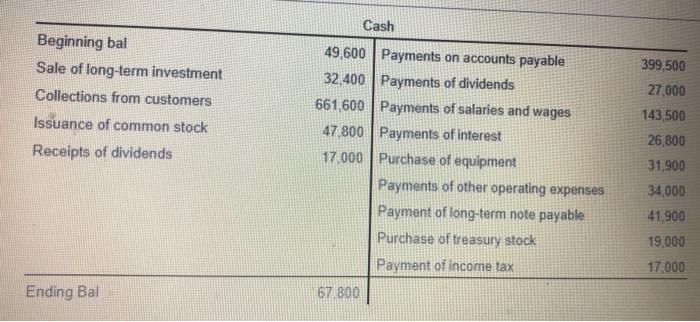

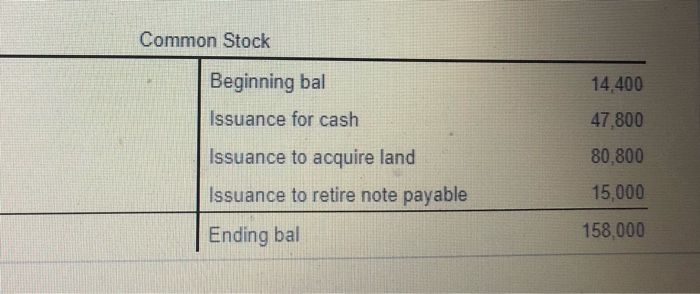

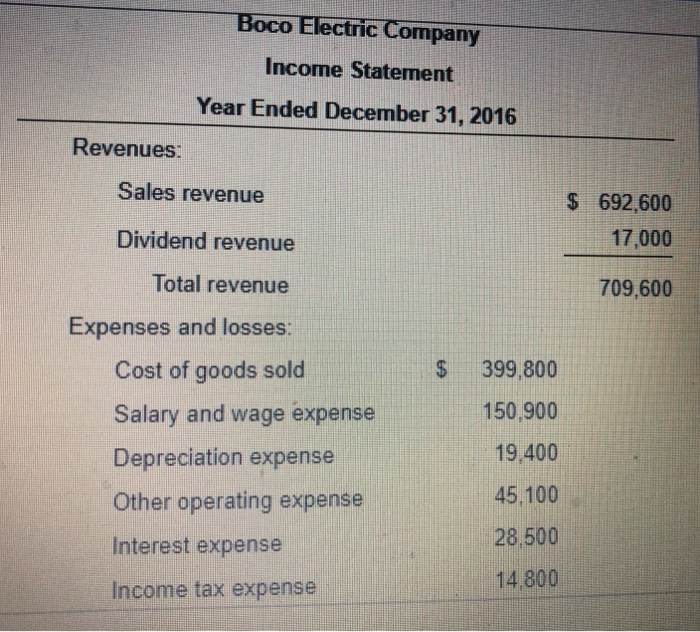

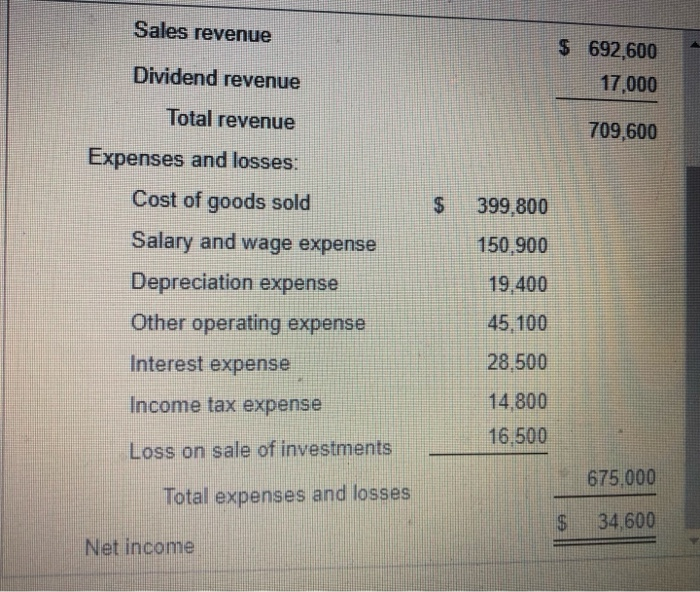

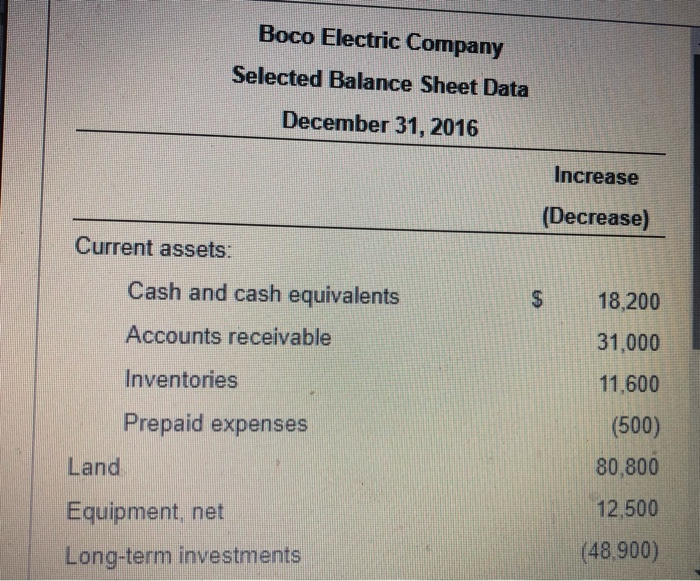

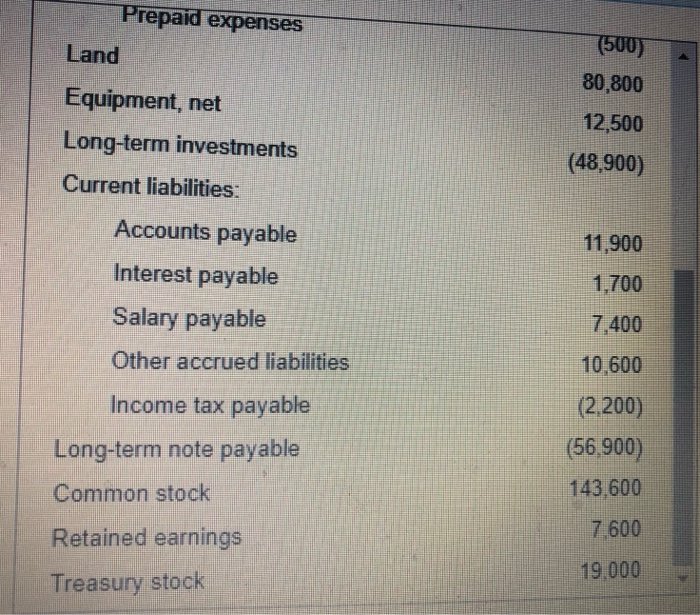

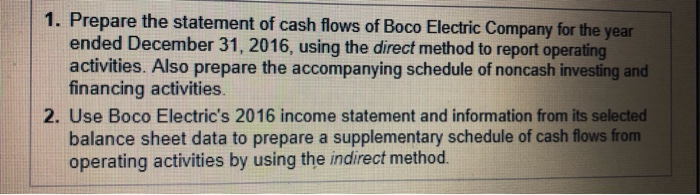

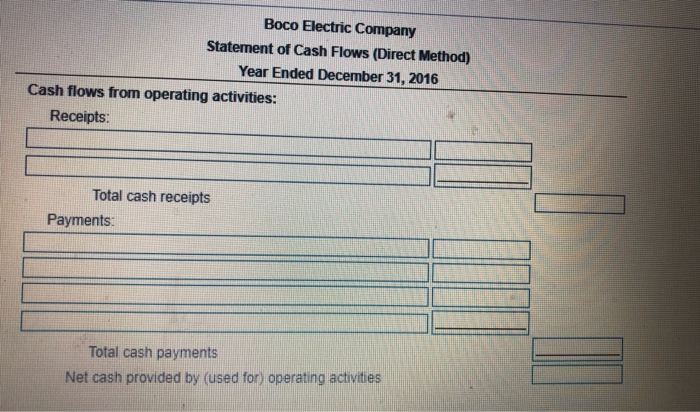

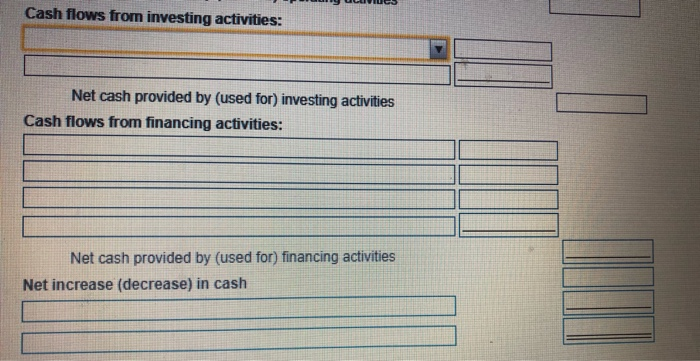

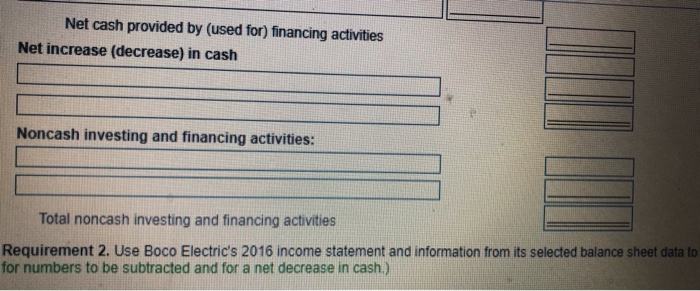

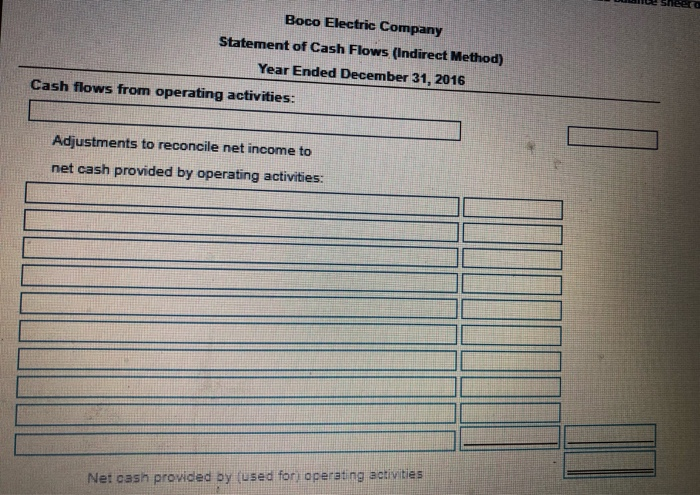

Cash Beginning bal 49,600 Payments on accounts payable 399,500 Sale of long-term investment 32,400 Payments of dividends 27,000 Collections from customers 661,600 Payments of salaries and wages 143,500 Issuance of common stock Payments of interest 47,800 26,800 Receipts of dividends Purchase of equipment 17.000 31,900 Payments of other operating expenses 34,000 Payment of long-term note payable 41.900 19,000 Purchase of treasury stock 17,000 Payment of income tax 67 800 Ending Bal Common Stock Beginning bal 14,400 Issuance for cash 47,800 Issuance to acquire land 80,800 15,000 Issuance to retire note payable 158,000 Ending bal Boco Electric Company Income Statement Year Ended December 31, 2016 Revenues: Sales revenue $ 692,600 17,000 Dividend revenue Total revenue 709,600 Expenses and losses: Cost of goods sold $ 399,800 150,900 Salary and wage expense 19,400 Depreciation expense 45,100 Other operating expense 28.500 Interest expense 14,800 Income tax expense Sales revenue S 692,600 Dividend revenue 17,000 Total revenue 709,600 Expenses and losses: Cost of goods sold 399,800 Salary and wage expense 150,900 Depreciation expense 19,400 Other operating expense 45,100 Interest expense 28,500 Income tax expense 14,800 16,500 Loss on sale of investments 675,000 Total expenses and losses 34.600 Net income Boco Electric Company Selected Balance Sheet Data December 31, 2016 Increase (Decrease) Current assets: Cash and cash equivalents $ 18,200 Accounts receivable 31,000 Inventories 11,600 Prepaid expenses (500) Land 80,800 12,500 Equipment, net (48,900) Long-term investments Prepaid expenses (500) Land 80,800 Equipment, net 12,500 Long-term investments (48,900) Current liabilities: Accounts payable 11,900 Interest payable 1,700 Salary payable 7,400 Other accrued liabilities 10,600 Income tax payable (2,200) (56900) Long-term note payable 143,600 Common stock 7.600 Retained earnings 19.000 Treasury stock 1. Prepare the statement of cash flows of Boco Electric Company for the year ended December 31, 2016, using the direct method to report operating activities. Also prepare the accompanying schedule of noncash investing and financing activities. 2. Use Boco Electric's 2016 income statement and information from its selected balance sheet data to prepare a supplementary schedule of cash flows from operating activities by using the indirect method. Boco Electric Company Statement of Cash Flows (Direct Method) Year Ended December 31, 2016 Cash flows from operating activities: Receipts: Total cash receipts Payments: Total cash payments Net cash provided by (used for) operating activities Cash flows from investing activities: Net cash provided by (used for) investing activities Cash flows from financing activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash Net cash provided by (used for) financing activities Net increase (decrease) in cash Noncash investing and financing activities: Total noncash investing and financing activities Requirement 2. Use Boco Electric's 2016 income statement and information from its selected balance sheet data to for numbers to be subtracted and for a net decrease in cash.) Boco Electric Company Statement of Cash Flows (Indirect Method) Year Ended December 31, 2016 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities: Net cash provided by (used for) operating activities