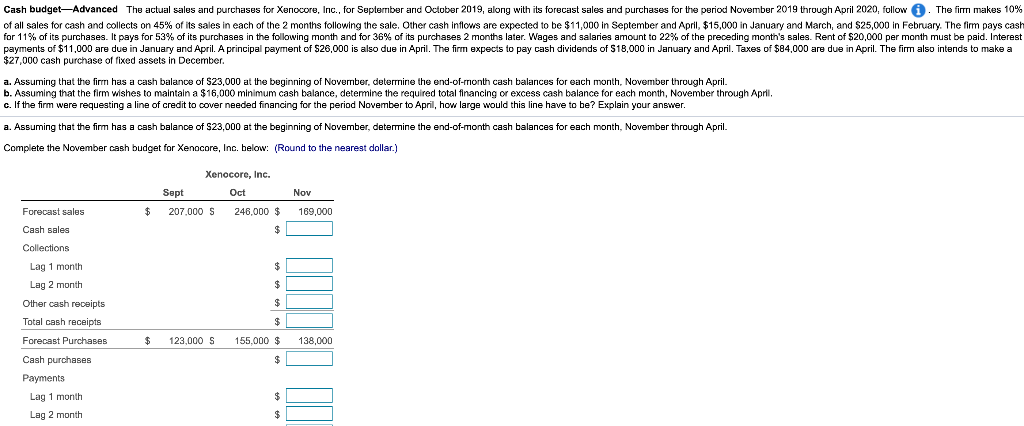

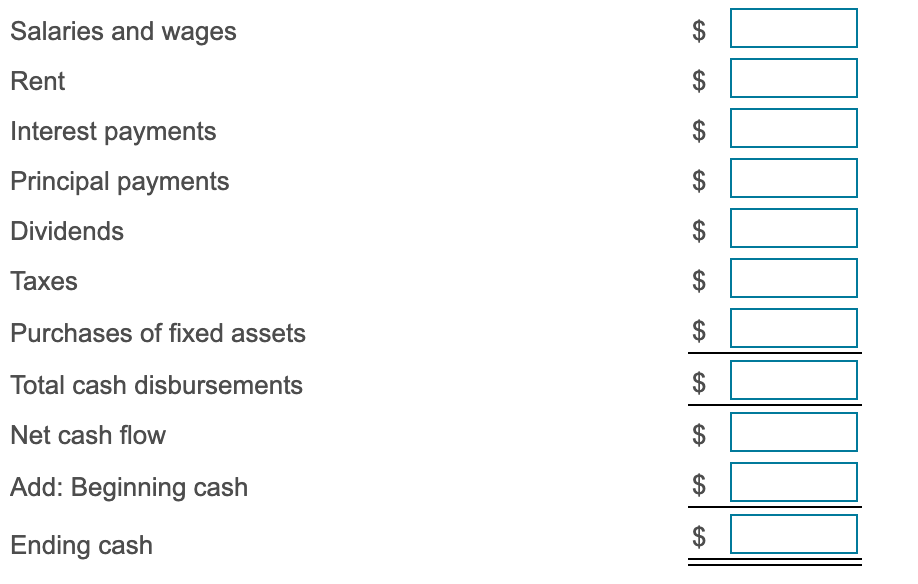

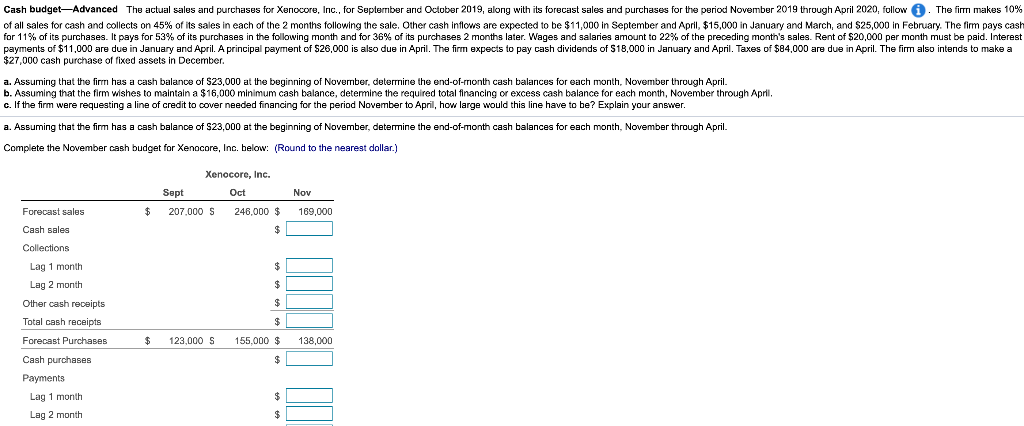

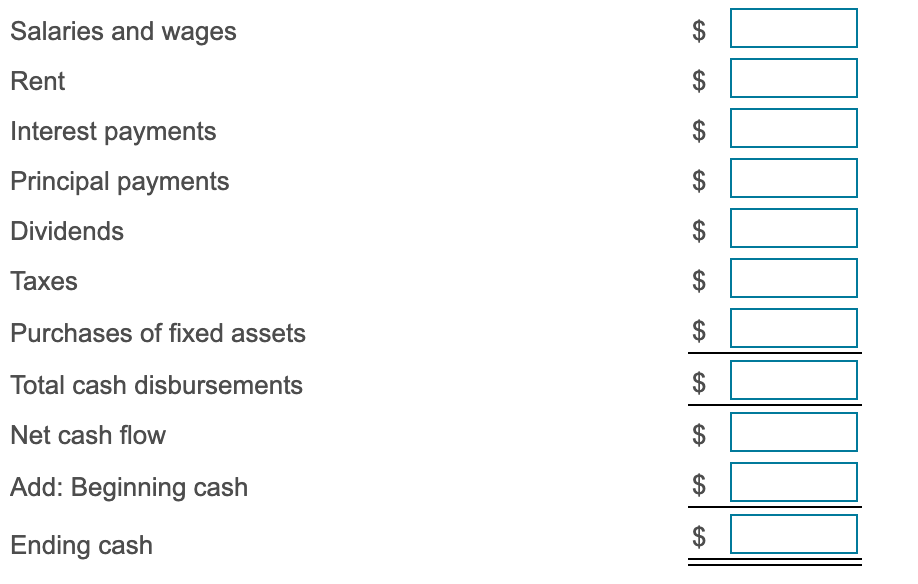

Cash budget-Advanced The actual sales and purchases for Xenocors, Inc., for September and October 2019, along with its forecast sales and purchases for the period November 2019 through April 2020, follow. The fimm makes 10% of all sales for cash and collects on 45% of its sales in each of the 2 months following the sale. Other cash inflows are expected to be $11,000 in September and April, $15,000 in January and March, and $25,000 in February. The firm pays cash for 11% of its purchases. It pays for 53% of its purchases in the following month and for 36% of its purchases 2 months later. Wages and salaries amount to 22% of the preceding month's sales. Rent of $20,000 per month must be paid. Interest payments of $11,000 are due in January and April. A principal payment of $26,000 is also due in April. The firm expects to pay cash dividends of $18,000 in January and April. Taxes of $84,000 are due in April. The firm also intends to make a $27,000 cash purchase of fixed assets in December. a. Assuming that the firm has a cash balance of $23,000 at the beginning of November, determine the end-of- month cash balances for each month, November through April. b. Assuming that the firm wishes to maintain a $16,000 minimum cash balance, determine the required total financing or excess cash balance for each month, November through April. c. If the firm were requesting a line of credit to cover needed financing for the period November to April, how large would this line have to be? Explain your answer. a. Assuming that the firm has a cash balance of S23,000 at the beginning of November, determine the end-of-month cash balances for each month, November through April. Complete the November cash budget for Xenocore, Inc. below: (Round to the nearest dollar.) Nov Xenocore, Inc. Sept Oct 207,000 S 246,000 $ $ $ 169.000 Forecast sales Cash sales Collections $ $ Lag 1 month Lag 2 month Other cash receipts Total cash receipts $ $ Forecast Purchases $ 123,000 S 155.000 $ 138,000 $ Cash purchases Payments Lag 1 month Lag 2 month $ $ Salaries and wages $ Rent $ Interest payments Principal payments Dividends LUI Taxes $ Purchases of fixed assets $ Total cash disbursements $ Net cash flow $ Add: Beginning cash $ $ Ending cash Cash budget-Advanced The actual sales and purchases for Xenocors, Inc., for September and October 2019, along with its forecast sales and purchases for the period November 2019 through April 2020, follow. The fimm makes 10% of all sales for cash and collects on 45% of its sales in each of the 2 months following the sale. Other cash inflows are expected to be $11,000 in September and April, $15,000 in January and March, and $25,000 in February. The firm pays cash for 11% of its purchases. It pays for 53% of its purchases in the following month and for 36% of its purchases 2 months later. Wages and salaries amount to 22% of the preceding month's sales. Rent of $20,000 per month must be paid. Interest payments of $11,000 are due in January and April. A principal payment of $26,000 is also due in April. The firm expects to pay cash dividends of $18,000 in January and April. Taxes of $84,000 are due in April. The firm also intends to make a $27,000 cash purchase of fixed assets in December. a. Assuming that the firm has a cash balance of $23,000 at the beginning of November, determine the end-of- month cash balances for each month, November through April. b. Assuming that the firm wishes to maintain a $16,000 minimum cash balance, determine the required total financing or excess cash balance for each month, November through April. c. If the firm were requesting a line of credit to cover needed financing for the period November to April, how large would this line have to be? Explain your answer. a. Assuming that the firm has a cash balance of S23,000 at the beginning of November, determine the end-of-month cash balances for each month, November through April. Complete the November cash budget for Xenocore, Inc. below: (Round to the nearest dollar.) Nov Xenocore, Inc. Sept Oct 207,000 S 246,000 $ $ $ 169.000 Forecast sales Cash sales Collections $ $ Lag 1 month Lag 2 month Other cash receipts Total cash receipts $ $ Forecast Purchases $ 123,000 S 155.000 $ 138,000 $ Cash purchases Payments Lag 1 month Lag 2 month $ $ Salaries and wages $ Rent $ Interest payments Principal payments Dividends LUI Taxes $ Purchases of fixed assets $ Total cash disbursements $ Net cash flow $ Add: Beginning cash $ $ Ending cash