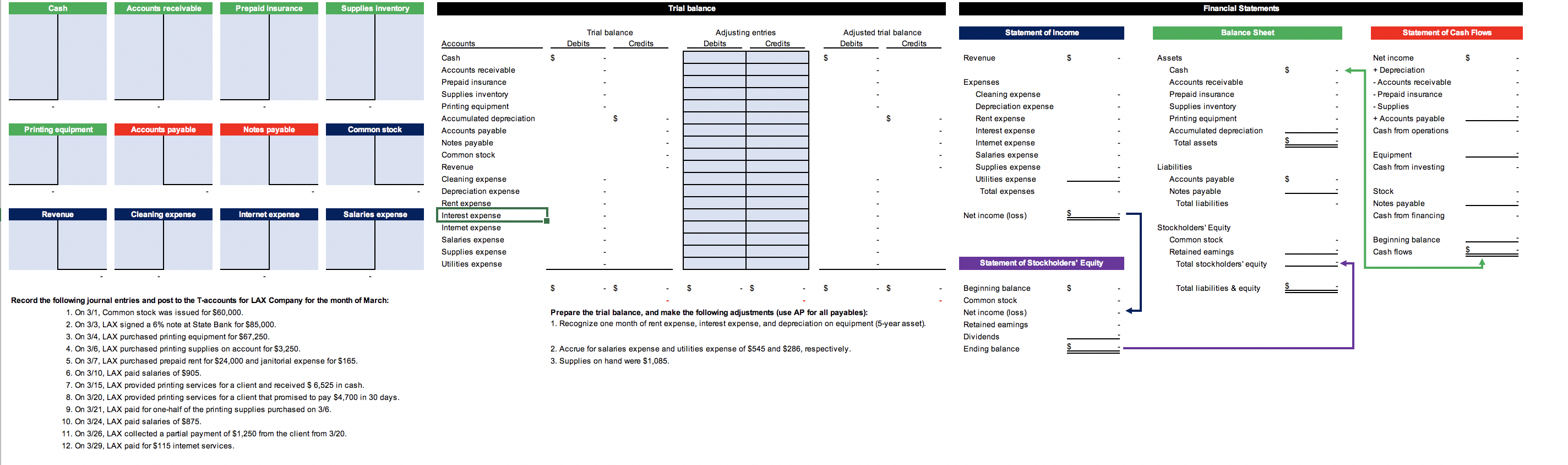

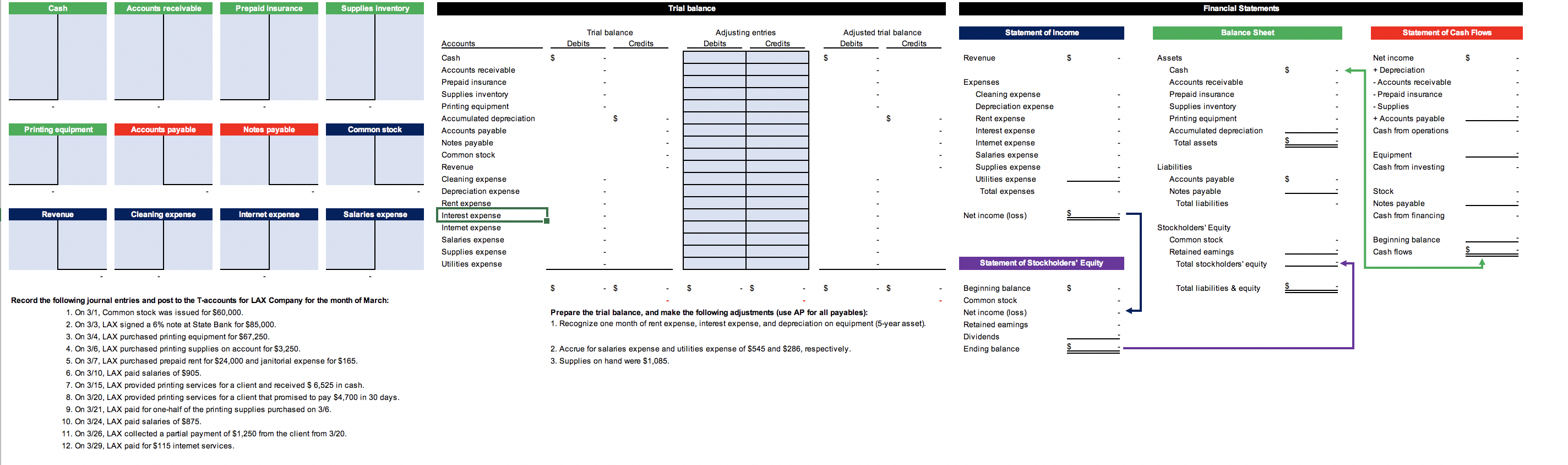

Cash A ccounts receivable P repaid insurance Supplies inventory Trial balance Financial Statements Statement of Income Balance Sheet Statement of Cash Flows Trial balance Debits Credits Adjusting entries Debits Credits Adjusted trial balance Debits Credits Revenue Assets Cash Accounts receivable Prepaid insurance Supplies inventory Printing equipment Accumulated depreciation Total assets Net income + Depreciation - Accounts receivable - Prepaid insurance - Supplies + Accounts payable Cash from operations Printing equipment Accounts payable Notes payable Common stock Accounts Cash Accounts receivable Prepaid insurance Supplies inventory Printing equipment Accumulated depreciation Accounts payable Notes payable Common stock Revenue Cleaning expense Depreciation expense Rent expense Interest expense Internet expense Salaries expense Supplies expense Utilities expense Expenses Cleaning expense Depreciation expense Rent expense Interest expense Internet expense Salaries expense Supplies expense Utilities expense Total expenses Equipment Cash from investing Liabilities Accounts payable Notes payable Total liabilities Stock Notes payable Cash from financing Revenue Cleaning expense Internet expense Salaries expense Net income (loss) Stockholders' Equity Common stock Retained earings Total stockholders' equity Beginning balance Cash flows Statement of Stockholders' Equity . . S - $ - $ - S S Total liabilities & equity Prepare the trial balance, and make the following adjustments (use AP for all payables): 1. Recognize one month of rent expense, interest expense, and depreciation on equipment (5-year asset). Beginning balance Common stock Net income (loss) Retained earings Dividends Ending balance 2. Accrue for salaries expense and utilities expense of $545 and $286, respectively. 3. Supplies on hand were $1,085. Record the following journal entries and post to the T-accounts for LAX Company for the month of March: 1. On 3/1, Common stock was issued for $60,000. 2. On 3/3, LAX signed a 6% note at State Bank for $85,000. 3. On 3/4, LAX purchased printing equipment for $67,250. 4. On 3/6, LAX purchased printing supplies on account for $3,250. 5. On 3/7, LAX purchased prepaid rent for $24,000 and janitorial expense for $165. 6. On 3/10, LAX paid salaries of $905. 7. On 3/15, LAX provided printing services for a client and received $ 6,525 in cash. 8. On 3/20, LAX provided printing services for a client that promised to pay $4,700 in 30 days. 9. On 3/21, LAX paid for one-half of the printing supplies purchased on 3/6. 10. On 3/24, LAX paid salaries of $875. 11. On 3/26, LAX collected a partial payment of $1,250 from the client from 3/20. 12. On 3/29, LAX paid for $115 intemet services