lid Original cost of inventory Profit on the sale = 1,200 55,000 (40.000) 15,000 Transfer price invoiced by S Ltd to P Ltd Original cost of inventory Profit on the sale PLtd $ 000 (5.000) 10,000 400 10,400 (2.000) 8,400 (1.400) 7,000 9.000 16,000 $ 000 200 (160) 40 3,400 2,000 500 21.900 a) Consolidated cost of sales; b) Consolidated inventory balance: c) Consolidated carrying amount of fixed assets d) Consolidated retained earnings 1)S Ltd purchased inventory from P Ltd on 1 November 2620. Details are as follows: 4) Assume a tax rate of 20% 2.300 3,600 16,000 21.900 Share capital and retained earnings of S Lid were $3,000,000 and 1,000,000respectively at the date of acquisition. Fair and book values of net assets of S Ltd at the date of acquisition are shown as follows: 2)S Ltd sold inventory to P Lad during 2021. Details are as follows: $ 000 1,000 (800) 200 |||||||| Fair value $ 000 1,800 600 2.400 600 (300) The remaining useful life of fixed assets of S Lad as at the date of acquisition is four years with no residual value at the end of the useful life, while the unrecognized intangible asset at the acquisition date had an indefinite useful life and showed no indications of impairment. $ 000 S Ltd $ 000 7,500 (4.000) 3.500 (500) 3.000 3,000 (600) 2,400 (400) 2,000 5.000 7,000 S Ltd $000 7,000 40% of the inventory was resold to third parties in 2021 with 60% remaining in S Ltd's inventory as at 31 December 2021. - 2,000 1,600 800 11,400 75% of the inventory was resold to the third party in 2021, and 25% of the inventory was unsold and remained in P Lid's inventory as at 31 December 2021. $ 000 360 1,400 3.000 7.000 11.400 2) Prepare the consolidation worksheets for P Ltd and S Ltd for the year ended 31 December 2021. (30 marks) 3) Determine the following amounts for 2021 analytically and compare with the amounts in your consolidation worksheets in part (2). (20 marks) 3) SLtd transferred its fixed asset to P Ltd on 10 January 2020. Details are as follows: Transfer price invoiced by S Ltd to P Lid Original cost of the fixed asset Accumulated depreciation Net book value at 10 January 2020 Profit on sale recorded by S Ltd in 2020 Original useful life at the date of purchase Remaining useful life after the transfer P had recognized a full year's depreciation on the transferred fixed asset in 2020. 300 60 6 years 3 years Required 1) Prepare the following consolidation adjustments and elimination entries for the year ended 31 December 2021. (50 marks) CJEI: Elimination of investment in S Ltd balance CJE2: Adjustment for past and current year's depreciation of undervalued fixed assets of S Ltd CJE3: Tax effect of CJE2 CJE4: Adjustment for the unrealized profit arising from downstream sale of inventory in 2020 CJES: Tax effect of CJE4 CJE6 Adjustment for the unrealized profit arising from upstream sale of inventory during 2021 CJE7: Tax effect of CJE6 CJES: Adjustment for the unrealized profit arising from transfer of fixed asset in prior year CJE9 Tax effect of CJES CJE10 Adjustment for past and current year's depreciation of the transferred fixed asset CJEII: Tax effect of CJE10 CJE12: Allocate share of post-acquisition retained earnings of S Ltd to NCI CJE13: Eliminate dividends declared by S Lid CJE14 Allocate share of current year's profit of S Ltd to NCI 2) Prepare the consolidation worksheets for P Ltd and S Ltd for the year ended 31 December 2021. (30 marks) 3) Determine the following amounts for 2021 analytically and compare with the amounts in your consolidation worksheets in part (2). (20 marks) a) Consolidated cost of sales b) Consolidated inventory balance c) Consolidated carrying amount of fixed assets Consolidated retained earnings

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

WNI Statement of Nell Assets of Leaf Share Capital Revaluation Reserve on NCA Reserve Surplus 810030...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started