Answered step by step

Verified Expert Solution

Question

1 Approved Answer

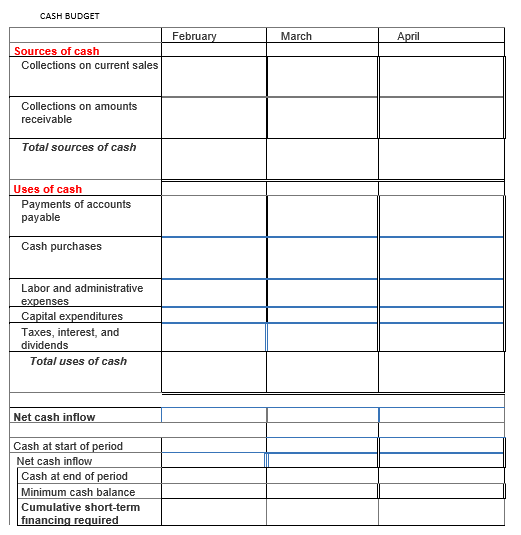

CASH BUDGET begin{tabular}{|l|l|l|l||} hline & February & March & April hline Sources of cash & & & hline Collections on current sales &

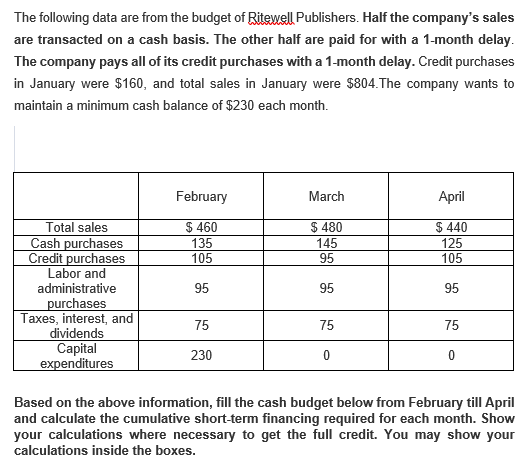

CASH BUDGET \begin{tabular}{|l|l|l|l||} \hline & February & March & April \\ \hline Sources of cash & & & \\ \hline Collections on current sales & & & \\ \hline Collectionsonamountsreceivable & & & \\ \hline Total sources of cash & & & \\ \hline UsesofcashPaymentsofaccountspayable & & & \\ \hline Cashpurchases & & & \\ \hline Laborandadministrativeexpenses & & & \\ \hline Capital expenditures & & & \\ \hline Taxes,interest,anddividends & & & \\ \hline \multicolumn{1}{|c||}{ Total uses of cash } & & & \\ \hline Cumulativeshort-termfunancingrequired & & & \\ \hline Nash at start of period & & & \\ \hline Net cash inflow & & & \\ \hline Cash at end of period & & & \\ \hline Minimum cash balance & & & \\ \hline \end{tabular} The following data are from the budget of Ritewell Publishers. Half the company's sales are transacted on a cash basis. The other half are paid for with a 1-month delay. The company pays all of its credit purchases with a 1-month delay. Credit purchases in January were $160, and total sales in January were $804. The company wants to maintain a minimum cash balance of $230 each month. Based on the above information, fill the cash budget below from February till April and calculate the cumulative short-term financing required for each month. Show your calculations where necessary to get the full credit. You may show your calculations inside the boxes

CASH BUDGET \begin{tabular}{|l|l|l|l||} \hline & February & March & April \\ \hline Sources of cash & & & \\ \hline Collections on current sales & & & \\ \hline Collectionsonamountsreceivable & & & \\ \hline Total sources of cash & & & \\ \hline UsesofcashPaymentsofaccountspayable & & & \\ \hline Cashpurchases & & & \\ \hline Laborandadministrativeexpenses & & & \\ \hline Capital expenditures & & & \\ \hline Taxes,interest,anddividends & & & \\ \hline \multicolumn{1}{|c||}{ Total uses of cash } & & & \\ \hline Cumulativeshort-termfunancingrequired & & & \\ \hline Nash at start of period & & & \\ \hline Net cash inflow & & & \\ \hline Cash at end of period & & & \\ \hline Minimum cash balance & & & \\ \hline \end{tabular} The following data are from the budget of Ritewell Publishers. Half the company's sales are transacted on a cash basis. The other half are paid for with a 1-month delay. The company pays all of its credit purchases with a 1-month delay. Credit purchases in January were $160, and total sales in January were $804. The company wants to maintain a minimum cash balance of $230 each month. Based on the above information, fill the cash budget below from February till April and calculate the cumulative short-term financing required for each month. Show your calculations where necessary to get the full credit. You may show your calculations inside the boxes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started