Answered step by step

Verified Expert Solution

Question

1 Approved Answer

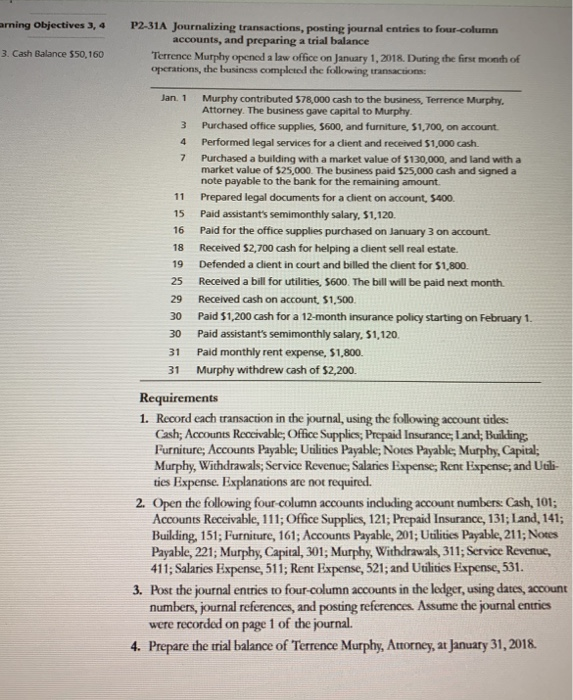

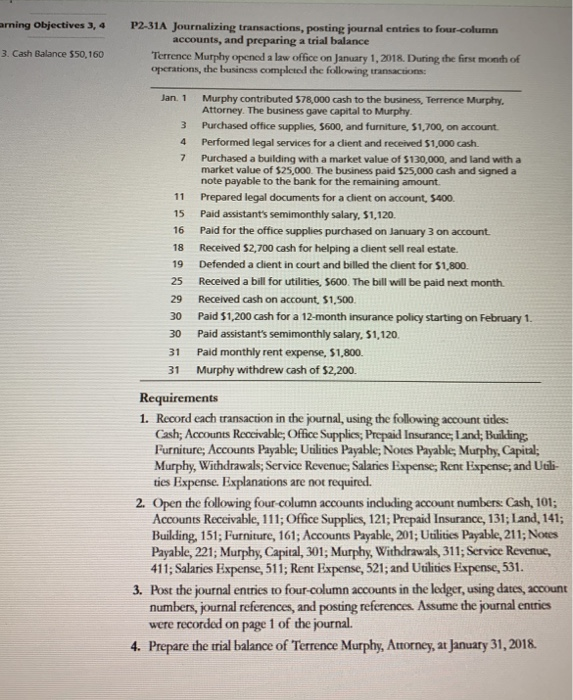

Cash balance is $50,160. Can someone help me with the requirements 1,2,3, and 4 arning Objectives 3, 4 P2-31A Journalizing transactions, posting journal entries to

Cash balance is $50,160. Can someone help me with the requirements 1,2,3, and 4

arning Objectives 3, 4 P2-31A Journalizing transactions, posting journal entries to four-column accounts, and preparing a trial balance Terrence Murphy opened a law office on January 1, 2018. During the first month of operations, the business completed the following transactions: 3. Cash Balance $50,160 Jan. 1 Murphy contributed $78,000 cash to the business, Terrence Murphy, Attorney. The business gave capital to Murphy Purchased office supplies, $600, and furniture, $1,700, on account. 4 Performed legal services for a client and received $1,000 cash Purchased a building with a market value of $130,000, and land with a market value of $25,000. The business paid 525,000 cash and signed a note payable to the bank for the remaining amount 7 11 Prepared legal documents for a client on account, $400. Paid assistant's semimonthly salary, $1,120 15 16 Paid for the office supplies purchased on January 3 on account Received $2,700 cash for helping a client sell real estate. 18 19 Defended a client in court and billed the dlient for $1,800. 25 Received a bill for utilities, $600. The bill will be paid next month 29 Received cash on account, $1,500. Paid $1,200 cash for a 12-month insurance policy starting on February 1. 30 Paid assistant's semimonthly salary, S1,120. 30 Paid monthly rent expense, $1,800. 31 Murphy withdrew cash of $2,200. 31 Requirements 1. Record each transaction in the journal, using the following account tides: Cash; Accounts Reccivable; Office Supplies, Prepaid Insurance; Land; Buikding Furniture; Accounts Payable; Unilities Payable; Notes Payable; Murphy, Capital; Murphy, Withdrawals, Service Revenue; Salaries Expense; Rent Expense; and Uali- ties Expense. Explanations are not required. 2. Open the following four-column accounts including account numbers: Cash, 101; Accounts Receivable, 111; Office Supplies, 121; Prepaid Insurance, 131; Land, 141; Building, 151; Furniture, 161; Accounts Payable, 201; Uuilitics Payable, 211; Notes Payable, 221; Murphy, Capital, 301; Murphy, Withdrawals, 311; Service Revenue, 411; Salaries Expense, 511; Rent Expense, 521; and Utilitics Expense, 531. 3. Post the journal entries to four-column accounts in the ledger, using dates, account numbers, journal references, and posting references. Assume the journal entries were recorded on page 1 of the journal. 4. Prepare the rrial balance of Terrence Murphy, Attorney, at January 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started