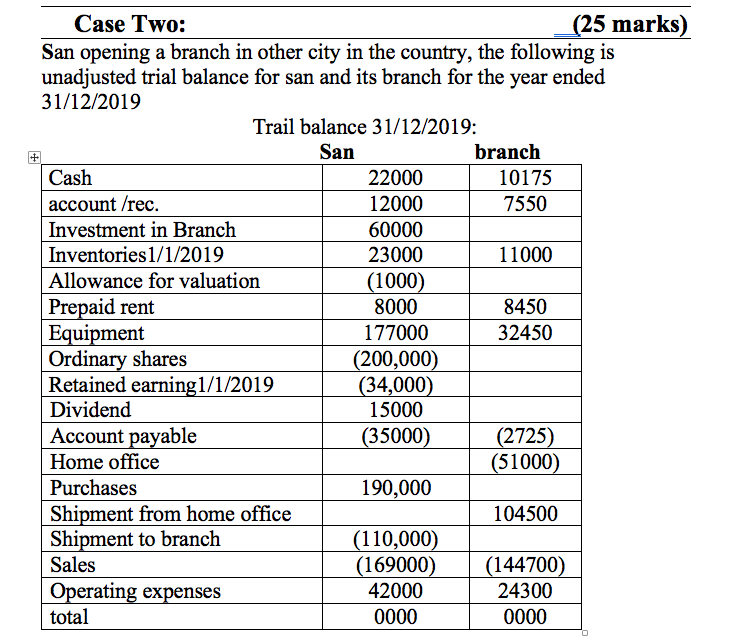

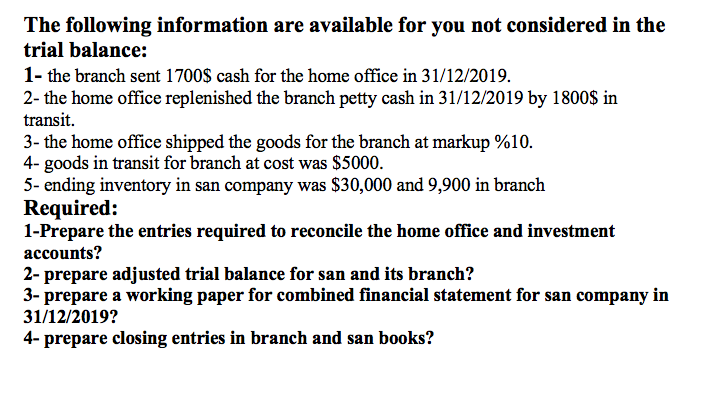

+ Case Two: (25 marks) San opening a branch in other city in the country, the following is unadjusted trial balance for san and its branch for the year ended 31/12/2019 Trail balance 31/12/2019: San branch Cash 22000 10175 account /rec. 12000 7550 Investment in Branch 60000 Inventories 1/1/2019 23000 11000 Allowance for valuation (1000) Prepaid rent 8000 8450 Equipment 177000 32450 Ordinary shares (200,000) Retained earning1/1/2019 (34,000) Dividend 15000 Account payable (35000) (2725) Home office (51000) Purchases 190,000 Shipment from home office 104500 Shipment to branch (110,000) Sales (169000) (144700) Operating expenses 42000 24300 total 0000 0000 The following information are available for you not considered in the trial balance: 1- the branch sent 1700$ cash for the home office in 31/12/2019. 2- the home office replenished the branch petty cash in 31/12/2019 by 1800$ in transit. 3- the home office shipped the goods for the branch at markup %10. 4- goods in transit for branch at cost was $5000. 5- ending inventory in san company was $30,000 and 9,900 in branch Required: 1-Prepare the entries required to reconcile the home office and investment accounts? 2- prepare adjusted trial balance for san and its branch? 3- prepare a working paper for combined financial statement for san company in 31/12/2019? 4- prepare closing entries in branch and san books? + Case Two: (25 marks) San opening a branch in other city in the country, the following is unadjusted trial balance for san and its branch for the year ended 31/12/2019 Trail balance 31/12/2019: San branch Cash 22000 10175 account /rec. 12000 7550 Investment in Branch 60000 Inventories 1/1/2019 23000 11000 Allowance for valuation (1000) Prepaid rent 8000 8450 Equipment 177000 32450 Ordinary shares (200,000) Retained earning1/1/2019 (34,000) Dividend 15000 Account payable (35000) (2725) Home office (51000) Purchases 190,000 Shipment from home office 104500 Shipment to branch (110,000) Sales (169000) (144700) Operating expenses 42000 24300 total 0000 0000 The following information are available for you not considered in the trial balance: 1- the branch sent 1700$ cash for the home office in 31/12/2019. 2- the home office replenished the branch petty cash in 31/12/2019 by 1800$ in transit. 3- the home office shipped the goods for the branch at markup %10. 4- goods in transit for branch at cost was $5000. 5- ending inventory in san company was $30,000 and 9,900 in branch Required: 1-Prepare the entries required to reconcile the home office and investment accounts? 2- prepare adjusted trial balance for san and its branch? 3- prepare a working paper for combined financial statement for san company in 31/12/2019? 4- prepare closing entries in branch and san books