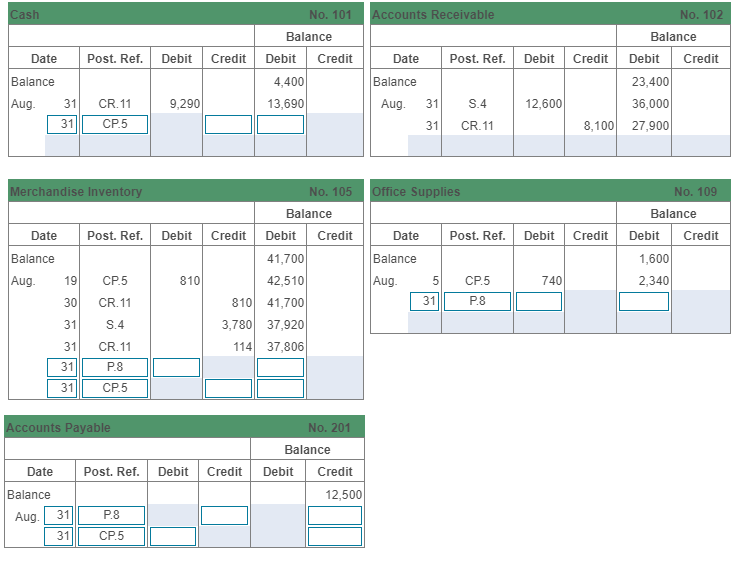

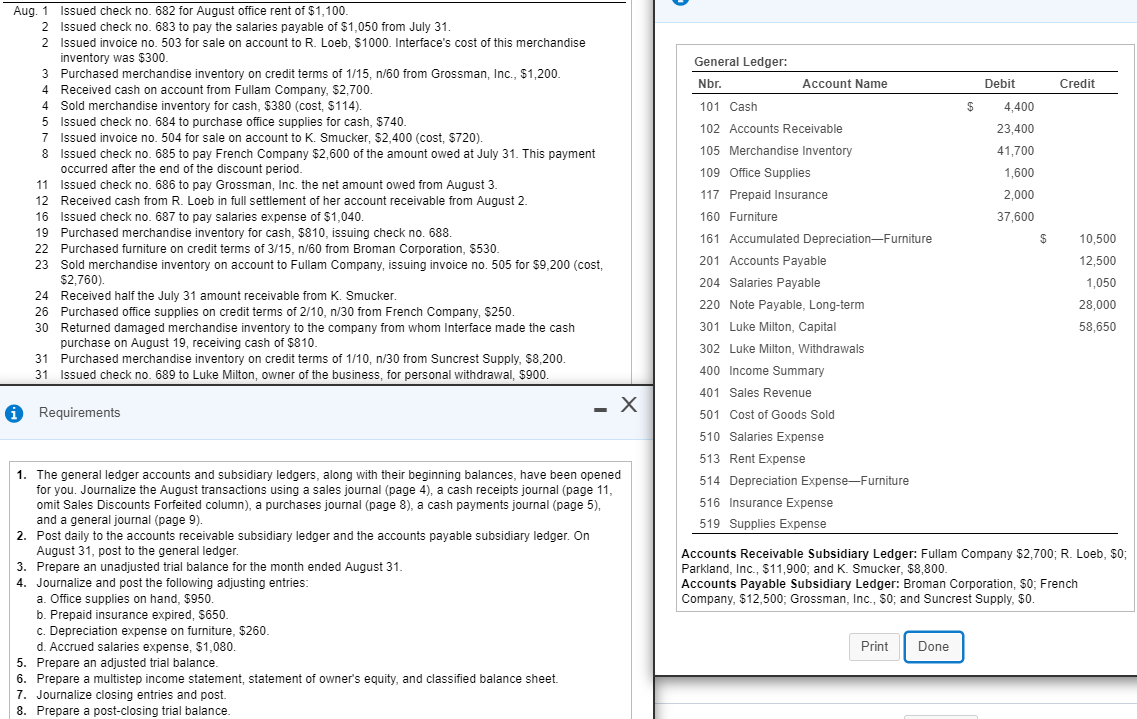

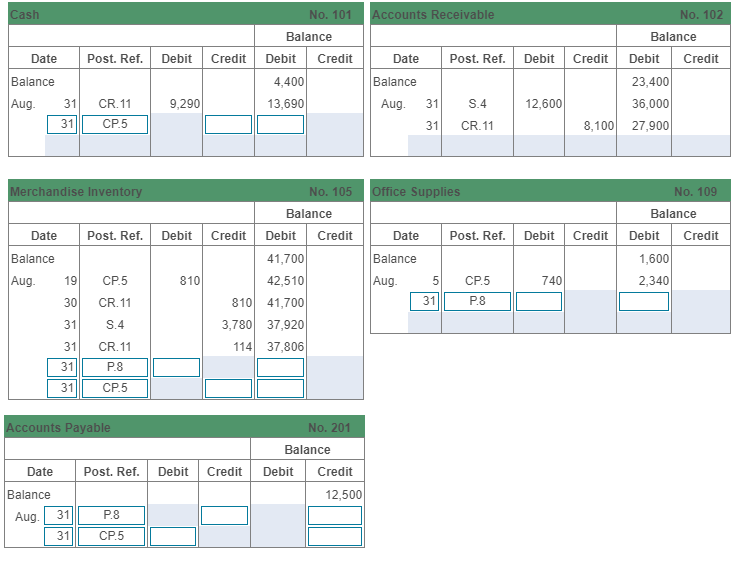

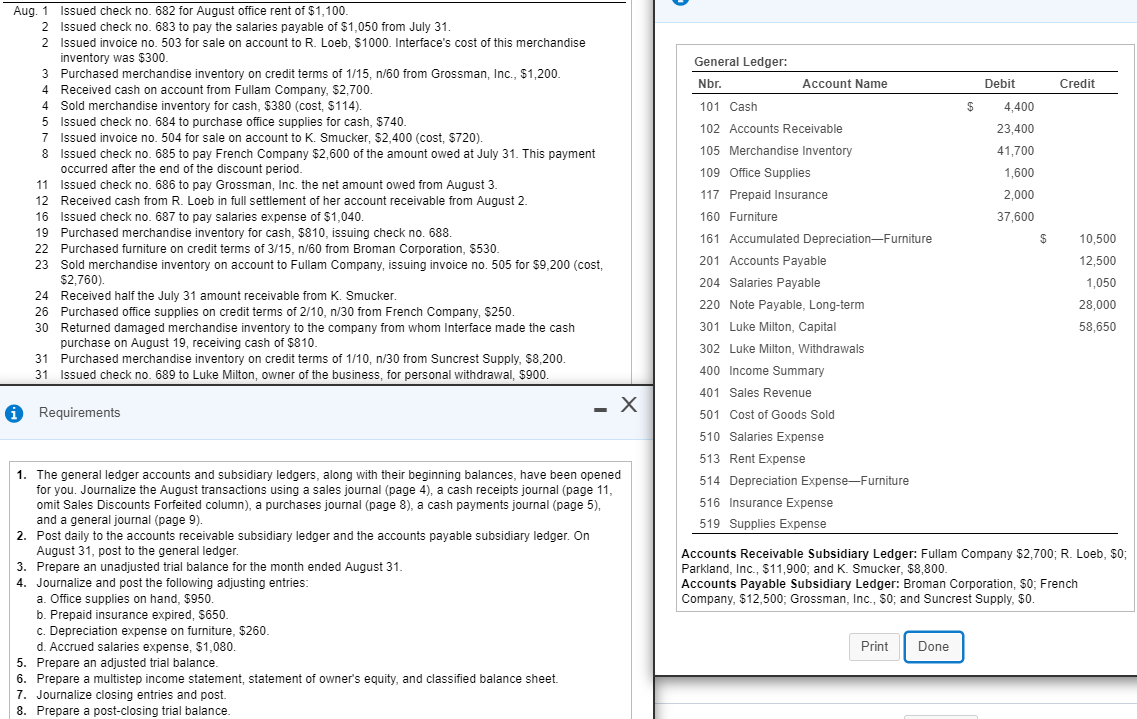

Cash Accounts Receivable Post. Ref. Debit Credit No. 101 Balance Debit Credit 4,400 13,690 Post. Ref. Debit Date Balance Aug. Credit Date Balance Aug. 31 31 No. 102 Balance Debit Credit 23,400 36,000 27,900 9,290 12,600 31 31||| CR. 11 CP.5 S.4 CR. 11 8,100 Merchandise Inventory Office Supplies Post. Ref. Debit Credit Post. Ref. Debit Credit Date Balance Aug. No. 105 Balance Debit Credit 41,700 42,510 41,700 37,920 37,806 Date Balance Aug. 5 31 No. 109 Balance Debit Credit 1,600 2,340 19 810 CP.5 P.8 810 N . CP.5 CR. 11 5.4 CR.11 P.8 CP.5 3,780 114 31 31 Accounts Payable No. 201 Balance Debit Credit 12,500 Debit Credit Date Post. Ref. Balance Aug. 31P.8 | 31 || CP.5 Credit $ Aug. 1 Issued check no. 682 for August office rent of $1,100. 2 Issued check no. 683 to pay the salaries payable of $1,050 from July 31. 2 Issued invoice no. 503 for sale on account to R. Loeb, S1000. Interface's cost of this merchandise inventory was $300. 3 Purchased merchandise inventory on credit terms of 1/15, n/60 from Grossman, Inc., $1,200. 4 Received cash on account from Fullam Company, $2,700. 4 Sold merchandise inventory for cash, $380 (cost. $114). Issued check no. 684 to purchase office supplies for cash, $740. 7 Issued invoice no. 504 for sale on account to K. Smucker, $2,400 (cost, $720). 8 Issued check no. 685 to pay French Company $2,600 of the amount owed at July 31. This payment occurred after the end of the discount period. 11 Issued check no. 686 to pay Grossman, Inc. the net amount owed from August 3. 12 Received cash from R. Loeb in full settlement of her account receivable from August 2. 16 Issued check no. 687 to pay salaries expense of $1,040. 19 Purchased merchandise inventory for cash, $810, issuing check no. 688. 22 Purchased furniture on credit terms of 3/15, n/60 from Broman Corporation, $530. 23 Sold merchandise inventory on account to Fullam Company, issuing invoice no. 505 for $9,200 (cost, $2,760). 24 Received half the July 31 amount receivable from K. Smucker. 26 Purchased office supplies on credit terms of 2/10, n/30 from French Company, $250. 30 Returned damaged merchandise inventory to the company from whom Interface made the cash purchase on August 19, receiving cash of $810. 31 Purchased merchandise inventory on credit terms of 1/10, n/30 from Suncrest Supply, $8,200. 31 Issued check no. 689 to Luke Milton, owner of the business, for personal withdrawal, $900. Debit 4,400 23,400 41,700 1,600 2,000 37,600 General Ledger: Nbr. Account Name 101 Cash 102 Accounts Receivable 105 Merchandise Inventory 109 Office Supplies 117 Prepaid Insurance 160 Furniture 161 Accumulated Depreciation Furniture 201 Accounts Payable 204 Salaries Payable 220 Note Payable, Long-term 301 Luke Milton, Capital 302 Luke Milton, Withdrawals 400 Income Summary 401 Sales Revenue 501 Cost of Goods Sold 510 Salaries Expense 513 Rent Expense 514 Depreciation Expense-Furniture 516 Insurance Expense 519 Supplies Expense 10,500 12,500 1,050 28,000 58,650 i Requirements - X 1. The general ledger accounts and subsidiary ledgers, along with their beginning balances, have been opened for you. Journalize the August transactions using a sales journal (page 4), a cash receipts journal (page 11, omit Sales Discounts Forfeited column), a purchases journal (page 8), a cash payments journal (page 5), and a general journal (page 9). 2. Post daily to the accounts receivable subsidiary ledger and the accounts payable subsidiary ledger. On August 31, post to the general ledger. 3. Prepare an unadjusted trial balance for the month ended August 31. 4. Journalize and post the following adjusting entries a. Office supplies on hand, $950. b. Prepaid insurance expired, S650. c. Depreciation expense on furniture, $260. d. Accrued salaries expense, $1,080. 5. Prepare an adjusted trial balance. 6. Prepare a multistep income statement, statement of owner's equity, and classified balance sheet. 7. Journalize closing entries and post. 8. Prepare a post-closing trial balance. Accounts Receivable Subsidiary Ledger: Fullam Company $2,700; R. Loeb, $0; Parkland, Inc., $11,900; and K. Smucker, $8,800. Accounts Payable Subsidiary Ledger: Broman Corporation, $o; French Company, $12,500; Grossman, Inc., 50, and Suncrest Supply, $0. Print Done Cash Accounts Receivable Post. Ref. Debit Credit No. 101 Balance Debit Credit 4,400 13,690 Post. Ref. Debit Date Balance Aug. Credit Date Balance Aug. 31 31 No. 102 Balance Debit Credit 23,400 36,000 27,900 9,290 12,600 31 31||| CR. 11 CP.5 S.4 CR. 11 8,100 Merchandise Inventory Office Supplies Post. Ref. Debit Credit Post. Ref. Debit Credit Date Balance Aug. No. 105 Balance Debit Credit 41,700 42,510 41,700 37,920 37,806 Date Balance Aug. 5 31 No. 109 Balance Debit Credit 1,600 2,340 19 810 CP.5 P.8 810 N . CP.5 CR. 11 5.4 CR.11 P.8 CP.5 3,780 114 31 31 Accounts Payable No. 201 Balance Debit Credit 12,500 Debit Credit Date Post. Ref. Balance Aug. 31P.8 | 31 || CP.5 Credit $ Aug. 1 Issued check no. 682 for August office rent of $1,100. 2 Issued check no. 683 to pay the salaries payable of $1,050 from July 31. 2 Issued invoice no. 503 for sale on account to R. Loeb, S1000. Interface's cost of this merchandise inventory was $300. 3 Purchased merchandise inventory on credit terms of 1/15, n/60 from Grossman, Inc., $1,200. 4 Received cash on account from Fullam Company, $2,700. 4 Sold merchandise inventory for cash, $380 (cost. $114). Issued check no. 684 to purchase office supplies for cash, $740. 7 Issued invoice no. 504 for sale on account to K. Smucker, $2,400 (cost, $720). 8 Issued check no. 685 to pay French Company $2,600 of the amount owed at July 31. This payment occurred after the end of the discount period. 11 Issued check no. 686 to pay Grossman, Inc. the net amount owed from August 3. 12 Received cash from R. Loeb in full settlement of her account receivable from August 2. 16 Issued check no. 687 to pay salaries expense of $1,040. 19 Purchased merchandise inventory for cash, $810, issuing check no. 688. 22 Purchased furniture on credit terms of 3/15, n/60 from Broman Corporation, $530. 23 Sold merchandise inventory on account to Fullam Company, issuing invoice no. 505 for $9,200 (cost, $2,760). 24 Received half the July 31 amount receivable from K. Smucker. 26 Purchased office supplies on credit terms of 2/10, n/30 from French Company, $250. 30 Returned damaged merchandise inventory to the company from whom Interface made the cash purchase on August 19, receiving cash of $810. 31 Purchased merchandise inventory on credit terms of 1/10, n/30 from Suncrest Supply, $8,200. 31 Issued check no. 689 to Luke Milton, owner of the business, for personal withdrawal, $900. Debit 4,400 23,400 41,700 1,600 2,000 37,600 General Ledger: Nbr. Account Name 101 Cash 102 Accounts Receivable 105 Merchandise Inventory 109 Office Supplies 117 Prepaid Insurance 160 Furniture 161 Accumulated Depreciation Furniture 201 Accounts Payable 204 Salaries Payable 220 Note Payable, Long-term 301 Luke Milton, Capital 302 Luke Milton, Withdrawals 400 Income Summary 401 Sales Revenue 501 Cost of Goods Sold 510 Salaries Expense 513 Rent Expense 514 Depreciation Expense-Furniture 516 Insurance Expense 519 Supplies Expense 10,500 12,500 1,050 28,000 58,650 i Requirements - X 1. The general ledger accounts and subsidiary ledgers, along with their beginning balances, have been opened for you. Journalize the August transactions using a sales journal (page 4), a cash receipts journal (page 11, omit Sales Discounts Forfeited column), a purchases journal (page 8), a cash payments journal (page 5), and a general journal (page 9). 2. Post daily to the accounts receivable subsidiary ledger and the accounts payable subsidiary ledger. On August 31, post to the general ledger. 3. Prepare an unadjusted trial balance for the month ended August 31. 4. Journalize and post the following adjusting entries a. Office supplies on hand, $950. b. Prepaid insurance expired, S650. c. Depreciation expense on furniture, $260. d. Accrued salaries expense, $1,080. 5. Prepare an adjusted trial balance. 6. Prepare a multistep income statement, statement of owner's equity, and classified balance sheet. 7. Journalize closing entries and post. 8. Prepare a post-closing trial balance. Accounts Receivable Subsidiary Ledger: Fullam Company $2,700; R. Loeb, $0; Parkland, Inc., $11,900; and K. Smucker, $8,800. Accounts Payable Subsidiary Ledger: Broman Corporation, $o; French Company, $12,500; Grossman, Inc., 50, and Suncrest Supply, $0. Print Done