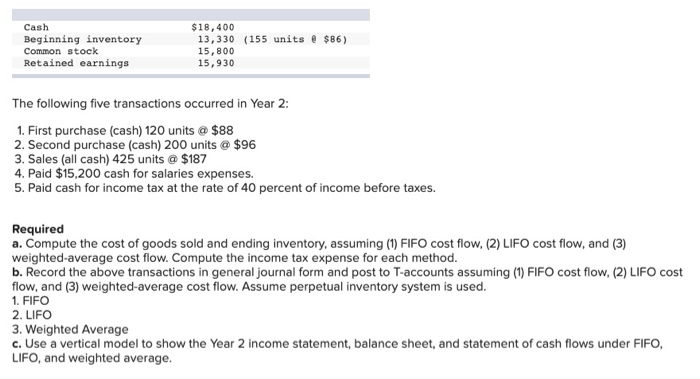

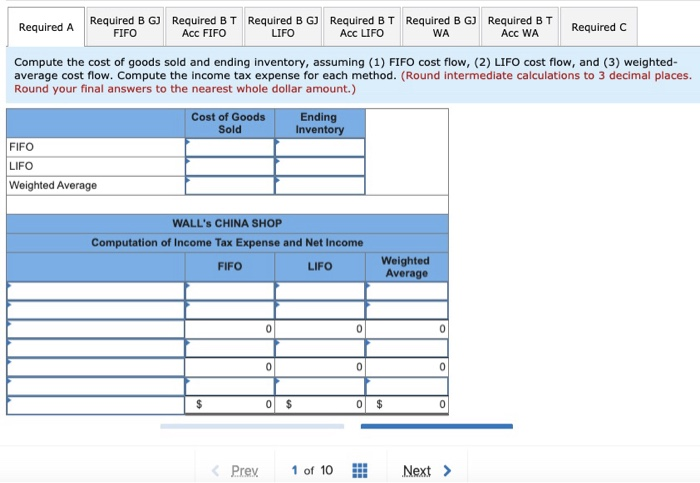

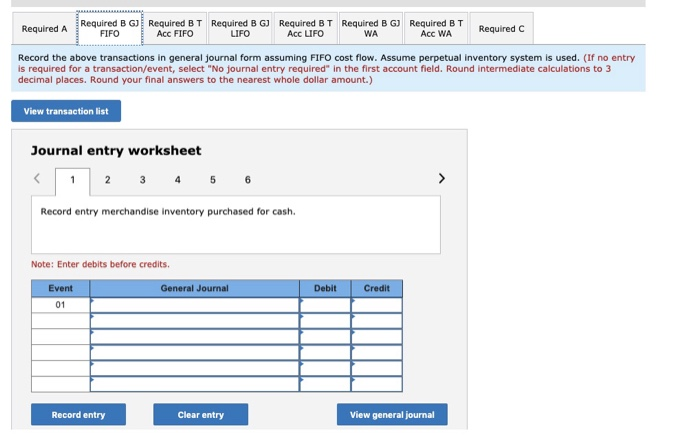

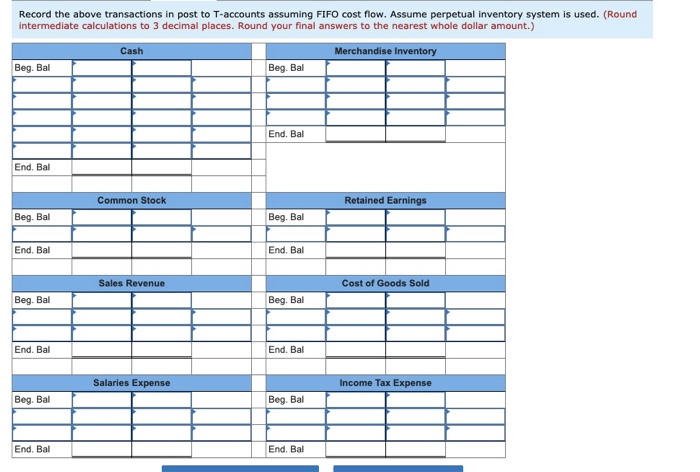

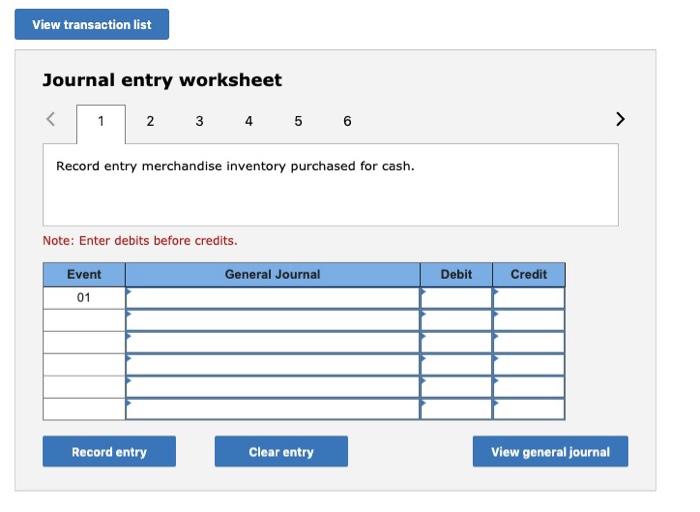

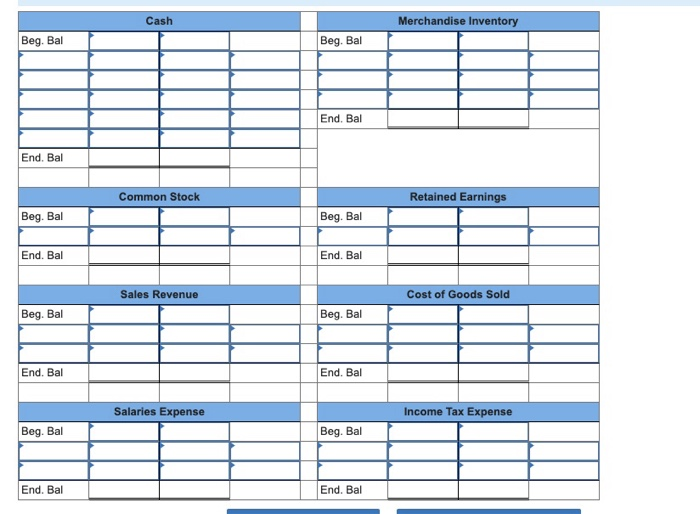

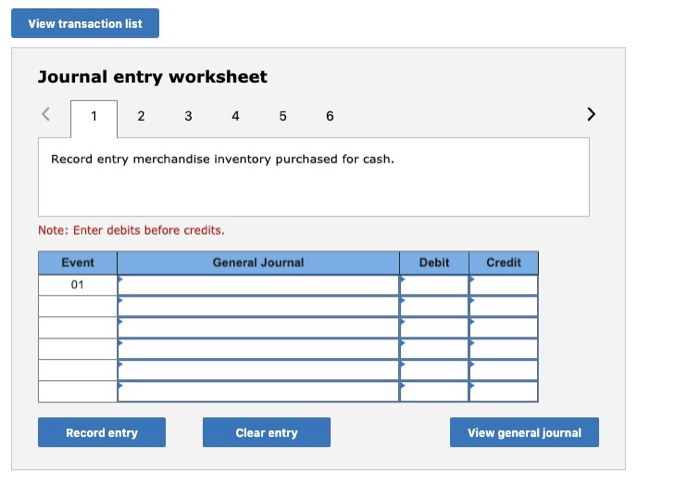

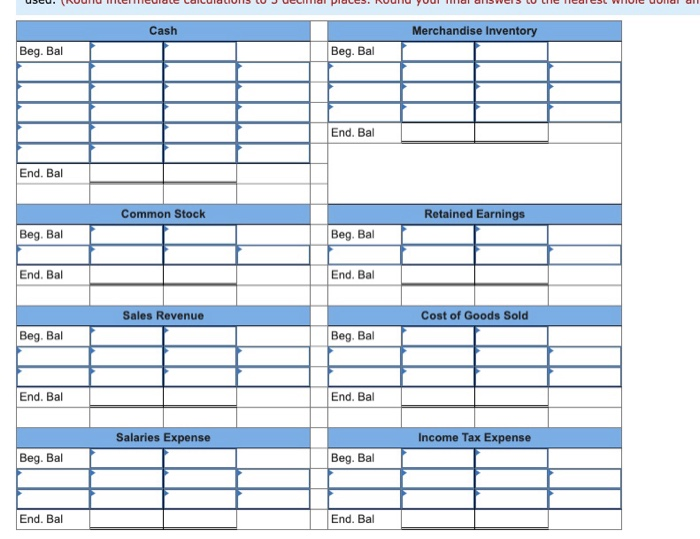

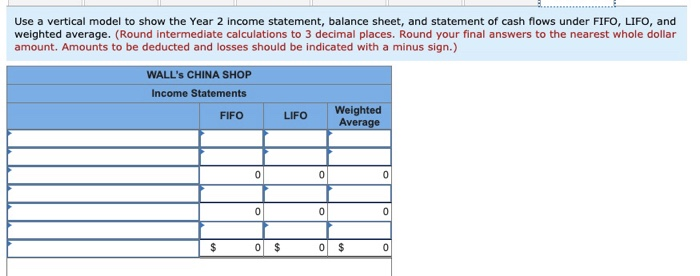

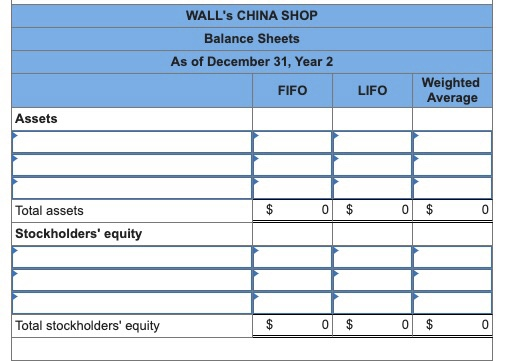

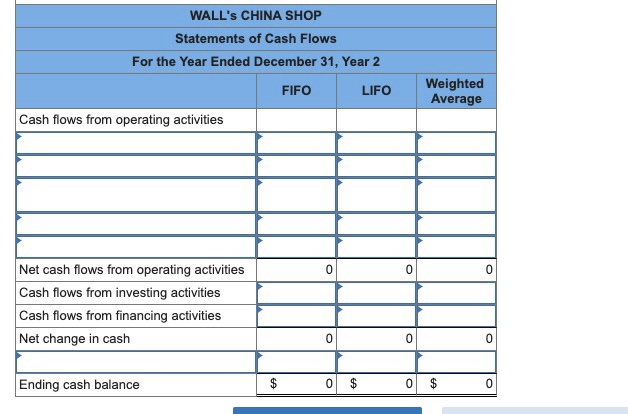

Cash Beginning inventory Common stock Retained earnings $18,400 13,330 (155 units @ $86) 15,800 15,930 The following five transactions occurred in Year 2: 1. First purchase (cash) 120 units @ $88 2. Second purchase (cash) 200 units @ $96 3. Sales (all cash) 425 units @ $187 4. Paid $15,200 cash for salaries expenses. 5. Paid cash for income tax at the rate of 40 percent of income before taxes. Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted average cost flow. Compute the income tax expense for each method. b. Record the above transactions in general journal form and post to T-accounts assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted average cost flow. Assume perpetual inventory system is used. 1. FIFO 2. LIFO 3. Weighted Average c. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. Required A Required B G Required BT Required B G Required BT Required B G Required BT FIFO Acc FIFO LIFO Acc LIFO WA Acc WA Required C Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. Compute the income tax expense for each method. (Round intermediate calculations to 3 decimal places. Round your final answers to the nearest whole dollar amount.) Cost of Goods Ending Sold Inventory FIFO LIFO Weighted Average WALL'S CHINA SHOP Computation of Income Tax Expense and Net Income FIFO LIFO Weighted Average 0 0 0 0 0 0 0 $ 0 $ 0 Prey 1 of 10 Next > Required A Required B G Required BT Required B G Required BT Required B G Required BT FIFO Acc FIFO LIFO Acc LIFO WA Acc WA Required Record the above transactions in general Journal form assuming FIFO cost flow. Assume perpetual inventory system is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations to 3 decimal places. Round your final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 2 3 4 5 6 Record entry merchandise inventory purchased for cash. Note: Enter debits before credits. Event General Journal Debit Credit 01 Record entry Clear entry View general journal Record the above transactions in post to T-accounts assuming FIFO cost flow. Assume perpetual inventory system is used. (Round intermediate calculations to 3 decimal places. Round your final answers to the nearest whole dollar amount.) Cash Merchandise Inventory Beg. Bal Beg. Bal End. Bal End. Bal Common Stock Retained Earnings Beg. Bal Beg. Bal End. Bal End. Bal Sales Revenue Cost of Goods Sold Beg. Bal Beg. Bal End. Bal End. Bal Salaries Expense Income Tax Expense Beg. Bal Beg. Bal End. Bal End. Bal View transaction list Journal entry worksheet Record entry merchandise inventory purchased for cash. Note: Enter debits before credits. General Journal Debit Credit Event 01 Record entry Clear entry View general journal Cash Merchandise Inventory Beg. Bal Beg. Bal End, Bal End. Bal Common Stock Retained Earnings Beg. Bal Beg. Bal End. Bal End. Bal Sales Revenue Cost of Goods Sold Beg. Bal Beg. Bal End. Bal End. Bal Salaries Expense Income Tax Expense Beg. Bal Beg. Bal End. Bal End. Bal View transaction list Journal entry worksheet 12 3 4 5 6 > Record entry merchandise inventory purchased for cash. Note: Enter debits before credits. Event General Journal Debit Credit 01 Record entry Clear entry View general journal Cash Merchandise Inventory Beg. Bal Beg. Bal End. Bal End. Bal Common Stock Retained Earnings Beg. Bal Beg. Bal End. Bal End. Bal Sales Revenue Cost of Goods Sold Beg, Bal Beg. Bal End. Bal End. Bal Salaries Expense Income Tax Expense Beg. Bal Beg. Bal End. Bal End. Bal Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Round intermediate calculations to 3 decimal places. Round your final answers to the nearest whole dollar amount. Amounts to be deducted and losses should be indicated with a minus sign.) WALL'S CHINA SHOP Income Statements LIFO Weighted Average FIFO 0 0 0 0 0 0 $ 0 $ 0 $ 0 WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO LIFO Weighted Average Assets $ 0 $ 0 $ 0 Total assets Stockholders' equity Total stockholders' equity $ 0 $ 0 $ 0 WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Weighted Average Cash flows from operating activities 0 0 0 Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash 0 0 0 Ending cash balance $ 0 $ 0 $ 0