Answered step by step

Verified Expert Solution

Question

1 Approved Answer

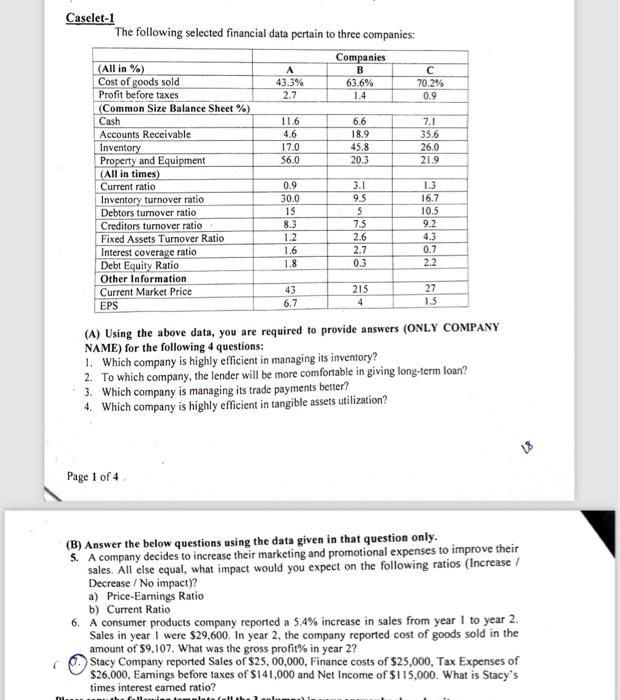

( Caselet-1 The following selected financial data pertain to three companies: Companies B (All in %) Cost of goods sold Profit before taxes (Common

( Caselet-1 The following selected financial data pertain to three companies: Companies B (All in %) Cost of goods sold Profit before taxes (Common Size Balance Sheet %) Cash Accounts Receivable Inventory Property and Equipment (All in times) Current ratio Inventory turnover ratio Debtors turnover ratio Creditors turnover ratio Fixed Assets Turnover Ratio Interest coverage ratio Debt Equity Ratio Other Information Current Market Price EPS 432 Page 1 of 4 11.6 4.6 17.0 56.0 0.9 30.0 9853260 15 1.2 1.6 1.8 43 6.7 63.6% 1.4 6.6 18.9 45.8 20.3 3.1 9.5 5 7.5 2.6 2.7 0.3 215 4 go UND C 70.2% 0.9 7.1 35.6 26.0 21.9 1.3 16.7 10.5 9.2 4.3 0.7 2.2 Te 27 1.5 (A) Using the above data, you are required to provide answers (ONLY COMPANY NAME) for the following 4 questions: 1. Which company is highly efficient in managing its inventory? 2. To which company, the lender will be more comfortable in giving long-term loan? 3. Which company is managing its trade payments better? 4. Which company is highly efficient in tangible assets utilization? (B) Answer the below questions using the data given in that question only. 5. A company decides to increase their marketing and promotional expenses to improve their sales. All else equal, what impact would you expect on the following ratios (Increase / Decrease / No impact)? a) Price-Earnings Ratio b) Current Ratio 6. A consumer products company reported a 5.4% increase in sales from year I to year 2. Sales in year I were $29,600. In year 2, the company reported cost of goods sold in the amount of $9,107. What was the gross profit% in year 2? Stacy Company reported Sales of $25,00,000, Finance costs of $25,000, Tax Expenses of $26.000, Earnings before taxes of $141,000 and Net Income of $115,000. What is Stacy's times interest earned ratio?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Q1 Which company is highly efficient in managing its inventory To determine which company is highly efficient in managing its inventory we can look at the inventory turnover ratio The higher th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started