Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASH BUDGET FOR the last two quarters 2002 100 points 6 Add class comment Please refer to the Problem 12.5 Cash Budget. As a continuation

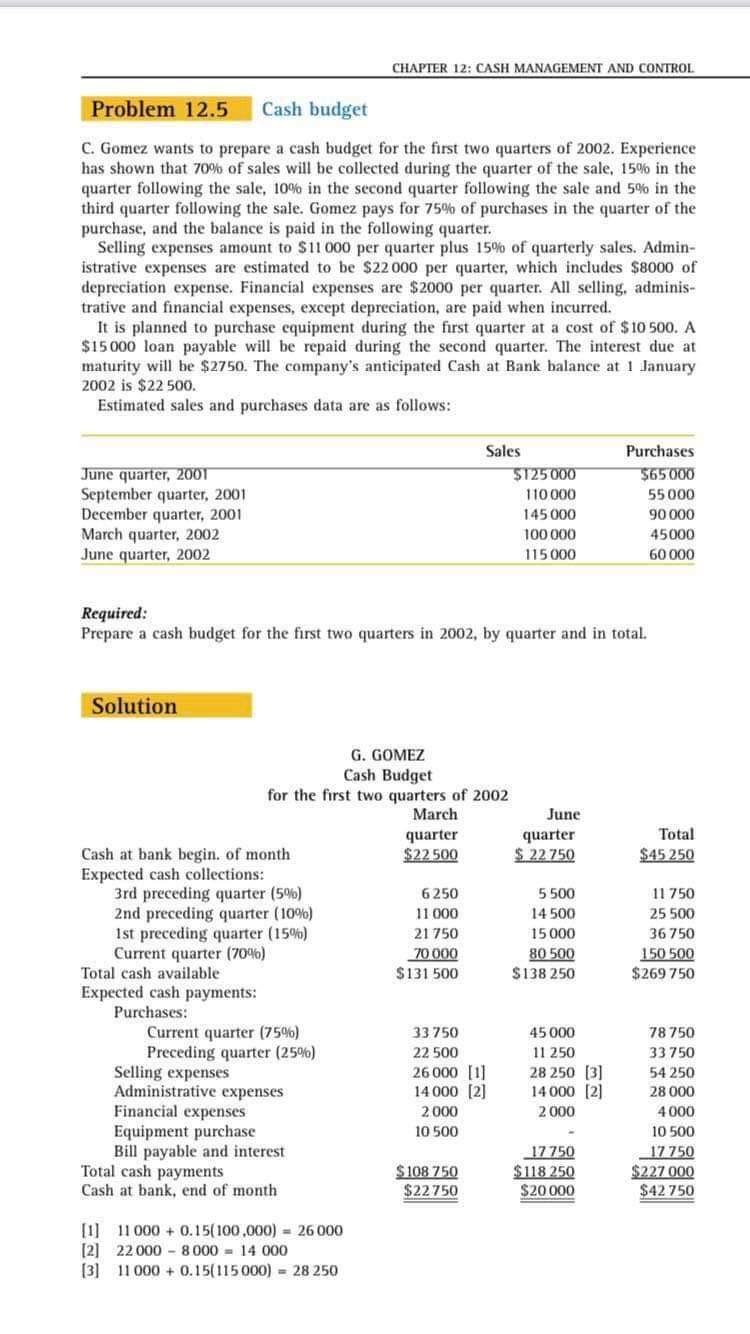

CASH BUDGET FOR the last two quarters 2002 100 points 6 Add class comment Please refer to the Problem 12.5 Cash Budget. As a continuation of the given information, we need to add the following information : Estimated sales September quarter $130,000, purchases $ 75,000; December quarter sales $ 145,000 and purchases $ 90,000. Prepare the CASH BUDGET FOR the last two quarters and retain the selling, administrative, financial, equipment, and bill payable and interest. For March for September and June for December. CHAPTER 12: CASH MANAGEMENT AND CONTROL Problem 12.5 Cash budget C. Gomez wants to prepare a cash budget for the first two quarters of 2002. Experience has shown that 70% of sales will be collected during the quarter of the sale. 15% in the quarter following the sale, 10% in the second quarter following the sale and 5% in the third quarter following the sale. Gomez pays for 75% of purchases in the quarter of the purchase, and the balance is paid in the following quarter, Selling expenses amount to $11 000 per quarter plus 15% of quarterly sales. Admin- istrative expenses are estimated to be $22000 per quarter, which includes $8000 of depreciation expense. Financial expenses are $2000 per quarter. All selling, adminis- trative and financial expenses, except depreciation, are paid when incurred. It is planned to purchase equipment during the first quarter at a cost of $10 500. A $15000 loan payable will be repaid during the second quarter. The interest due at maturity will be $2750. The company's anticipated Cash at Bank balance at 1 January 2002 is $22 500. Estimated sales and purchases data are as follows: June quarter, 2007 September quarter, 2001 December quarter, 2001 March quarter, 2002 June quarter, 2002 Sales $125000 110 000 145 000 100 000 115000 Purchases $65000 55 000 90 000 45000 60 000 Required: Prepare a cash budget for the first two quarters in 2002, by quarter and in total. Solution Total $45 250 G. GOMEZ Cash Budget for the first two quarters of 2002 March June quarter quarter Cash at bank begin. of month $22500 $ 22750 Expected cash collections: 3rd preceding quarter (5%) 6250 5500 2nd preceding quarter (10%) 11 000 14 500 1st preceding quarter (15%) 21 750 15 000 Current quarter (70%) 70 000 80 500 Total cash available $131 500 $138 250 Expected cash payments: Purchases: Current quarter (75%) 33750 45 000 Preceding quarter (25%) 22 500 11 250 Selling expenses 26000 [1] 28 250 (3) Administrative expenses 14 000 (2) 14 000 (2) Financial expenses 2000 2000 Equipment purchase 10 500 Bill payable and interest 17 750 Total cash payments $ 108 750 $118 250 Cash at bank, end of month $22750 $20 000 11 750 25 500 36 750 150.500 $269 750 78 750 33 750 54 250 28 000 4000 10 500 17 750 $227 000 $42 750 [1] 11000+ 0.15(100.000) = 26 000 [2] 22000 - 8000 = 14 000 [3] 11000+ 0.15(115000) = 28 250 CASH BUDGET FOR the last two quarters 2002 100 points 6 Add class comment Please refer to the Problem 12.5 Cash Budget. As a continuation of the given information, we need to add the following information : Estimated sales September quarter $130,000, purchases $ 75,000; December quarter sales $ 145,000 and purchases $ 90,000. Prepare the CASH BUDGET FOR the last two quarters and retain the selling, administrative, financial, equipment, and bill payable and interest. For March for September and June for December. CHAPTER 12: CASH MANAGEMENT AND CONTROL Problem 12.5 Cash budget C. Gomez wants to prepare a cash budget for the first two quarters of 2002. Experience has shown that 70% of sales will be collected during the quarter of the sale. 15% in the quarter following the sale, 10% in the second quarter following the sale and 5% in the third quarter following the sale. Gomez pays for 75% of purchases in the quarter of the purchase, and the balance is paid in the following quarter, Selling expenses amount to $11 000 per quarter plus 15% of quarterly sales. Admin- istrative expenses are estimated to be $22000 per quarter, which includes $8000 of depreciation expense. Financial expenses are $2000 per quarter. All selling, adminis- trative and financial expenses, except depreciation, are paid when incurred. It is planned to purchase equipment during the first quarter at a cost of $10 500. A $15000 loan payable will be repaid during the second quarter. The interest due at maturity will be $2750. The company's anticipated Cash at Bank balance at 1 January 2002 is $22 500. Estimated sales and purchases data are as follows: June quarter, 2007 September quarter, 2001 December quarter, 2001 March quarter, 2002 June quarter, 2002 Sales $125000 110 000 145 000 100 000 115000 Purchases $65000 55 000 90 000 45000 60 000 Required: Prepare a cash budget for the first two quarters in 2002, by quarter and in total. Solution Total $45 250 G. GOMEZ Cash Budget for the first two quarters of 2002 March June quarter quarter Cash at bank begin. of month $22500 $ 22750 Expected cash collections: 3rd preceding quarter (5%) 6250 5500 2nd preceding quarter (10%) 11 000 14 500 1st preceding quarter (15%) 21 750 15 000 Current quarter (70%) 70 000 80 500 Total cash available $131 500 $138 250 Expected cash payments: Purchases: Current quarter (75%) 33750 45 000 Preceding quarter (25%) 22 500 11 250 Selling expenses 26000 [1] 28 250 (3) Administrative expenses 14 000 (2) 14 000 (2) Financial expenses 2000 2000 Equipment purchase 10 500 Bill payable and interest 17 750 Total cash payments $ 108 750 $118 250 Cash at bank, end of month $22750 $20 000 11 750 25 500 36 750 150.500 $269 750 78 750 33 750 54 250 28 000 4000 10 500 17 750 $227 000 $42 750 [1] 11000+ 0.15(100.000) = 26 000 [2] 22000 - 8000 = 14 000 [3] 11000+ 0.15(115000) = 28 250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started