For each of the following differences between the amount of taxable income and income recorded for financial

Question:

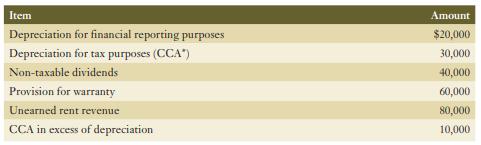

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes, compute the effect of each difference on deferred taxes balances on the balance sheet. Treat each item independently of the others. Assume a tax rate of 25%.

CCA = capital cost allowance

Transcribed Image Text:

Item Depreciation for financial reporting purposes Depreciation for tax purposes (CCA*) Non-taxable dividends Provision for warranty Unearned rent revenue CCA in excess of depreciation Amount $20,000 30,000 40,000 60,000 80,000 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

Depreciation for financial reporting purposes This difference will not have any effect on deferred t...View the full answer

Answered By

Ernie Moises Evora

I have worked as a teacher, a tutor and instructor.

I have also worked as a community leader in my community.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Compute SWK Inc.'s tax liability for each of the following scenarios: a. SWK's taxable income is $60,000. b. SWK's taxable income is $275,000. c. SWK's taxable income is $15,500,000. d. SWK's taxable...

-

For each of the following income statement line items, state whether the item is a by nature expense item or a by function expense item. ________ Cost of goods sold ________ Depreciation expense...

-

Compute the debt-to-equity ratio for each of the following companies. Which company appears to have a riskier financing structure?Explain. Canal Company $492,000 656,000 Sears Company 384.000...

-

In Exercises 1126, determine whether each equation defines y as a function of x. x + y = 16

-

How is related to p, the number of items, when the mean inter-item correlation is held constant?

-

A researcher collects one sample of 27 measurements from a population and wants to find a 95% confidence interval. What value should he use for t*? (Recall that df = n - 1 for a one-sample...

-

12. Develop a complete proposal in response to the RFP you created for question

-

Bridgeport Delivery Service is owned and operated by Jerome Foley. The following selected transactions were completed by Bridgeport Delivery Service during February: 1. Received cash from owner as...

-

Melissa is a partner in a continuing partnership. at the end of the current year, the partnership makes a proportionate, non liquidating distribution to Melissa of $50,00 cash, inventory (basis of...

-

What risks do you feel P&G will face going forward?

-

The following summarizes information relating to Grafton Corporations operations for the current year: Required: Compute the amount of taxes payable and income tax expense for Grafton Corporation....

-

Identify whether the following items relate to a deductible temporary difference, a taxable temporary difference, or neither. CCA = capital cost allowance a. b. Item Warranty expense accrued but not...

-

A new project will generate sales of $74 million, costs of $42 million, and depreciation expense of $10 million in the coming year. The firm's tax rate is 35%. Calculate cash flow for the year by...

-

Rosita Flores owns Rosita's Mexican Restaurant in Tempe, Arizona. Rosita's is an affordable restaurant near campus and several hotels. Rosita accepts cash and checks. Checks are deposited...

-

Your second task will require you to recover a payload from the conversation. Just need 2.3. Need you to explain step by step, and concept by concept if possible. Use wireshark. Tell me your answer...

-

2. Supply for art sketchbooks at a price of $p per book can be modelled by P <10 S(p) = = textbooks. p3+p+3 p 10 (a) What is the producer revenue at the shutdown point? (b) What is the producer...

-

Patterson Company produces wafers for integrated circuits. Data for the most recent year are provided: Expected Consumption Ratios Activity Driver Wafer A Wafer B Inserting and sorting process...

-

The elementary gas-phase reaction 2A + B C+D is carried out isothermally at 450 K in a PBR with no pressure drop. The specific reaction rate was measured to be 2x10-3 L/(mol-min-kgcat) at 50C and the...

-

The following information was drawn from the records of Tristan Company: Accounts payable (ending) ......................................................$12,000 Cash collected from accounts...

-

The rate at which the temperature of an object changes is proportional to the difference between its own temperature and the temperature of the surrounding medium. Express this rate as a function of...

-

Pelican Inc. made a December 31 adjusting entry to debit Salaries and Wages Expense and credit Salaries and Wages Payable for $2,700. On January 2, Pelican paid the weekly payroll of $5,000. Prepare...

-

Tiger Inc. has the following year-end account balances: Sales Revenue $928,900; Interest Income $17,500; Cost of Goods Sold $406,200; Operating Expenses $129,000; Income Tax Expense $55,100; and...

-

Using the information from BE18.3, prepare Nilson's journal entry to record 2020 income tax. Assume a tax rate of 25% and that Nilson uses the taxes payable method of accounting for income taxes...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

-

Regarding research and experimental expenditures, which of the following are not qualified expenditures? 3 a. costs of ordinary testing of materials b. costs to develop a plant process c. costs of...

-

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting...

Study smarter with the SolutionInn App