Answered step by step

Verified Expert Solution

Question

1 Approved Answer

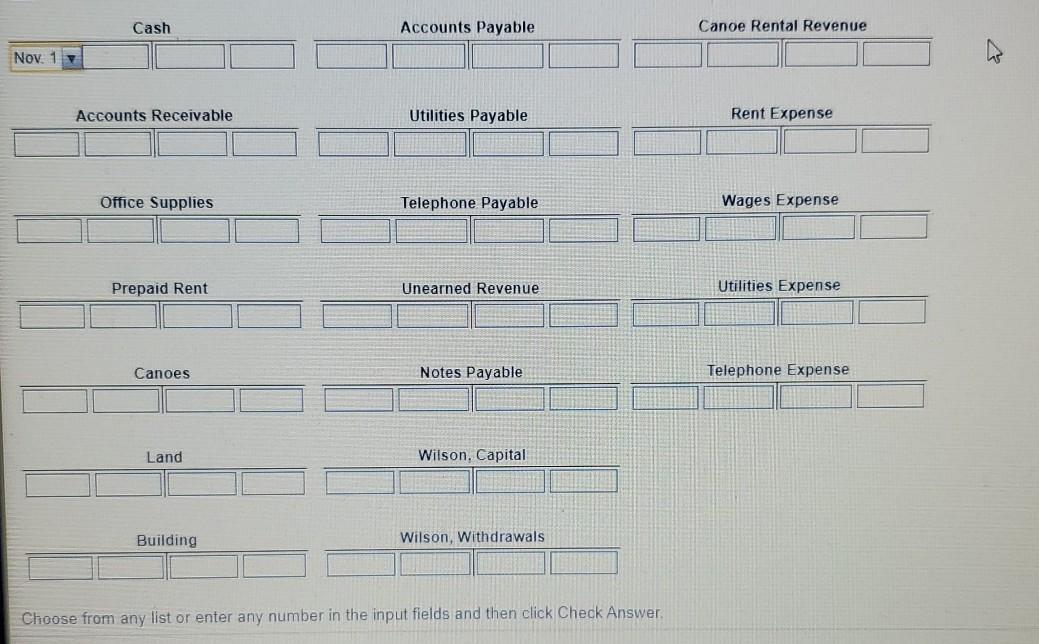

Cash Accounts Payable Canoe Rental Revenue Nov. 1 Accounts Receivable Utilities Payable Rent Expense Office Supplies Telephone Payable Wages Expense Prepaid Rent Unearned Revenue Utilities

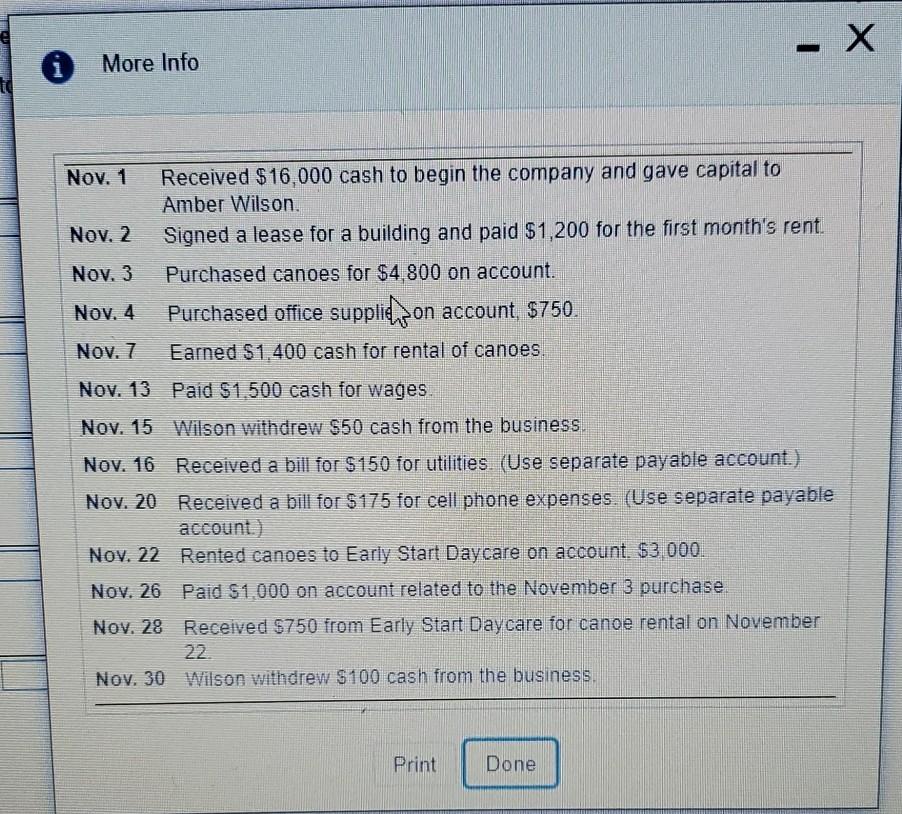

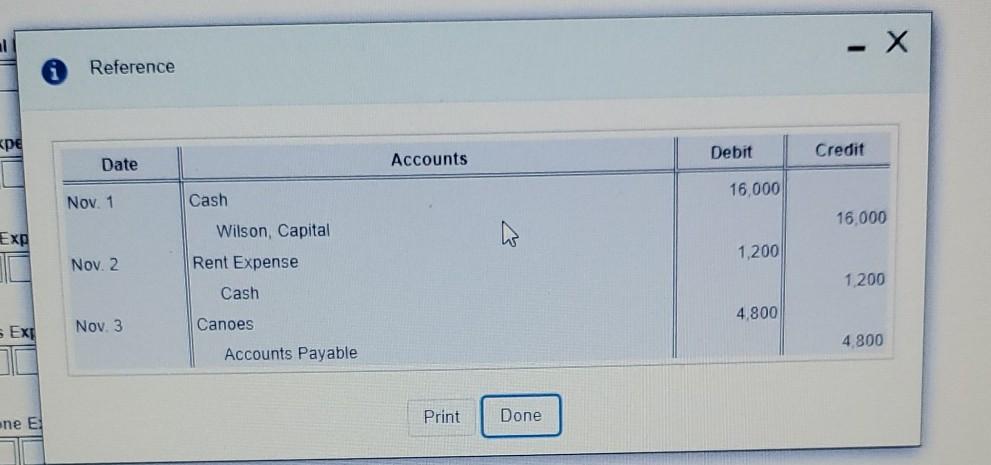

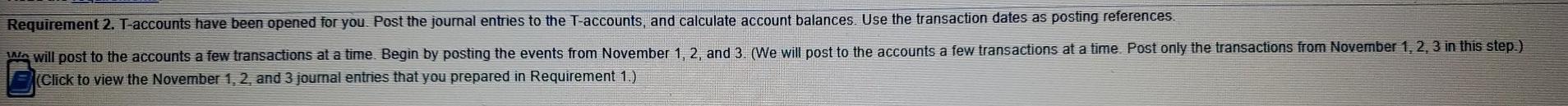

Cash Accounts Payable Canoe Rental Revenue Nov. 1 Accounts Receivable Utilities Payable Rent Expense Office Supplies Telephone Payable Wages Expense Prepaid Rent Unearned Revenue Utilities Expense Canoes Notes Payable Telephone Expense Land Wilson, Capital Building Wilson, Withdrawals Choose from any list or enter any number in the input fields and then click Check Answer - X i More Info Nov. 1 Nov. 2 Nov. 3 Received $16,000 cash to begin the company and gave capital to Amber Wilson Signed a lease for a building and paid $1,200 for the first month's rent. Purchased canoes for $4,800 on account. Purchased office supplieron account, $750. Earned $1.400 cash for rental of canoes Nov. 4 Nov. 7 Nov. 13 Paid $1.500 cash for wages Nov. 15 Wilson withdrew $50 cash from the business Nov. 16 Received a bill for $150 for utilities. (Use separate payable account.) Nov. 20 Received a bill for $175 for cell phone expenses. (Use separate payable account.) Nov. 22 Rented canoes to Early Start Daycare on account. $3.000. Nov. 26 Paid $1.000 on account related to the November 3 purchase Nov. 28 Received $750 from Early Start Daycare for canoe rental on November 22. Nov. 30 Wilson withdrew $100 cash from the business. Print Done - X Reference Debit Credit Date Accounts 16.000 Nov. 1 Cash 16,000 Exp Wilson, Capital 1,200 Nov. 2 Rent Expense 1.200 Cash 4.800 s Exp Nov. 3 Canoes Accounts Payable 4.800 Print one E Done Done Requirement 2. T-accounts have been opened for you. Post the journal entries to the T-accounts, and calculate account balances. Use the transaction dates as posting references Wa will post to the accounts a few transactions at a time. Begin by posting the events from November 1, 2, and 3. (We will post to the accounts a few transactions at a time. Post only the transactions from November 1, 2, 3 in this step.) (Click to view the November 1, 2, and 3 journal entries that you prepared in Requirement 1.) Cash Accounts Payable Canoe Rental Revenue Nov. 1 Accounts Receivable Utilities Payable Rent Expense Office Supplies Telephone Payable Wages Expense Prepaid Rent Unearned Revenue Utilities Expense Canoes Notes Payable Telephone Expense Land Wilson, Capital Building Wilson, Withdrawals Choose from any list or enter any number in the input fields and then click Check Answer - X i More Info Nov. 1 Nov. 2 Nov. 3 Received $16,000 cash to begin the company and gave capital to Amber Wilson Signed a lease for a building and paid $1,200 for the first month's rent. Purchased canoes for $4,800 on account. Purchased office supplieron account, $750. Earned $1.400 cash for rental of canoes Nov. 4 Nov. 7 Nov. 13 Paid $1.500 cash for wages Nov. 15 Wilson withdrew $50 cash from the business Nov. 16 Received a bill for $150 for utilities. (Use separate payable account.) Nov. 20 Received a bill for $175 for cell phone expenses. (Use separate payable account.) Nov. 22 Rented canoes to Early Start Daycare on account. $3.000. Nov. 26 Paid $1.000 on account related to the November 3 purchase Nov. 28 Received $750 from Early Start Daycare for canoe rental on November 22. Nov. 30 Wilson withdrew $100 cash from the business. Print Done - X Reference Debit Credit Date Accounts 16.000 Nov. 1 Cash 16,000 Exp Wilson, Capital 1,200 Nov. 2 Rent Expense 1.200 Cash 4.800 s Exp Nov. 3 Canoes Accounts Payable 4.800 Print one E Done Done Requirement 2. T-accounts have been opened for you. Post the journal entries to the T-accounts, and calculate account balances. Use the transaction dates as posting references Wa will post to the accounts a few transactions at a time. Begin by posting the events from November 1, 2, and 3. (We will post to the accounts a few transactions at a time. Post only the transactions from November 1, 2, 3 in this step.) (Click to view the November 1, 2, and 3 journal entries that you prepared in Requirement 1.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started