Answered step by step

Verified Expert Solution

Question

1 Approved Answer

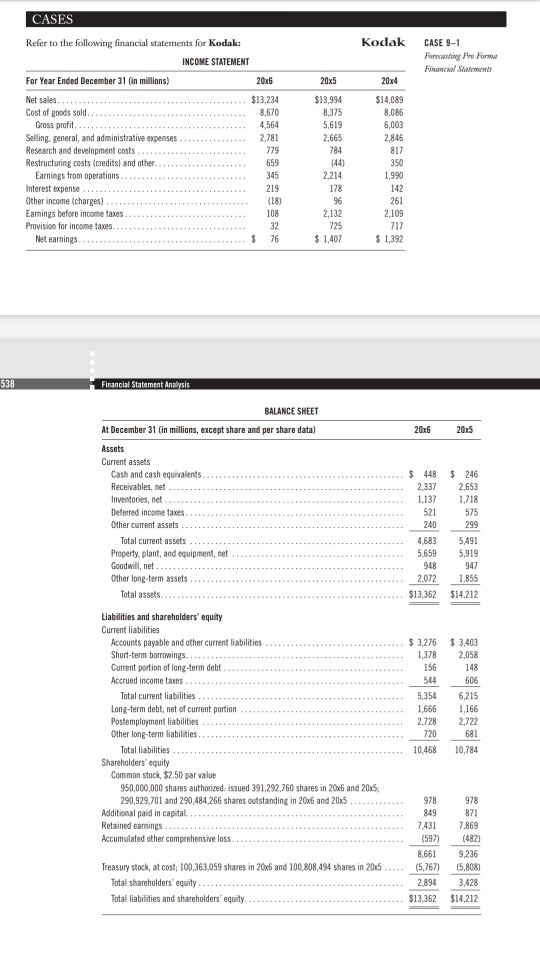

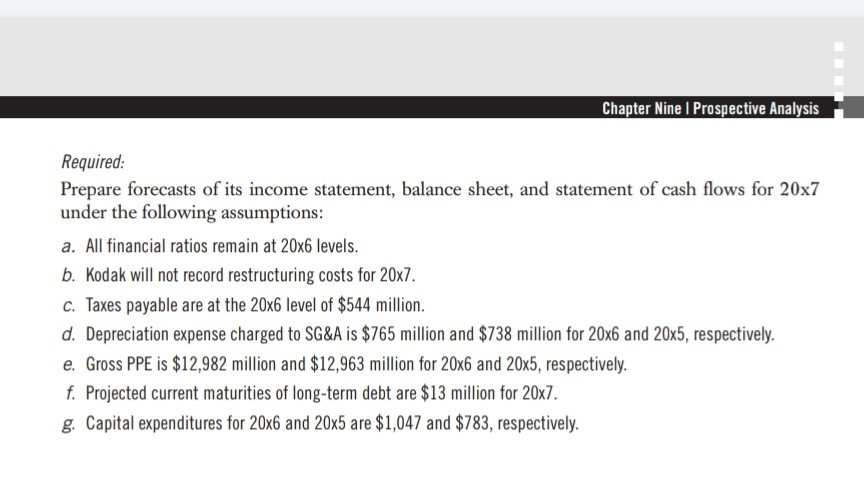

CASES Kodak Refer to the following financial statements for Kodak: INCOME STATEMENT CASE 9-1 Forecasting Pro Form Ft Swim For Year Ended December 31 (in

CASES Kodak Refer to the following financial statements for Kodak: INCOME STATEMENT CASE 9-1 Forecasting Pro Form Ft Swim For Year Ended December 31 (in millions) 20x6 20x5 20x4 $13,234 8,670 4,564 2,781 $14,089 8,086 6,003 2,846 779 817 659 Net sales...... Cost of goods sold.......... Gross profit. Selling, general, and administrative expenses Research and development costs Restructuring costs (credits) and other. Earnings from operations.. Interest expense Other income (charges) Earnings before income taxes Provision for income taxes..... Net earnings 345 219 (18) $13,994 8,375 5,619 2,665 784 (44) 2,214 178 96 2,132 725 $ 1,407 350 1,990 142 261 2,109 717 $ 1,392 109 76 538 Financial Statement Analysis BALANCE SHEET At December 31 (in millions, except share and per share data) 20x6 2015 Assets Current assets Cash and cash equivalents... Receivables, net Inventories, net Deferred income taxes.... Other current assets Total current assets Property, plant, and equipment, net Goodwill, net Other long-term assets... Total assets........ $ 448 $ 246 2,337 2,653 1,137 1.718 521 575 240299 4,683 5,491 5,659 5910 947 2.072 1,855 $13,362 $14,212 544 Liabilities and shareholders' equity Current liabilities Accounts payable and other current liabilities Short-term borrowings. Current portion of long-term debt.... Accrued income taxes Total current liabilities Long-term debt, net of current portion Postemployment liabilities Other long-term liabilities Total liabilities Shareholders' equity Common stock, $2.50 par value 950,000,000 shares authorized: issued 391,292,760 shares in 20x6 and 2005; 290,929,701 and 290,484.266 shares outstanding in 2016 and 2005.......... Additional paid in capital... Retained earnings Accumulated other comprehensive loss $ 3,276 $ 3,403 1,378 2,058 156 148 606 5,354 6,215 1.666 1.166 2.728 2.722 720681 10,468 10,784 978978 849871 7.431 7.869 (597 (482) 8.661 9,236 (5,767) 15.808 Treasury stock, at cost; 100,363,059 shares in 20x6 and 100,808,494 shares in 2015 Total shareholders' equity ........ Total liabilities and shareholders' equity................. 2.894 3.428 $13,362 $14.212 Chapter Nine | Prospective Analysis Required: Prepare forecasts of its income statement, balance sheet, and statement of cash flows for 20x7 under the following assumptions: a. All financial ratios remain at 20x6 levels. b. Kodak will not record restructuring costs for 20x7. c. Taxes payable are at the 20x6 level of $544 million. d. Depreciation expense charged to SG&A is $765 million and $738 million for 20x6 and 20x5, respectively. e. Gross PPE is $12,982 million and $12,963 million for 20x6 and 20x5, respectively. f. Projected current maturities of long-term debt are $13 million for 20x7. g. Capital expenditures for 20x6 and 20x5 are $1,047 and $783, respectively. CASES Kodak Refer to the following financial statements for Kodak: INCOME STATEMENT CASE 9-1 Forecasting Pro Form Ft Swim For Year Ended December 31 (in millions) 20x6 20x5 20x4 $13,234 8,670 4,564 2,781 $14,089 8,086 6,003 2,846 779 817 659 Net sales...... Cost of goods sold.......... Gross profit. Selling, general, and administrative expenses Research and development costs Restructuring costs (credits) and other. Earnings from operations.. Interest expense Other income (charges) Earnings before income taxes Provision for income taxes..... Net earnings 345 219 (18) $13,994 8,375 5,619 2,665 784 (44) 2,214 178 96 2,132 725 $ 1,407 350 1,990 142 261 2,109 717 $ 1,392 109 76 538 Financial Statement Analysis BALANCE SHEET At December 31 (in millions, except share and per share data) 20x6 2015 Assets Current assets Cash and cash equivalents... Receivables, net Inventories, net Deferred income taxes.... Other current assets Total current assets Property, plant, and equipment, net Goodwill, net Other long-term assets... Total assets........ $ 448 $ 246 2,337 2,653 1,137 1.718 521 575 240299 4,683 5,491 5,659 5910 947 2.072 1,855 $13,362 $14,212 544 Liabilities and shareholders' equity Current liabilities Accounts payable and other current liabilities Short-term borrowings. Current portion of long-term debt.... Accrued income taxes Total current liabilities Long-term debt, net of current portion Postemployment liabilities Other long-term liabilities Total liabilities Shareholders' equity Common stock, $2.50 par value 950,000,000 shares authorized: issued 391,292,760 shares in 20x6 and 2005; 290,929,701 and 290,484.266 shares outstanding in 2016 and 2005.......... Additional paid in capital... Retained earnings Accumulated other comprehensive loss $ 3,276 $ 3,403 1,378 2,058 156 148 606 5,354 6,215 1.666 1.166 2.728 2.722 720681 10,468 10,784 978978 849871 7.431 7.869 (597 (482) 8.661 9,236 (5,767) 15.808 Treasury stock, at cost; 100,363,059 shares in 20x6 and 100,808,494 shares in 2015 Total shareholders' equity ........ Total liabilities and shareholders' equity................. 2.894 3.428 $13,362 $14.212 Chapter Nine | Prospective Analysis Required: Prepare forecasts of its income statement, balance sheet, and statement of cash flows for 20x7 under the following assumptions: a. All financial ratios remain at 20x6 levels. b. Kodak will not record restructuring costs for 20x7. c. Taxes payable are at the 20x6 level of $544 million. d. Depreciation expense charged to SG&A is $765 million and $738 million for 20x6 and 20x5, respectively. e. Gross PPE is $12,982 million and $12,963 million for 20x6 and 20x5, respectively. f. Projected current maturities of long-term debt are $13 million for 20x7. g. Capital expenditures for 20x6 and 20x5 are $1,047 and $783, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started