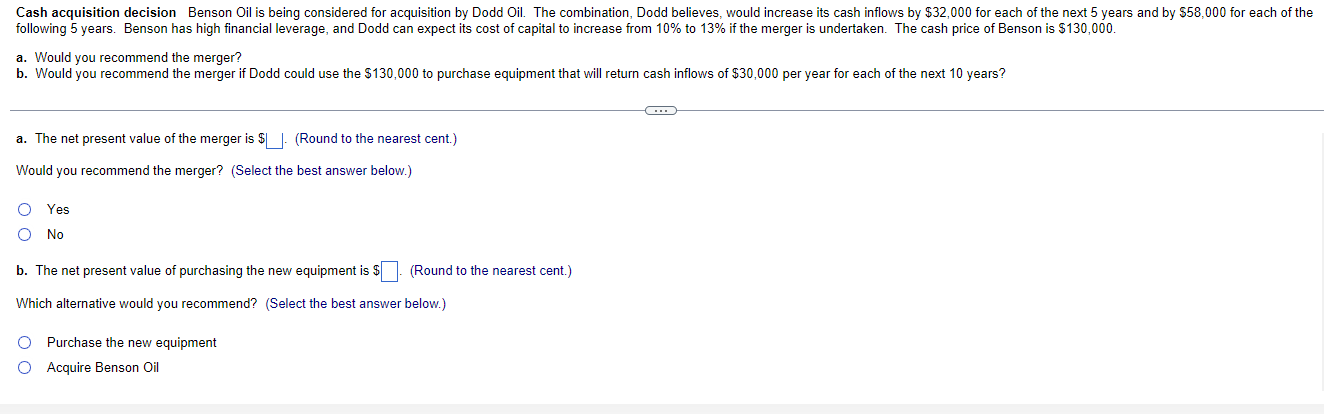

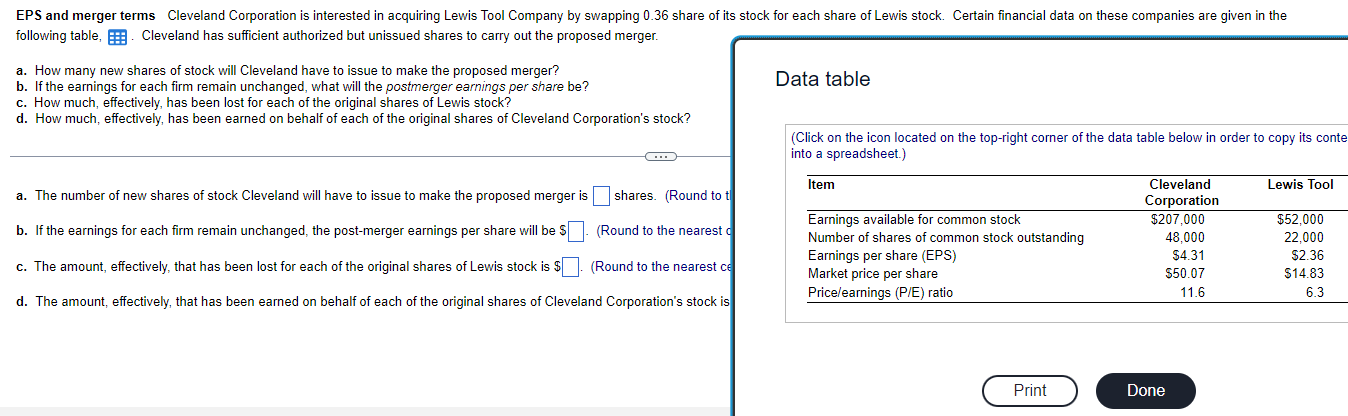

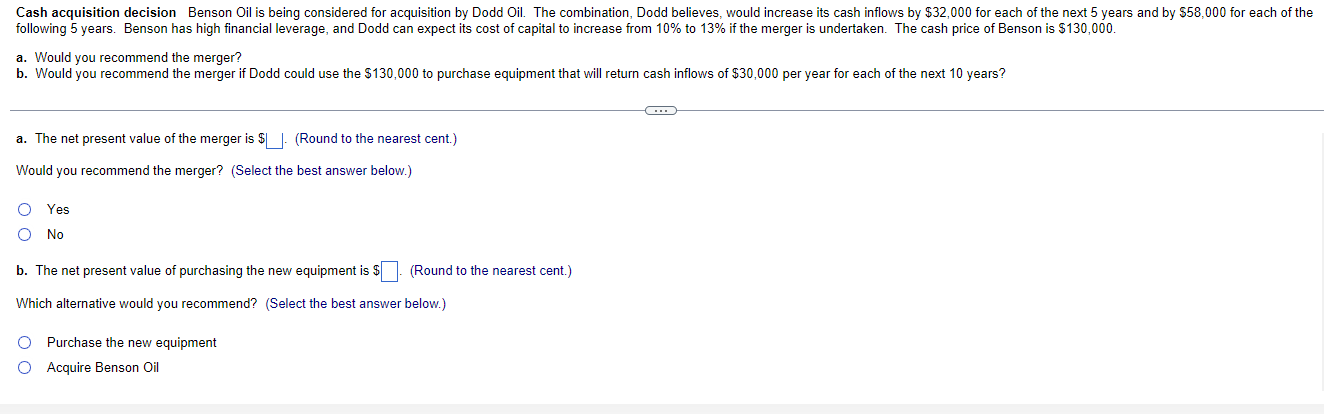

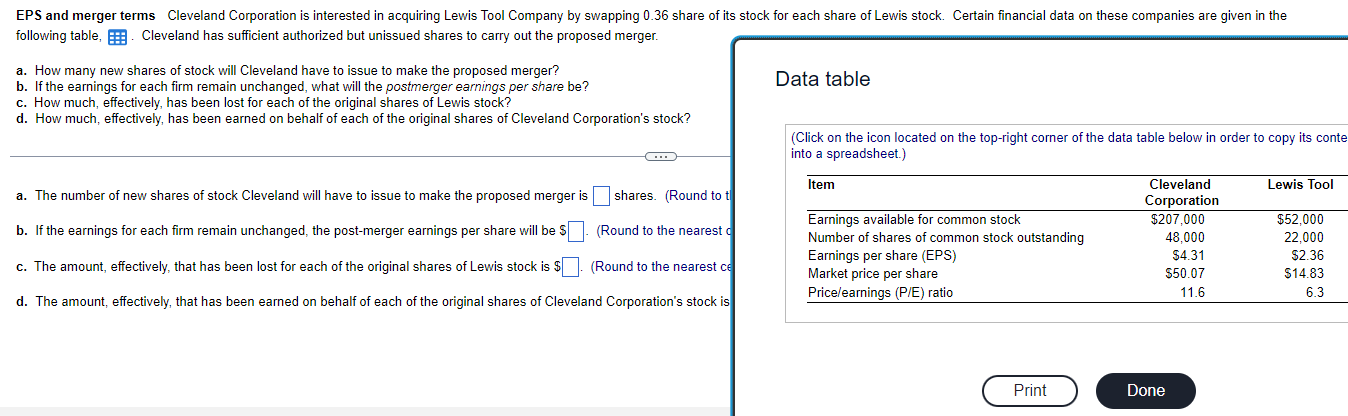

Cash acquisition decision Benson Oil is being considered for acquisition by Dodd Oil. The combination, Dodd believes would increase its cash inflows by $32,000 for each of the next 5 years and by 558,000 for each of the following 5 years. Benson has high financial leverage, and Dodd can expect its cost of capital to increase from 10% to 13% if the merger is undertaken. The cash price of Benson is $130,000. a. Would you recommend the merger? b. Would you recommend the merger if Dodd could use the $130,000 to purchase equipment that will return cash inflows of $30,000 per year for each of the next 10 years? a. The net present value of the merger is $U. (Round to the nearest cent.) Would you recommend the merger? (Select the best answer below.) Yes No b. The net present value of purchasing the new equipment is $ []. (Round to the nearest cent.) Which alternative would you recommend? (Select the best answer below.) O Purchase the new equipment O Acquire Benson Oil EPS and merger terms Cleveland Corporation is interested in acquiring Lewis Tool Company by swapping 0.36 share of its stock for each share of Lewis stock. Certain financial data on these companies are given in the following table, Cleveland has sufficient authorized but unissued shares to carry out the proposed merger. Data table a. How many new shares of stock will Cleveland have to issue to make the proposed merger? b. If the earnings for each firm remain unchanged, what will the postmerger earnings per share be? c. How much, effectively, has been lost for each of the original shares of Lewis stock? d. How much, effectively, has been earned on behalf of each of the original shares of Cleveland Corporation's stock? (Click on the icon located on the top-right corner of the data table below in order to copy its conte into a spreadsheet.) C. Item Lewis Tool a. The number of new shares of stock Cleveland will have to issue to make the proposed merger is shares. (Round to t b. If the earnings for each firm remain unchanged, the post-merger earnings per share will be $1. (Round to the nearest a c. The amount, effectively, that has been lost for each of the original shares of Lewis stock is $. (Round to the nearest ce Earnings available for common stock Number of shares of common stock outstanding Earnings per share (EPS) Market price per share Price/earnings (P/E) ratio Cleveland Corporation $207,000 48,000 $4.31 $50.07 11.6 $52.000 22,000 $2.36 $14.83 6.3 d. The amount, effectively, that has been earned on behalf of each of the original shares of Cleveland Corporation's stock is Print Done