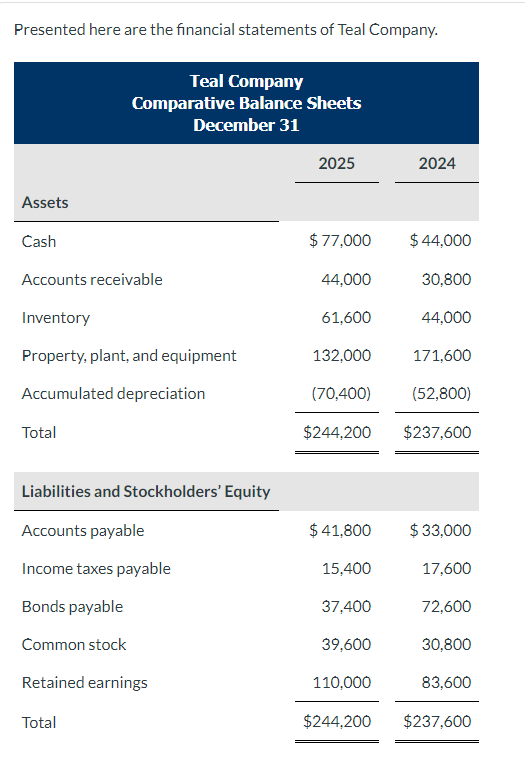

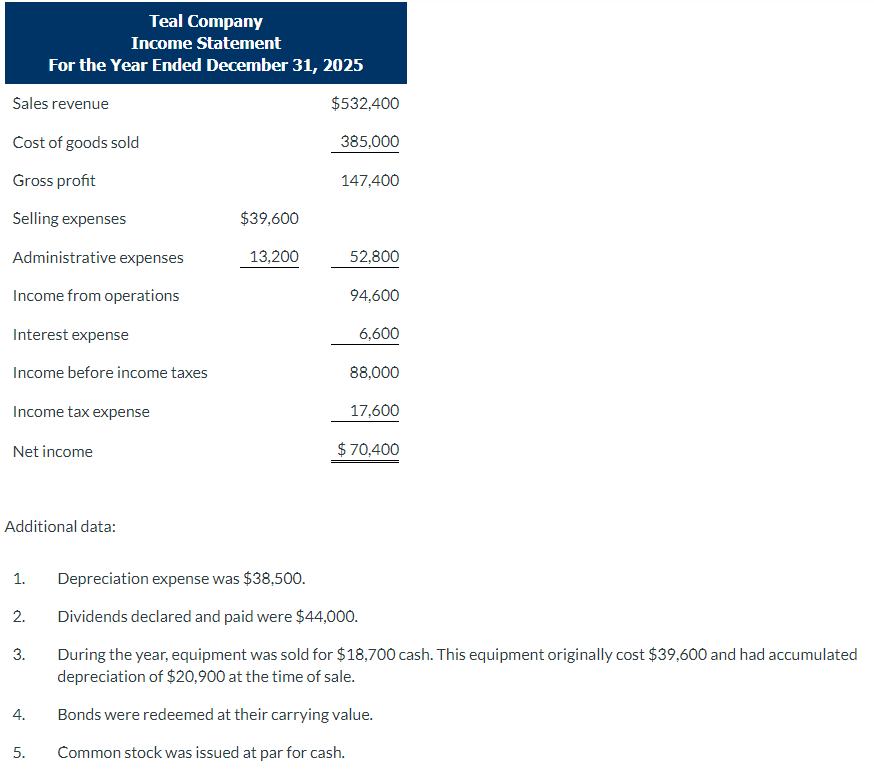

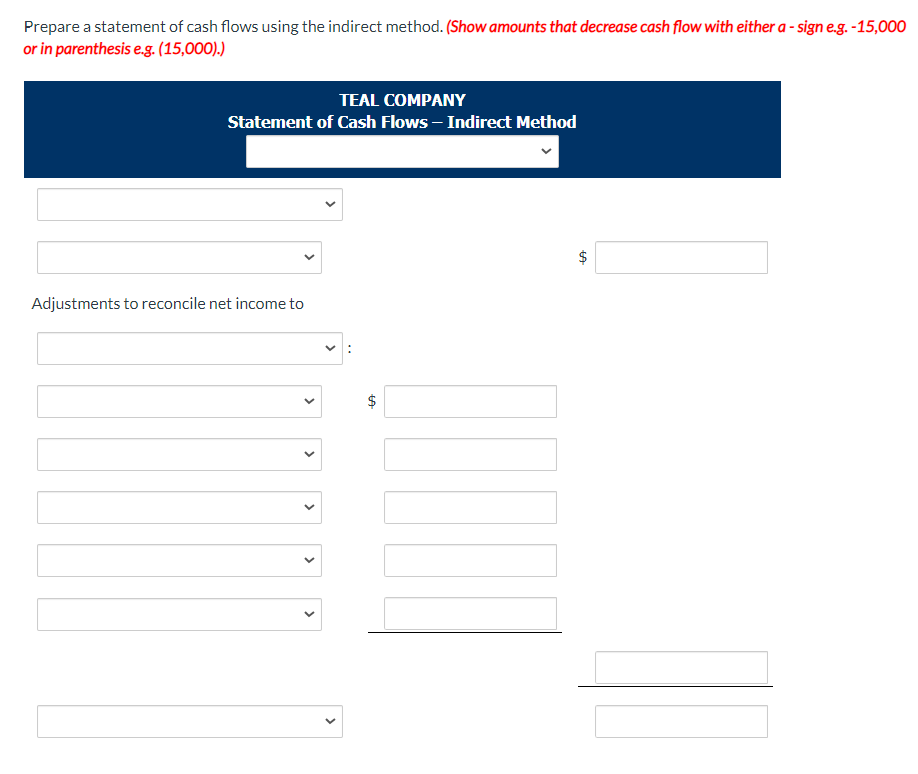

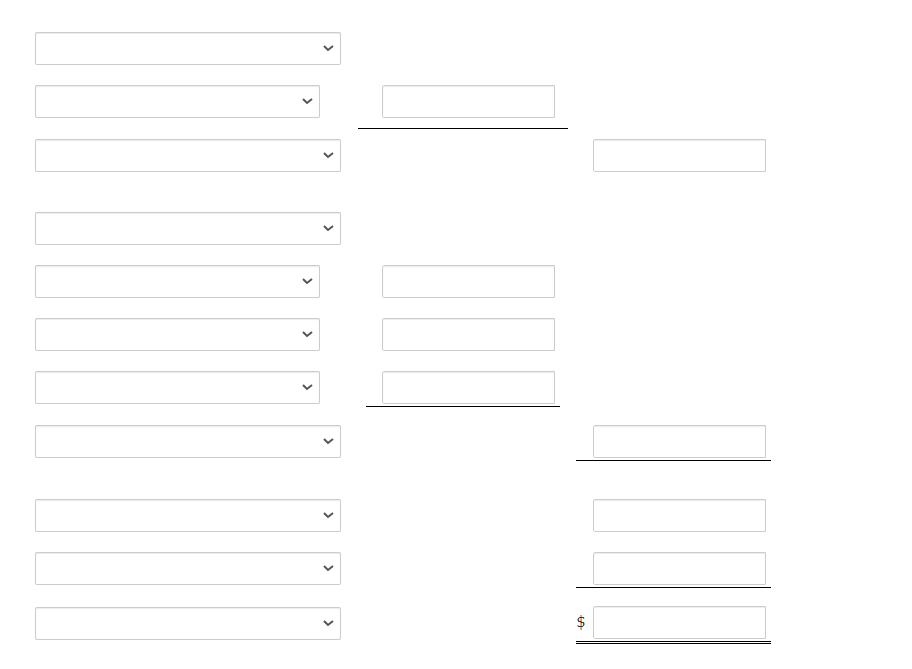

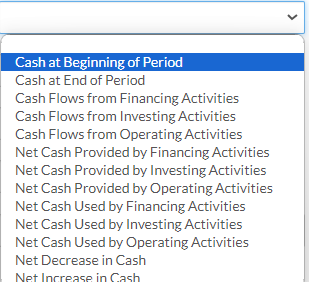

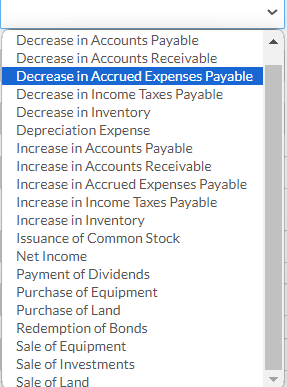

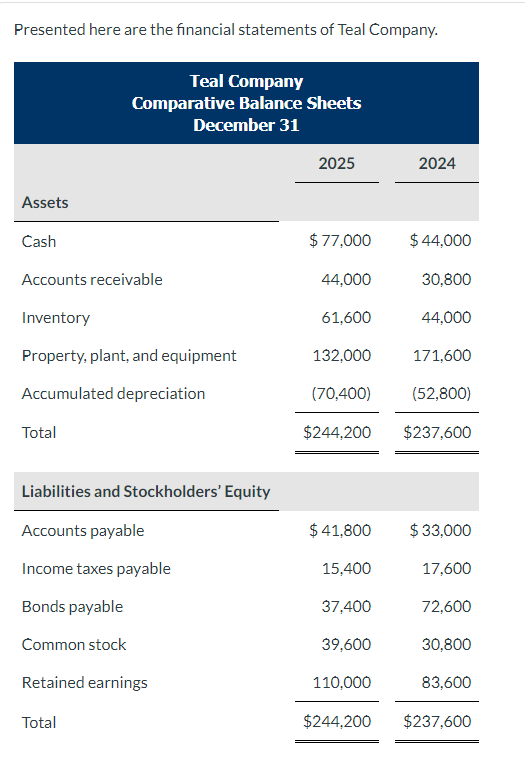

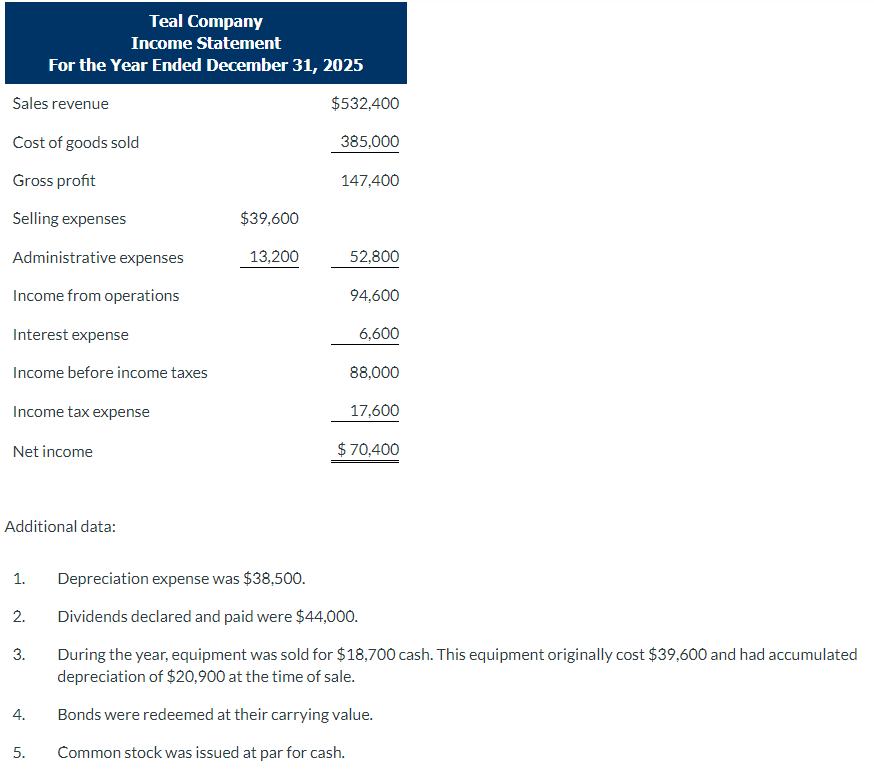

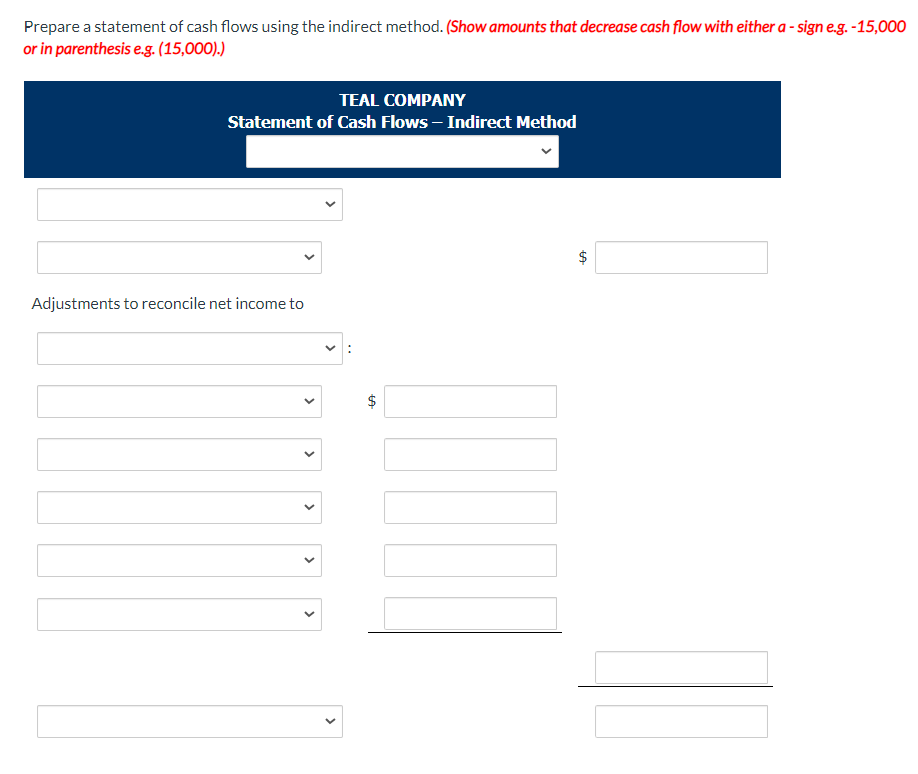

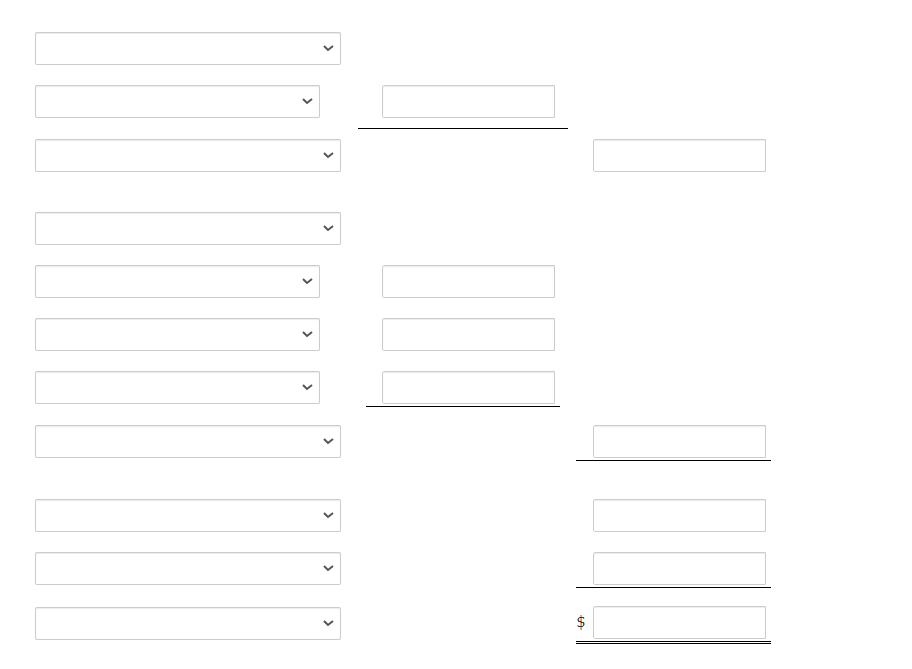

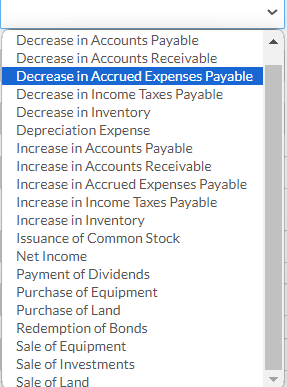

Cash at Beginning of Period Cash at End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Additional data: 1. Depreciation expense was $38,500. 2. Dividends declared and paid were $44,000. 3. During the year, equipment was sold for $18,700 cash. This equipment originally cost $39,600 and had accumulated depreciation of $20,900 at the time of sale. 4. Bonds were redeemed at their carrying value. 5. Common stock was issued at par for cash. Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Accrued Expenses Payable Decrease in Income Taxes Payable Decrease in Inventory Depreciation Expense Increase in Accounts Payable Increase in Accounts Receivable Increase in Accrued Expenses Payable Increase in Income Taxes Payable Increase in Inventory Issuance of Common Stock Net Income Payment of Dividends Purchase of Equipment Purchase of Land Redemption of Bonds Sale of Equipment Sale of Investments Sale of Land Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 Presented here are the financial statements of Teal Company. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{c} Teal Company \\ Comparative Balance Sheets \\ December 31 \end{tabular}} \\ \hline \multirow[b]{2}{*}{ Assets } & 2025 & 2024 \\ \hline & & \\ \hline Cash & $77,000 & $44,000 \\ \hline Accounts receivable & 44,000 & 30,800 \\ \hline Inventory & 61,600 & 44,000 \\ \hline Property, plant, and equipment & 132,000 & 171,600 \\ \hline Accumulated depreciation & (70,400) & (52,800) \\ \hline Total & $244,200 & $237,600 \\ \hline \multicolumn{3}{|c|}{ Liabilities and Stockholders' Equity } \\ \hline Accounts payable & $41,800 & $33,000 \\ \hline Income taxes payable & 15,400 & 17,600 \\ \hline Bonds payable & 37,400 & 72,600 \\ \hline Common stock & 39,600 & 30,800 \\ \hline Retained earnings & 110,000 & 83,600 \\ \hline Total & $244,200 & $237,600 \\ \hline \end{tabular}