The following summarizes information relating to Grafton Corporations operations for the current year: Required: Compute the amount

Question:

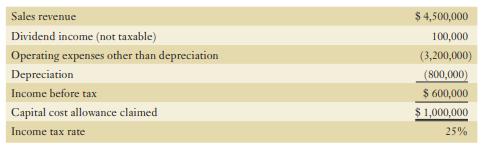

The following summarizes information relating to Grafton Corporation’s operations for the current year:

Required:

Compute the amount of taxes payable and income tax expense for Grafton Corporation.

Transcribed Image Text:

Sales revenue Dividend income (not taxable) Operating expenses other than depreciation Depreciation Income before tax Capital cost allowance claimed Income tax rate $4,500,000 100,000 (3,200,000) (800,000) $ 600,000 $1,000,000 25%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

The amount of taxes payable and income tax expense for Grafton C...View the full answer

Answered By

BillClinton Muguai

I have been a tutor for the past 5 years. I have experience working with students in a variety of subject areas, including computer science, math, science, English, and history. I have also worked with students of all ages, from elementary school to college. In addition to my tutoring experience, I have a degree in education from a top university. This has given me a strong foundation in child development and learning theories, which I use to inform my tutoring practices.

I am patient and adaptable, and I work to create a positive and supportive learning environment for my students. I believe that all students have the ability to succeed, and it is my job to help them find and develop their strengths. I am confident in my ability to tutor students and help them achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

For its current tax year, Ilex Corporation has ordinary income of $240,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporation's tax liability...

-

The following journal entry summarizes for the current year the income tax expense of Wilsons Software Warehouse: Income Tax Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

The following journal entry summarizes for the current year the income tax expense of Sophie's Software Warehouse. Income tax expense..................................................1,500,000 Cash...

-

Use the graph of f to solve Exercises 924. Where applicable, use interval notation. Find the x-intercept(s). y = f(x) # [TD y X

-

Why is it important to make certain that all the items in a scale are scored in the same direction before you enter your variables into the reliability program to compute a Cronbach alpha?

-

A random sample of 25 baseball players from the 2017 Major League Baseball season was taken and the sample data was used to construct two confidence intervals for the population mean. One interval...

-

13 at the end of Chapter 2.

-

At the beginning of its fiscal year, Caf Med leased restaurant space from Crescent Corporation under a nine-year lease agreement. The contract calls for annual lease payments of $25,000 each at the...

-

Partnership(taxation) Assume that all partnership interests expressed as percentages are those percentages of both profits/losses and capital. Assume that all liabilities are recourse. a) Three...

-

The Roopchand Departmental Stores, New Delhi, has a separate section to sell winter garments. This section consists of two groups : permanent clerks and temporary clerks appointed during winter...

-

A company has income before tax of $300,000, which includes a permanent difference of $60,000 relating to non-taxable dividend income. There are no other permanent or temporary differences. The...

-

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes, compute the effect of each difference on deferred taxes balances on...

-

The data below are for Marvin Department Store. The account balances (in thousands) are for 2019. Marketing, distribution, and customer-service costs $ 37,000 Merchandise inventory, January 1, 2019...

-

speed of the three phase motor does not vary greatly from the experiment. 1. Draw the symbol for a Three Phase Electric Motor. (Hint: remember the symbol table from the beginning of the semester?) 2....

-

Lifetime Insurance Company has two supporting departments (actuarial and premium), and two production departments (advertising and sales). Data from operations for the current year are as follows:...

-

Consider a wireless local area network (LAN) with an access point and 10 stations (Station 1, Station 2, Station 3, , and Station 10). Distributed coordination function (DCF), which is based on...

-

A worker needs to pump water from a reservoir to a big container that is open to the atmosphere. The water velocity at the surface of the reservoir is 2.5 m/s. The worker uses a 35-m long, 18-cm...

-

Identify each fringe benefit provided to Maggie and determine whether an exemption applies. (6 marks) Question 2: Explain the impact the fringe benefits will have on Maggie's taxable income and/or...

-

Obtain the Target Corporations annual report at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. Which accounts on Targets balance...

-

a. Determine the domain and range of the following functions.b. Graph each function using a graphing utility. Be sure to experiment with the window and orientation to give the best perspective of the...

-

In June 2021, the board of directors for Holtzman Enterprises Inc. authorized the sale of $10 million of corporate bonds. Michelle Collins, treasurer for Holtzman Enterprises Inc., is concerned about...

-

Penron Limited is in the energy business, buying and selling gas and oil and related derivatives. It is a public company whose shares are widely held. It underwent a tremendous expansion over the...

-

On August 1, Secret Sauce Technologies Inc. paid $12,600 for an insurance policy that is for two years and is effective August 1. Prepare two sets of journal entries for Secret Sauce, with each set...

-

Calculate the current ratio and the quick ratio for the following partial financial statement for Tootsie Roll Note: Round your answers to the nearest hundredth

-

Required information Skip to question [ The following information applies to the questions displayed below. ] Golden Corporation's current year income statement, comparative balance sheets, and...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

Study smarter with the SolutionInn App