Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case: Two months ago, Lisa was honorably discharged from the Air Force where she spent four years training as an airplane mechanic. After discharge,

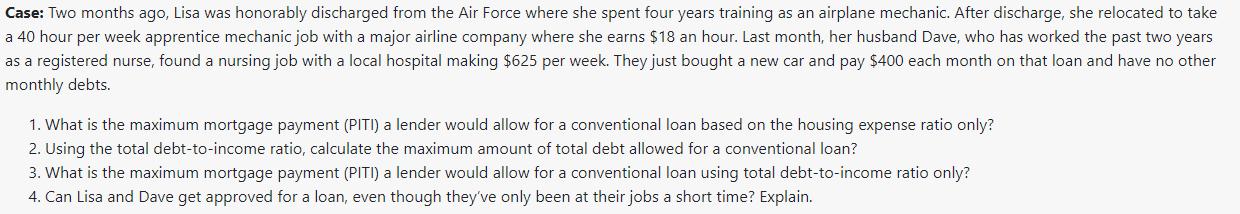

Case: Two months ago, Lisa was honorably discharged from the Air Force where she spent four years training as an airplane mechanic. After discharge, she relocated to take a 40 hour per week apprentice mechanic job with a major airline company where she earns $18 an hour. Last month, her husband Dave, who has worked the past two years as a registered nurse, found a nursing job with a local hospital making $625 per week. They just bought a new car and pay $400 each month on that loan and have no other monthly debts. 1. What is the maximum mortgage payment (PITI) a lender would allow for a conventional loan based on the housing expense ratio only? 2. Using the total debt-to-income ratio, calculate the maximum amount of total debt allowed for a conventional loan? 3. What is the maximum mortgage payment (PITI) a lender would allow for a conventional loan using total debt-to-income ratio only? 4. Can Lisa and Dave get approved for a loan, even though they've only been at their jobs a short time? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analysing Lisa and Daves Loan Eligibility Assumptions We cannot determine their exact monthly income without knowing how many weeks are in a month for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started