Question

Cash at the end of the year is supposed to be 158,300. I am off by 49,100. What am I missing???!! Details below: The comparative

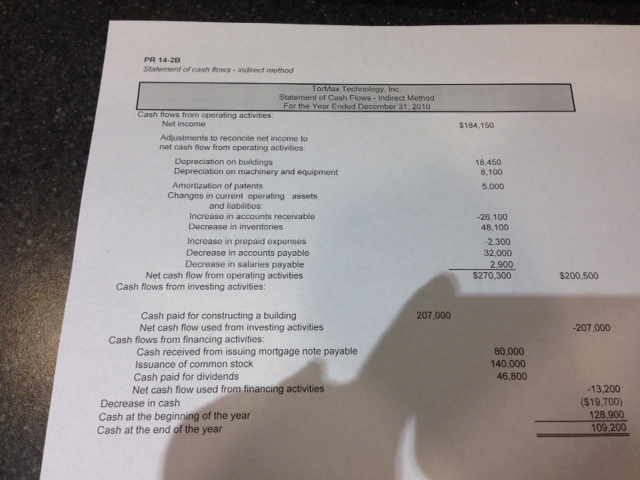

Cash at the end of the year is supposed to be 158,300. I am off by 49,100. What am I missing???!!

Details below:

The comparative balance sheet of TorMax Technology, Inc. at December 31, 2010 and 2009, is as follows: ASSETS DEC 31 2010 DEC 31 2009 CASH 158300 128900 ACCOUNTS RECEIVABLE (NET) 237600 211500 INVENTORIES 317100 365200 PREPAID EXPENSES 11300 9000 LAND 108000 108000 BUILDINGS 612000 405000 ACCUMULATED DEPRECIATION - BUILDING -166500 -148080 MACHINERY AND EQUIPTMENT 279000 279000 ACCUMULATED DEPRECIATION - MACHINERY AND EQUIPTMENT -76500 -68400 PATENTS 38200 43200 TOTAL 1518500 133350 LIAB AND STOCKHOLDERS EQUITY ACCOUNTS PAY (MERCHANIDISE CREDITORS) 299100 331100 DIVIDENDS PAYABLE 11700 9000 SALARIES PAYABLE 28200 31100 MORTGAGE NOTE PAYABLE, DUE 2017 80000 X BONDS PAYABLE X 140000 COMMON STOCK, $1 PAR 23000 18000 PAID-IN CAPITAL IN EXCESS OF - PAR COMMON STOCK 180000 45000 RETAINED EARNINGS 896500 759150 TOTAL 1518500 1333350 An examination of the income statement and the accounting records revealed the following additional information applicable to 2010: A. Net income, $184,150. B. Depreciation expense reported on the income statement: buildings, $18,450; machinery and equipment, $8,100. C. Patent amortization reported on the income statement, $5,000. D. A building was constructed for $207,000. E. A mortgage note for $80,000 was issued for cash. F. 5,000 shares of common stock were issued at $28 in exchange for the bonds payable. G. Cash dividends declared, $46,800. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. If needed, use the minus sign to indicate cash outflows or a decrease in cash.

Statement of Cash Flows - Indirect Method For the Year Ended December 31, 2012 Cash Flows from Operating Activities: Cash Flows from Investing Activities: Cash Flows from Financing ActivitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started