Question

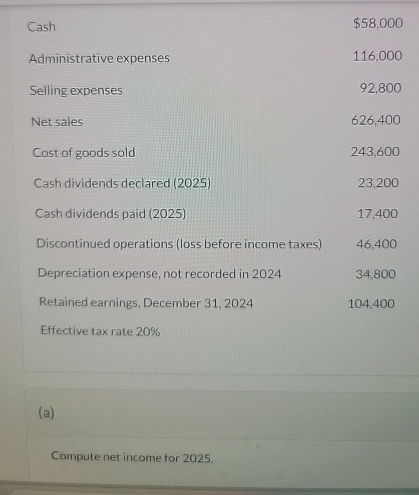

Cash $58,000 Administrative expenses 116,000 Selling expenses 92,800 Net sales 626,400 Cost of goods sold 243,600 Cash dividends declared (2025) 23,200 Cash dividends paid

Cash $58,000 Administrative expenses 116,000 Selling expenses 92,800 Net sales 626,400 Cost of goods sold 243,600 Cash dividends declared (2025) 23,200 Cash dividends paid (2025) 17,400 Discontinued operations (loss before income taxes) 46,400 Depreciation expense, not recorded in 2024 34,800 Retained earnings, December 31, 2024 104,400 Effective tax rate 20% (a) Compute net income for 2025.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer To compute net income for 2025 we need to use the formula Net Income Net Sales Cost of Goods ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

18th Edition

1119790972, 9781119790976

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App