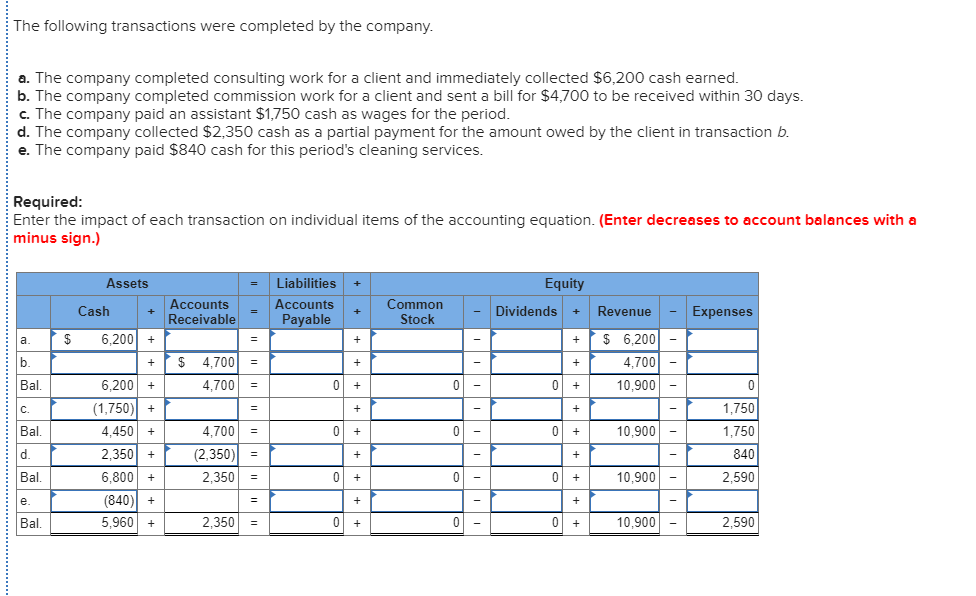

cash balance october 31 =

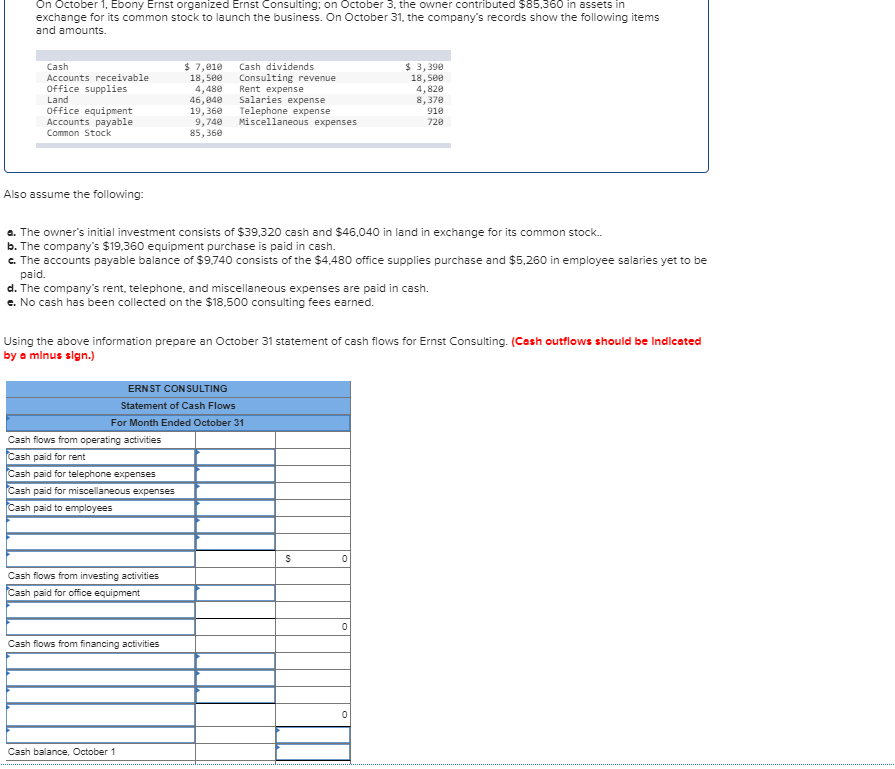

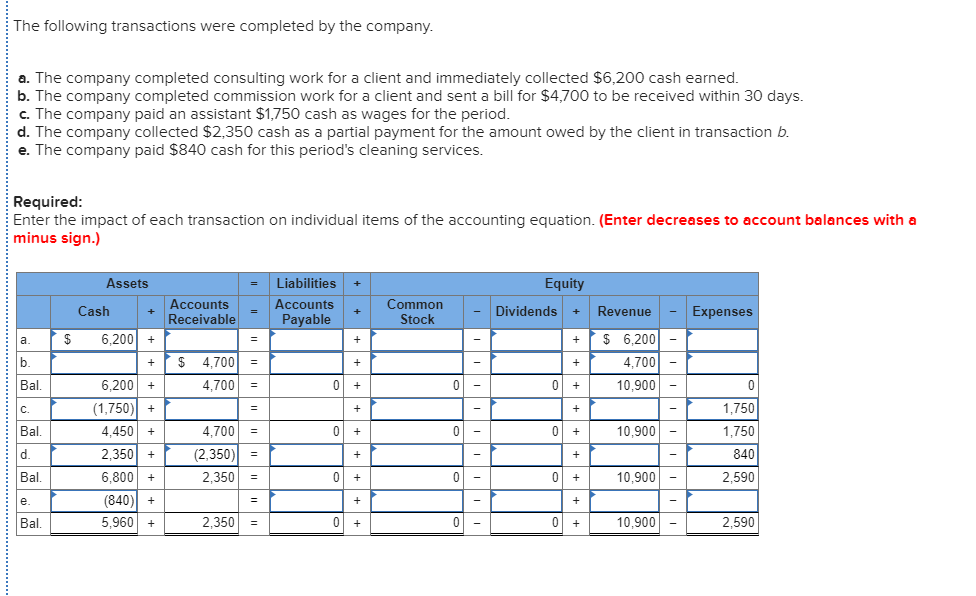

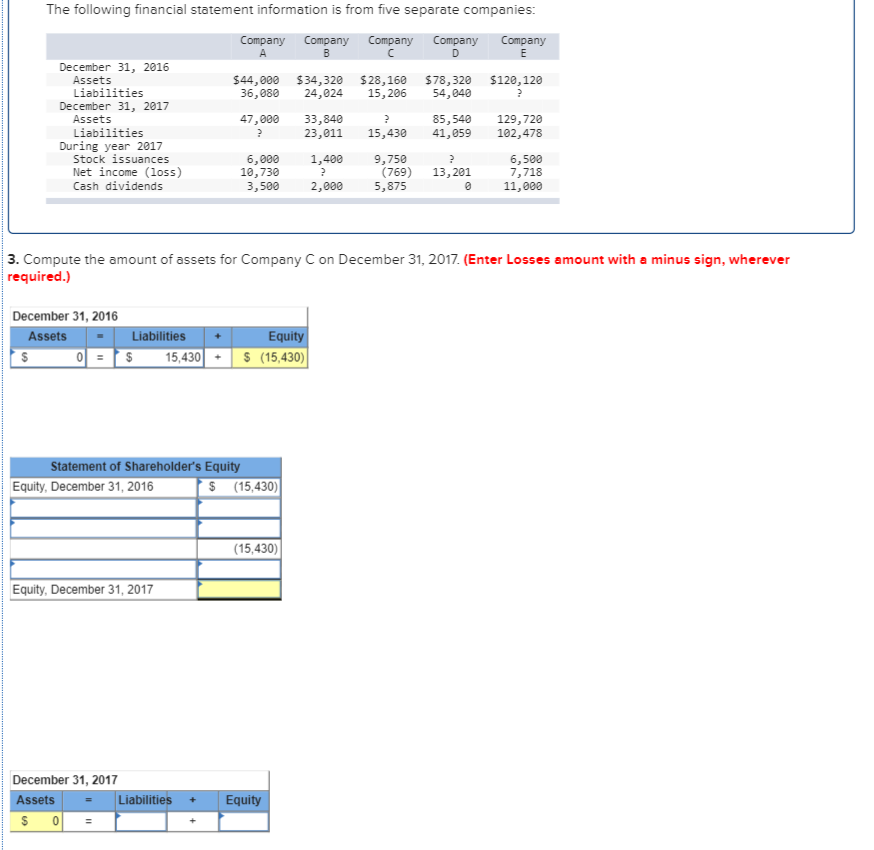

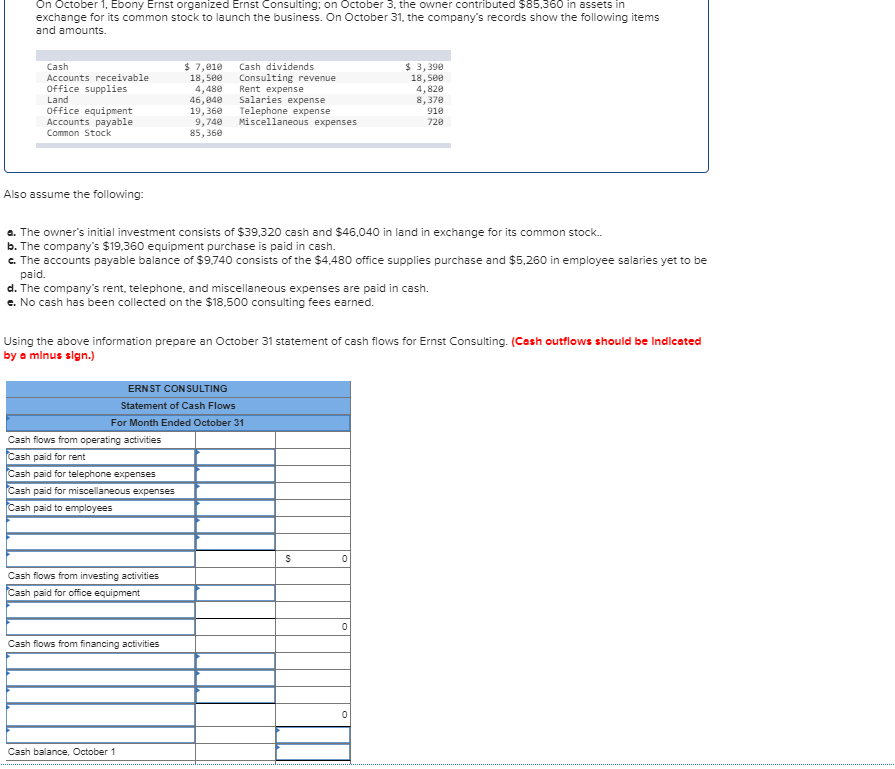

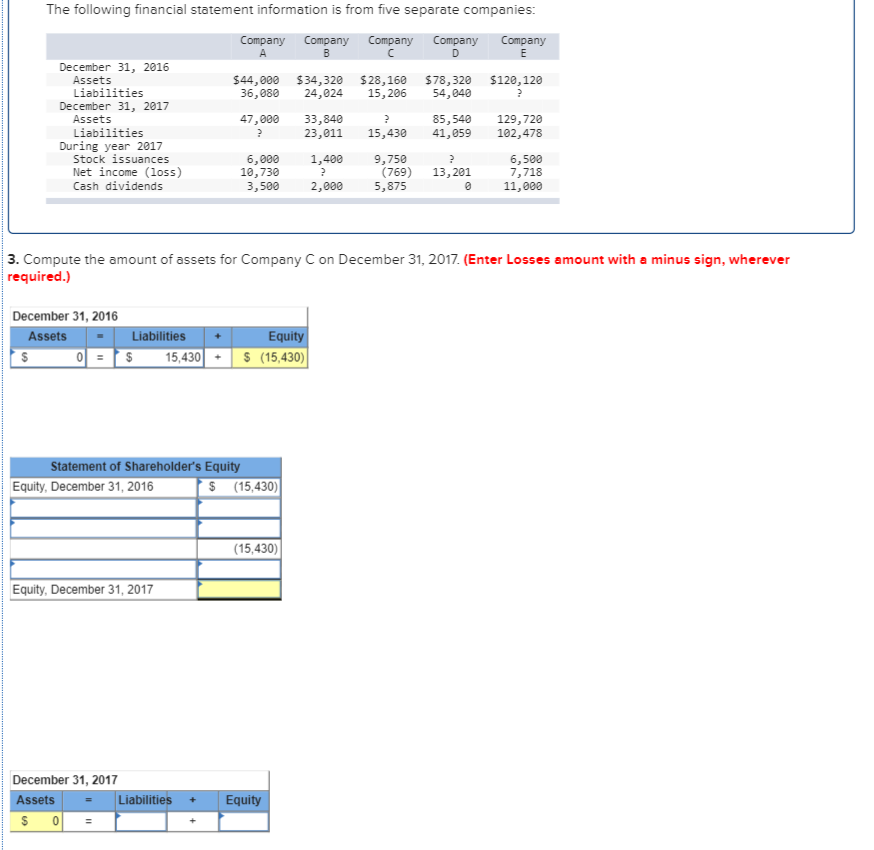

On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $85,360 in assets in exchange for its common stock to launch the business. On October 31, the company's records show the following items and amounts $ 7,010 18,50e 4,480 46,840 19,360 $ 3,390 18,500 4,820 8,370 Cash Cash dividends Accounts receivable Office supplies Land Consulting revenue Rent expense Salaries expense Telephone expense Miscellaneous expenses Office equipment Accounts payable Common Stock 910 9,740 85,360 72e Also assume the following: a. The owner's initial investment consists of $39,320 cash and $46,040 in land in exchange for its common stock... b. The company's $19.360 equipment purchase is paid in cash c. The accounts payable balance of $9.740 consists of the $4.480 office supplies purchase and $5,260 in employee salaries yet to be paid. d. The company's rent, telephone, and miscellaneous expenses are paid in cash e. No cash has been collected on the $18,500 consulting fees earned. Using the above information prepare an October 31 statement of cash flows for Ernst Consulting. (Cash outflows should be indicated by a minus sign.) ERNST CONSULTING Statement of Cash Flows For Month Ended October 31 Cash flows from operating activities Cash paid for rent Cash paid for telephone expenses Cash paid for miscellaneous expenses Cash paid to employees S Cash flows from investing activities Cash paid for office equipment 0 sh flows m financing activities 0 Cash balance, October 1 The following transactions were completed by the company. a. The company completed consulting work for a client and immediately collected $6,200 cash earned. b. The company completed commission work for a client and sent a bill for $4,700 to be received within 30 days. c. The company paid an assistant $1,750 cash as wages for the period. d. The company collected $2,350 cash as a partial payment for the amount owed by the client in transaction b. e. The company paid $840 cash for this period's cleaning services. Required: Enter the impact of each transaction on individual items of the accounting equation. (Enter decreases to account balances with a minus sign.) Assets Liabilities Equity = Accounts Receivable Accounts Common Cash Dividends Revenue Expenses + Payable Stock 6,200 6,200 + 4,700 b 4,700 + 4 6,200 4,700 10,900 Bal 0 0 + (1,750) 1,750 + 4 c. = Bal. 4,700 1,750 4,450 0 0 10,900 + 840 2,350 (2,350) + + = 10,900 Bal 6,800 2,350 0 0 2,590 (840) e. Bal. 10.900 5.960 2,350 0 0 0 2,590 + + The following financial statement information is from five separate companies: Company A Company Company Company Company D December 31, 2016 Assets Liabilities $44,000 36,080 $78,320 54,040 $34,320 24,024 $28,160 15,206 $120,120 December 31, 2017 85,540 41,059 Assets 47,000 33,840 23,011 129,720 Liabilities During year 2017 Stock issuances 15,430 102,478 6,000 10,730 3,500 1,400 9,750 (769) 5,875 6,500 7,718 11,000 Net income (loss) Cash dividends 13, 201 2,000 3. Compute the amount of assets for Company C on December 31, 2017. (Enter Losses amount with a minus sign, wherever required.) December 31, 2016 Liabilities Assets Equity 15,430 S (15,430) Statement of Shareholder's Equity Equity, December 31, 2016 $ (15,430) (15,430) Equity, December 31, 2017 December 31, 2017 Liabilities Equity Assets 0