Answered step by step

Verified Expert Solution

Question

1 Approved Answer

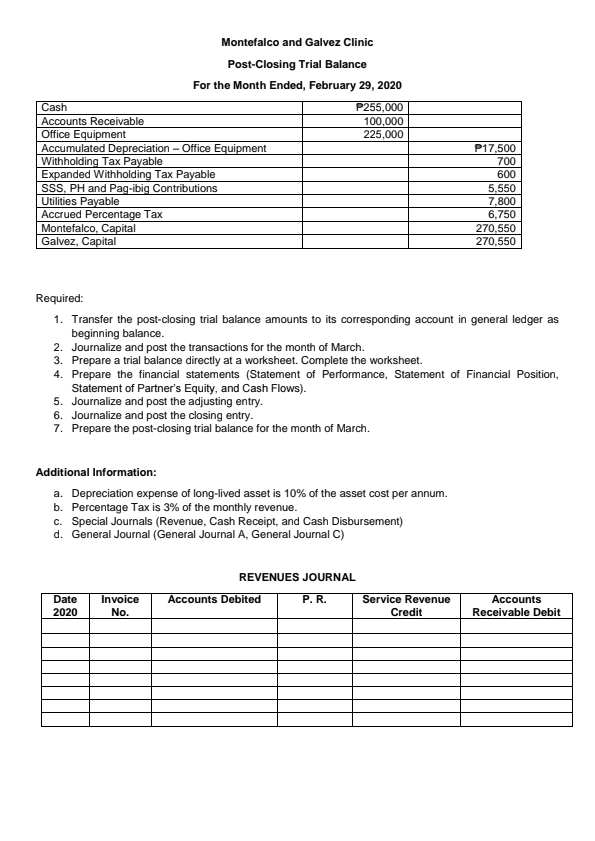

Cash Accounts Receivable Office Equipment Accumulated Depreciation - Office Equipment Withholding Tax Payable Expanded Withholding Tax Payable Montefalco and Galvez Clinic Post-Closing Trial Balance

Cash Accounts Receivable Office Equipment Accumulated Depreciation - Office Equipment Withholding Tax Payable Expanded Withholding Tax Payable Montefalco and Galvez Clinic Post-Closing Trial Balance For the Month Ended, February 29, 2020 P255,000 100,000 225,000 SSS, PH and Pag-ibig Contributions Utilities Payable Accrued Percentage Tax Montefalco, Capital Galvez, Capital Statement of Partner's Equity, and Cash Flows). 5. Journalize and post the adjusting entry. Required: 1. Transfer the post-closing trial balance amounts to its corresponding account in general ledger as beginning balance. 2. Journalize and post the transactions for the month of March. 6. Journalize and post the closing entry. 7. Prepare the post-closing trial balance for the month of March. 3. Prepare a trial balance directly at a worksheet. Complete the worksheet. 4. Prepare the financial statements (Statement of Performance, Statement of Financial Position, Additional Information: a. Depreciation expense of long-lived asset is 10% of the asset cost per annum. b. Percentage Tax is 3% of the monthly revenue. c. Special Journals (Revenue, Cash Receipt, and Cash Disbursement) d. General Journal (General Journal A, General Journal C) Date 2020 Invoice No. REVENUES JOURNAL Accounts Debited P17,500 700 600 P.R. 5,550 7,800 6,750 Service Revenue Credit 270,550 270,550 Accounts Receivable Debit

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To assist you with your request I will provide a stepbystep guide to address each requirement 1 Transfer the postclosing trial balance amounts to thei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started