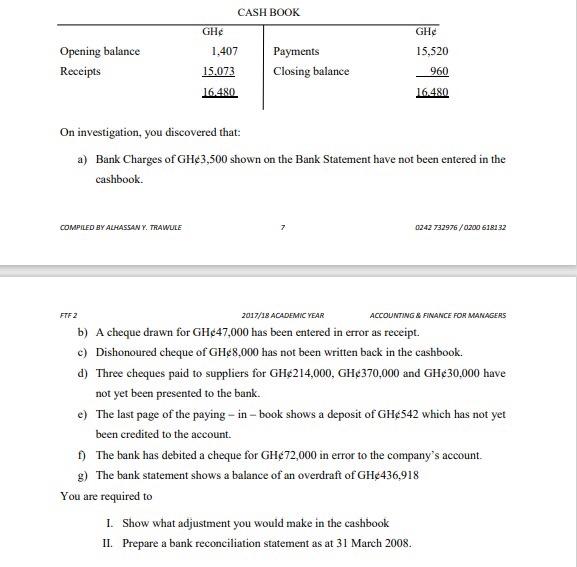

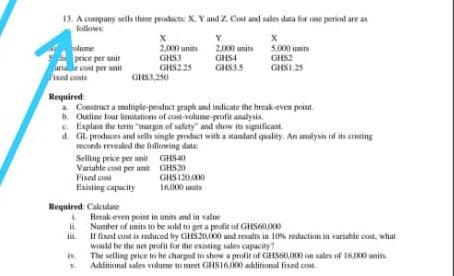

CASH BOOK GH Opening balance Receipts 1,407 15.073 16.480 Payments Closing balance GH 15,520 960 16.480 On investigation, you discovered that: a) Bank Charges of GH3,500 shown on the Bank Statement have not been entered in the cashbook. COMPILED BY ALHASSAN Y. TRAWULE 7 0242 732976 / 0200 618132 FTF 2 2017/18 ACADEMIC YEAR ACCOUNTING & FINANCE FOR MANAGERS b) A cheque drawn for GH47,000 has been entered in error as receipt. c) Dishonoured cheque of GH8.000 has not been written back in the cashbook. d) Three cheques paid to suppliers for GH6214,000, GH370,000 and GH30.000 have not yet been presented to the bank. e) The last page of the paying - in - book shows a deposit of GH542 which has not yet been credited to the account. The bank has debited a cheque for GH72,000 in error to the company's account. 8) The bank statement shows a balance of an overdraft of GH436,918 You are required to 1. Show what adjustment you would make in the cashbook II. Prepare a bank reconciliation statement as at 31 March 2008. 5.000 13. A company other products. Y und Z Cost and also for one peredaran X Y X lume 2,000 2.000 units price permit GHSS GHS GHS ricot per unit OHS225 GHSS GHS GHS3,20 Required Camille product yraph and indicate the break even point Online formations ontvolume-profit analysis Laplain the futy and how its significat 4. Cand single pact with a standard quality, Analyn of sing mon aded the following de Selling price per unit GHS Variable con perunt GRS Fixed GRS120,000 Big City Hequired Calle Hakeenpoint in tits and in ve Number of tisits to be sold to peta profit of HSG000 If fixat continereded by GHS20.00 and result 10 reduction in ruble cont what wild be the news for the capacity The wingice in the changed to show mit of GHS60000 as of 16.00 Achibitional sales wilt met GHS16.000 abitional find.com CASH BOOK GH Opening balance Receipts 1,407 15.073 16.480 Payments Closing balance GH 15,520 960 16.480 On investigation, you discovered that: a) Bank Charges of GH3,500 shown on the Bank Statement have not been entered in the cashbook. COMPILED BY ALHASSAN Y. TRAWULE 7 0242 732976 / 0200 618132 FTF 2 2017/18 ACADEMIC YEAR ACCOUNTING & FINANCE FOR MANAGERS b) A cheque drawn for GH47,000 has been entered in error as receipt. c) Dishonoured cheque of GH8.000 has not been written back in the cashbook. d) Three cheques paid to suppliers for GH6214,000, GH370,000 and GH30.000 have not yet been presented to the bank. e) The last page of the paying - in - book shows a deposit of GH542 which has not yet been credited to the account. The bank has debited a cheque for GH72,000 in error to the company's account. 8) The bank statement shows a balance of an overdraft of GH436,918 You are required to 1. Show what adjustment you would make in the cashbook II. Prepare a bank reconciliation statement as at 31 March 2008. 5.000 13. A company other products. Y und Z Cost and also for one peredaran X Y X lume 2,000 2.000 units price permit GHSS GHS GHS ricot per unit OHS225 GHSS GHS GHS3,20 Required Camille product yraph and indicate the break even point Online formations ontvolume-profit analysis Laplain the futy and how its significat 4. Cand single pact with a standard quality, Analyn of sing mon aded the following de Selling price per unit GHS Variable con perunt GRS Fixed GRS120,000 Big City Hequired Calle Hakeenpoint in tits and in ve Number of tisits to be sold to peta profit of HSG000 If fixat continereded by GHS20.00 and result 10 reduction in ruble cont what wild be the news for the capacity The wingice in the changed to show mit of GHS60000 as of 16.00 Achibitional sales wilt met GHS16.000 abitional find.com