Answered step by step

Verified Expert Solution

Question

1 Approved Answer

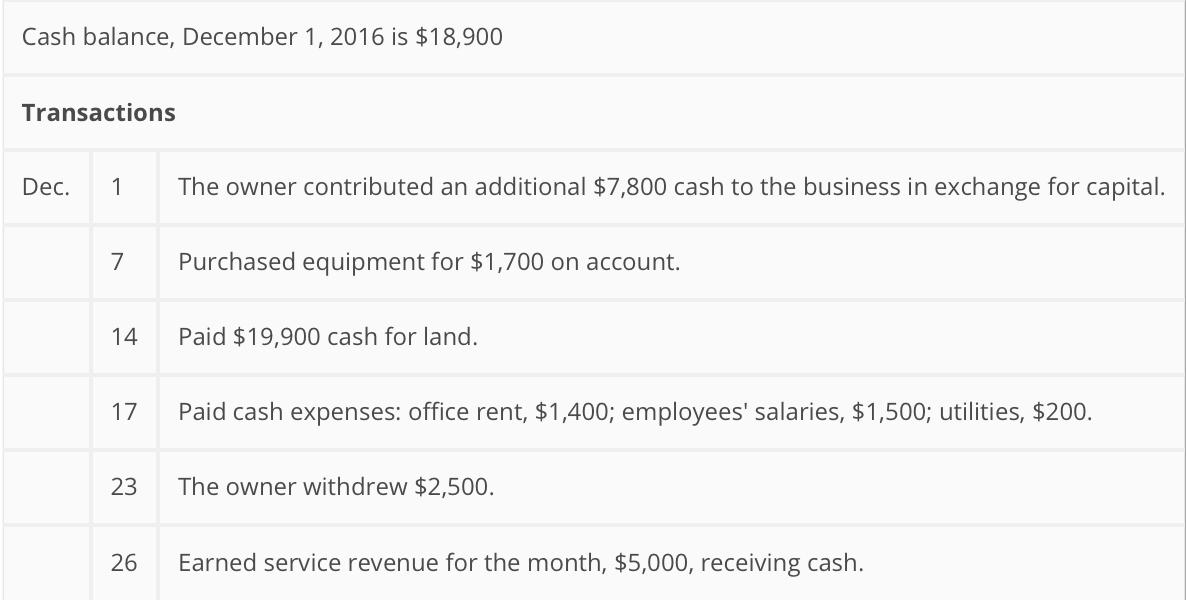

Cash balance, December 1, 2016 is $18,900 Transactions Dec. 1 7 14 17 23 26 The owner contributed an additional $7,800 cash to the

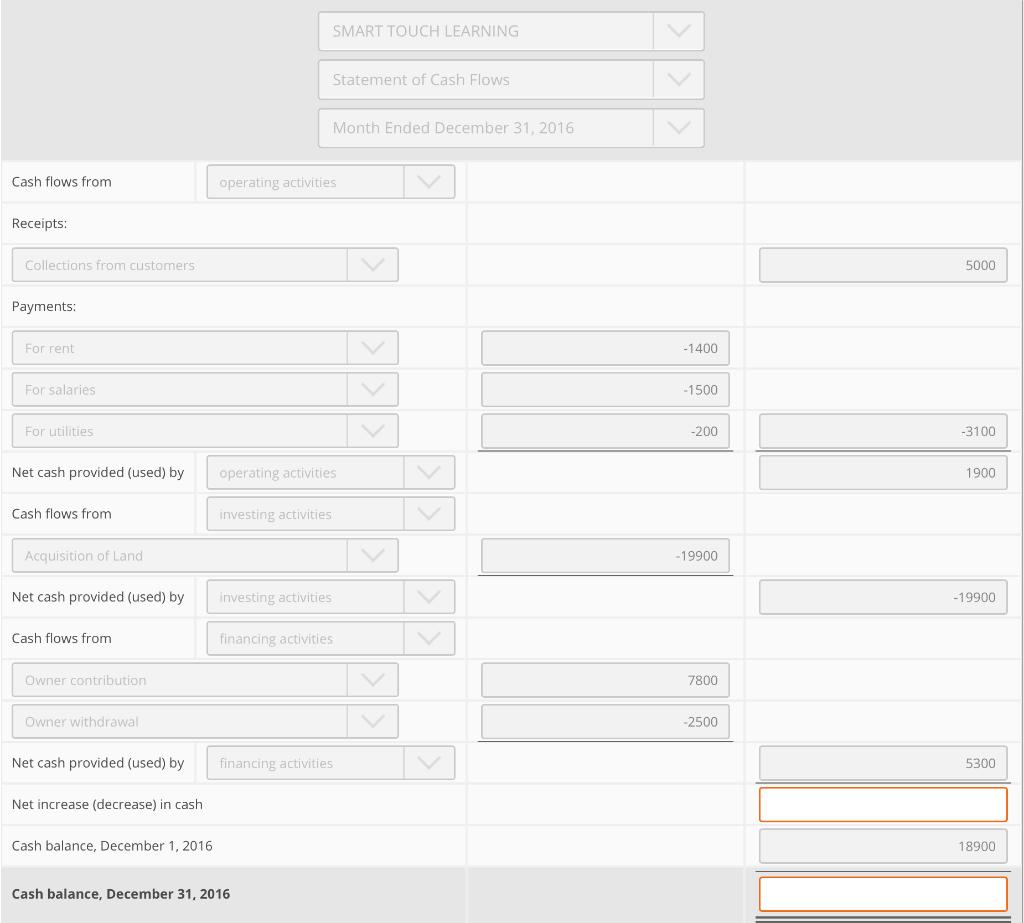

Cash balance, December 1, 2016 is $18,900 Transactions Dec. 1 7 14 17 23 26 The owner contributed an additional $7,800 cash to the business in exchange for capital. Purchased equipment for $1,700 on account. Paid $19,900 cash for land. Paid cash expenses: office rent, $1,400; employees' salaries, $1,500; utilities, $200. The owner withdrew $2,500. Earned service revenue for the month, $5,000, receiving cash. Cash flows from Receipts: Collections from customers Payments: For rent For salaries For utilities Cash flows from Acquisition of Land Net cash provided (used) by Cash flows from Net cash provided (used) by operating activities Owner contribution Owner withdrawal Net cash provided (used) by Net increase (decrease) in cash Cash balance, December 1, 2016 investing activities Statement of Cash Flows operating activities SMART TOUCH LEARNING investing activities financing activities financing activities Cash balance, December 31, 2016 Month Ended December 31, 2016 -1400 -1500 -200 -19900 7800 -2500 5000 -3100 1900 -19900 5300 18900

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution Cash flows from Operating Activities Receipts SMART ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started