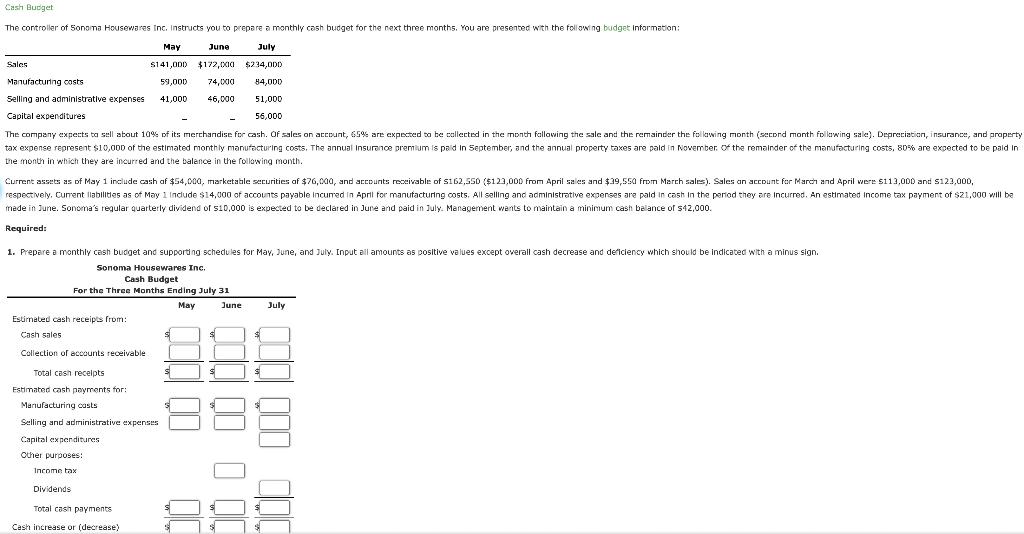

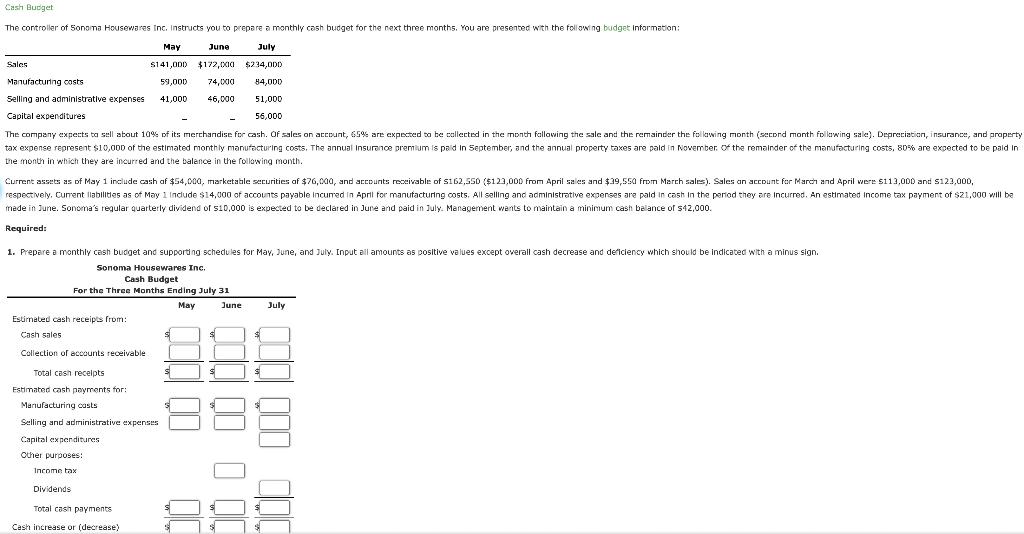

Cash Budget The controller of Sonoma Housewares Inc. Instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget Information: Sales Manufacturing costs Selling and administrative expenses Capital expenditures May June July $ 5141,000 $172,000 $234,000 59,000 74,0x10 94,000 41,000 46,000 51,000 56,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 65% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $10,000 of the estimated monthly manufacturing costs. The annual Insurance premium is paid in September, and the annual property taxes are paid in November of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balence in the following month. Current assets as of May 1 include cash af $54,000, marketable securities af $76,000, and accounts receivable of S162,550 ($123,000 from April sales and $39,550 from March sales). Sales an account for March and April were $112.000 and $123,000, respectively. Current liabilities as of May 1 Include 14,000 of accounts payable incurred in April for manufacturing costs. All selling and administrative experses are pald In cash in the period they are incurred. An estimated Income tax payment of $21.000 will be made in June. Sonoma's regular quarterly dividend of $10,000 is expected to be declared in June and paid in July. Management wants to maintain a minimum cash balance of $42,000. Required: 1. Prepare a monthly cash budget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency which should be indicated with a minus sign. Sonoma Housewares Inc. Cash Budget For the Three Months Ending July 31 May June July Estimated cash receipts from: Cash sales Collection of accounts receivable Total cash receipts Om Estimated cash payments for: Manufacturing casts Selling and administrative expenses Capital expenditures Other purposes: 000 0 0 OC QUI QI DOC Income tax Dividends Total cash payments Cash increase or (decrease) The controller forests you to prepare my cash budget for the next three are presented with wingi July SIA,800 $172,00 120.000 Manufacturing 91,600 74,00.000 Strand 41000 40.00 $1,000 nithi pram onto Humi nu a) utta tamil are tumi u ariya aurita ureaus H I ' NOT Ina $10.000 of the time that he were in the area of the murdere ting, den Och 1600 ... 2.50 2.000 or 19 Mies on April were Cena 4,000 forming and come new for a 10.000 sette decor and insgenererinnen 2.000 Required Sonoma How Cash Budget For the Three Monte di v 31 Cash Budget The controller of Sonoma Housewares Inc. Instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget Information: Sales Manufacturing costs Selling and administrative expenses Capital expenditures May June July $ 5141,000 $172,000 $234,000 59,000 74,0x10 94,000 41,000 46,000 51,000 56,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 65% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $10,000 of the estimated monthly manufacturing costs. The annual Insurance premium is paid in September, and the annual property taxes are paid in November of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balence in the following month. Current assets as of May 1 include cash af $54,000, marketable securities af $76,000, and accounts receivable of S162,550 ($123,000 from April sales and $39,550 from March sales). Sales an account for March and April were $112.000 and $123,000, respectively. Current liabilities as of May 1 Include 14,000 of accounts payable incurred in April for manufacturing costs. All selling and administrative experses are pald In cash in the period they are incurred. An estimated Income tax payment of $21.000 will be made in June. Sonoma's regular quarterly dividend of $10,000 is expected to be declared in June and paid in July. Management wants to maintain a minimum cash balance of $42,000. Required: 1. Prepare a monthly cash budget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency which should be indicated with a minus sign. Sonoma Housewares Inc. Cash Budget For the Three Months Ending July 31 May June July Estimated cash receipts from: Cash sales Collection of accounts receivable Total cash receipts Om Estimated cash payments for: Manufacturing casts Selling and administrative expenses Capital expenditures Other purposes: 000 0 0 OC QUI QI DOC Income tax Dividends Total cash payments Cash increase or (decrease) The controller forests you to prepare my cash budget for the next three are presented with wingi July SIA,800 $172,00 120.000 Manufacturing 91,600 74,00.000 Strand 41000 40.00 $1,000 nithi pram onto Humi nu a) utta tamil are tumi u ariya aurita ureaus H I ' NOT Ina $10.000 of the time that he were in the area of the murdere ting, den Och 1600 ... 2.50 2.000 or 19 Mies on April were Cena 4,000 forming and come new for a 10.000 sette decor and insgenererinnen 2.000 Required Sonoma How Cash Budget For the Three Monte di v 31