Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Assets Leeds School of Business 2013 $35,000

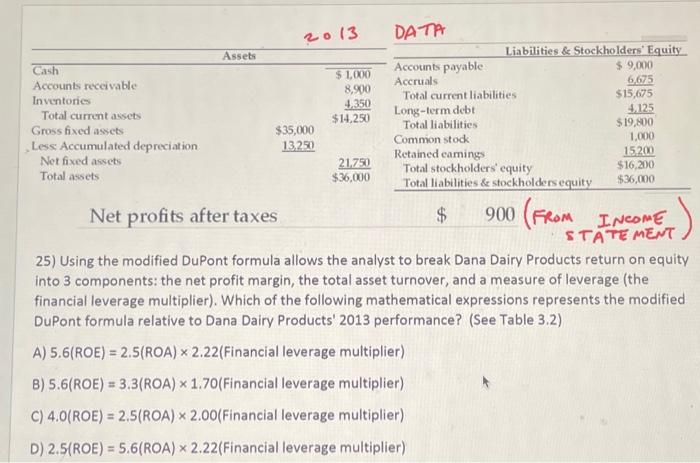

Cash Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Assets Leeds School of Business 2013 $35,000 13,250 $1,000 8,900 4,350 $14,250 21,750 $36,000 DATA Accounts payable Accruals Total current liabilities Long-term debt Total liabilities Liabilities & Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities & stockholders equity $ $9,000 6,675 $15,675 4,125 $19,800 1,000 15,200 $16,200 $36,000 Net profits after taxes 25) Using the modified DuPont formula allows the analyst to break Dana Dairy Products return on equity into 3 components: the net profit margin, the total asset turnover, and a measure of leverage (the financial leverage multiplier). Which of the following mathematical expressions represents the modified DuPont formula relative to Dana Dairy Products' 2013 performance? (See Table 3.2) A) 5.6(ROE) = 2.5(ROA) x 2.22 (Financial leverage multiplier) B) 5.6(ROE) = 3.3 (ROA) x 1.70(Financial leverage multiplier) C) 4.0(ROE) = 2.5(ROA) x 2.00(Financial leverage multiplier) D) 2.5(ROE) = 5.6(ROA) x 2.22 (Financial leverage multiplier) 900 (FROM INCOME STATEMENT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started