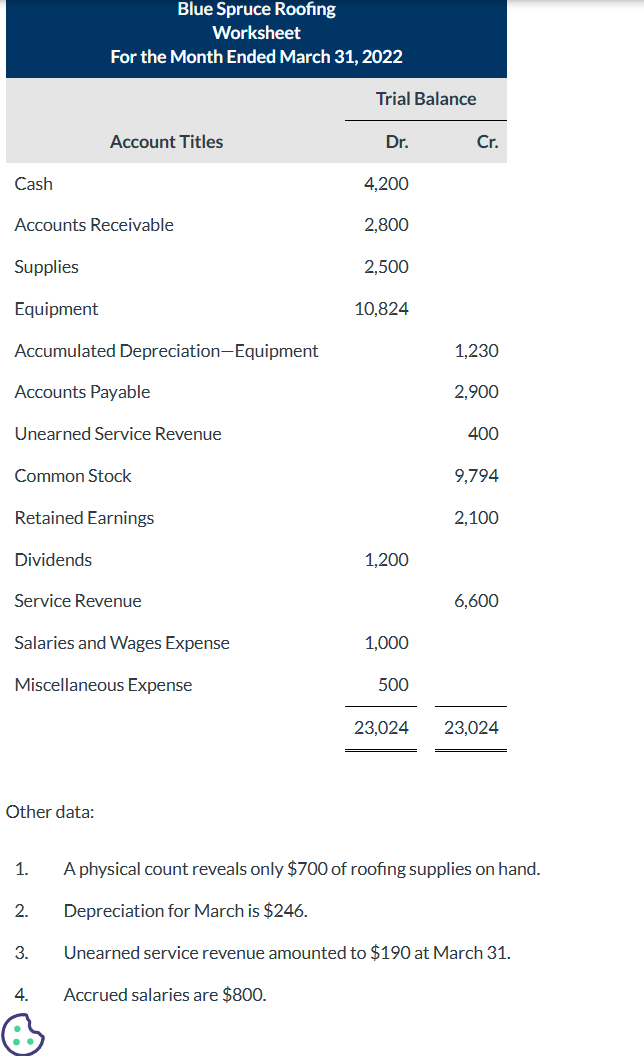

Cash Accounts Receivable Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Blue Spruce Roofing Worksheet For the Month Ended March 31, 2022 Common

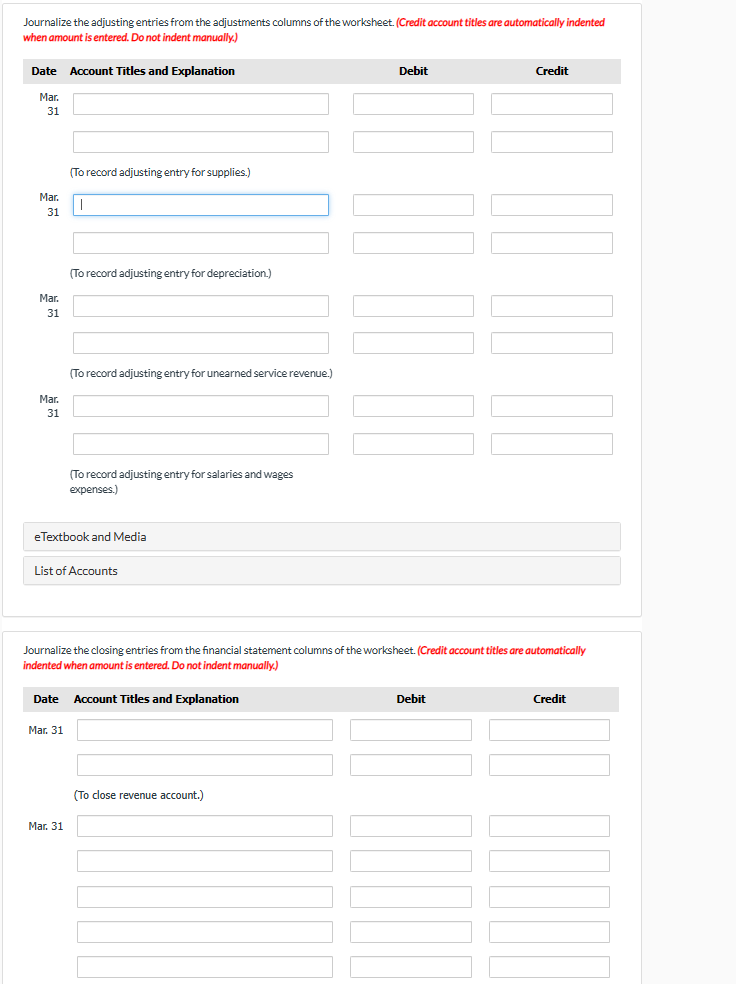

Cash Accounts Receivable Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Blue Spruce Roofing Worksheet For the Month Ended March 31, 2022 Common Stock Retained Earnings Dividends Account Titles Service Revenue Salaries and Wages Expense Other data: Miscellaneous Expense 1. 2. 3. 4. Trial Balance Dr. 4,200 2,800 2,500 10,824 1,200 1,000 500 23,024 Cr. 1,230 2,900 400 9,794 2,100 6,600 23,024 A physical count reveals only $700 of roofing supplies on hand. Depreciation for March is $246. Unearned service revenue amounted to $190 at March 31. Accrued salaries are $800. Journalize the adjusting entries from the adjustments columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 31 Mar. 31 Mar. 31 Mar. 31 (To record adjusting entry for supplies.) | (To record adjusting entry for depreciation.) (To record adjusting entry for unearned service revenue.) eTextbook and Media Mar. 31 (To record adjusting entry for salaries and wages expenses.) List of Accounts Mar. 31 Date Account Titles and Explanation Journalize the closing entries from the financial statement columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit (To close revenue account.) Credit Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Adjusting Entries Date Account Titles and Explanation Debit Credit Mar 31 S...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started