Cash budgeting: veterinary clinic

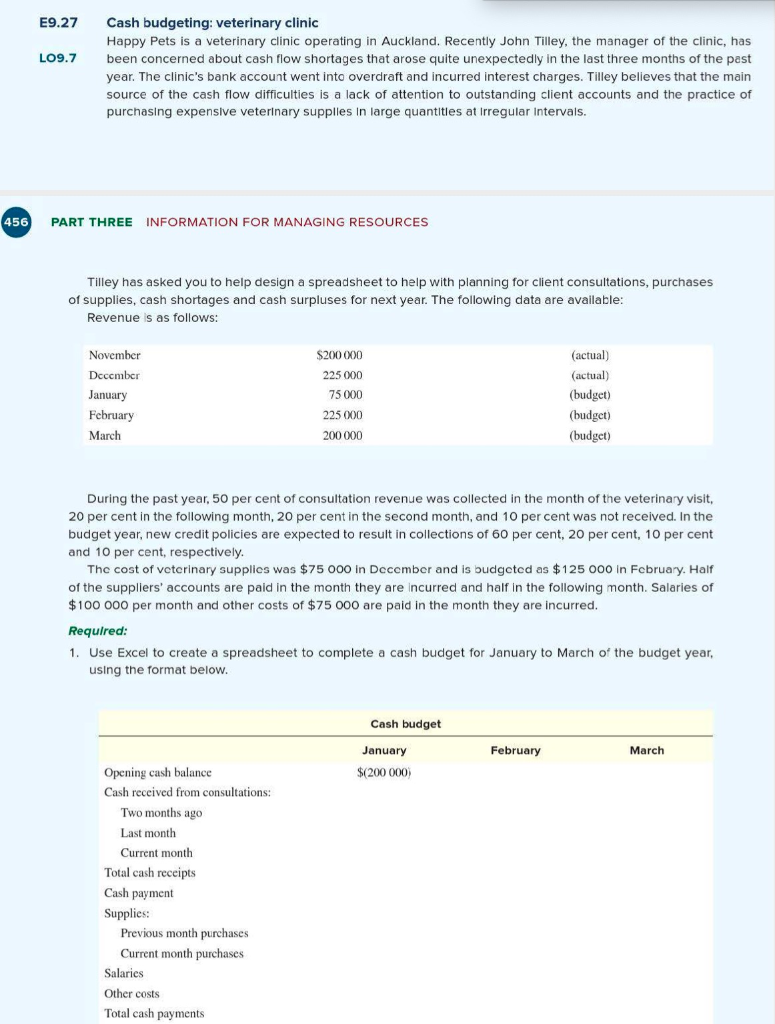

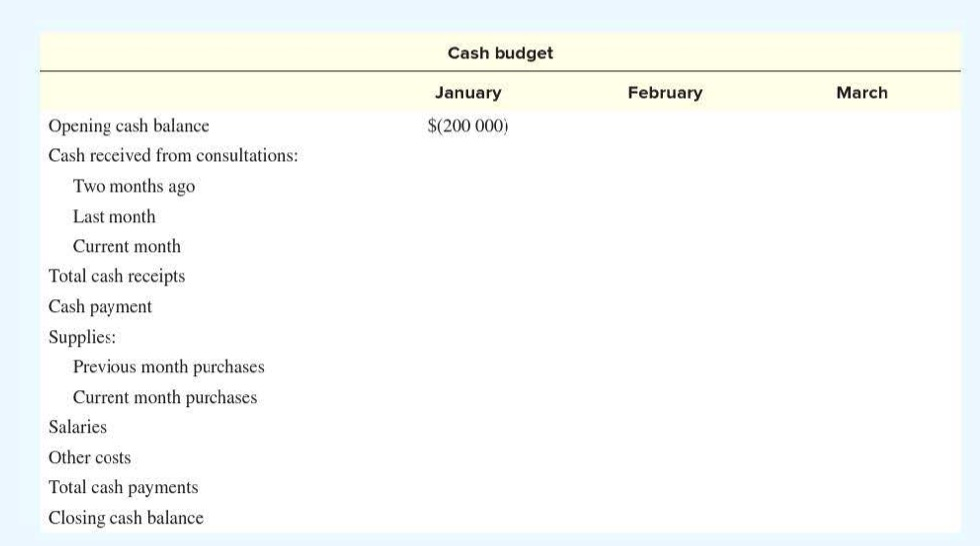

E9.27 LO9.7 Cash budgeting: veterinary clinic Happy Pets is a veterinary clinic operating in Auckland. Recently John Tilley, the manager of the clinic, has been concerned about cash flow shortages that arose quite unexpectedly in the last three months of the past year. The clinic's bank account went into overdraft and incurred interest charges. Tilley believes that the main source of the cash flow difficulties is a lack of attention to outstanding client accounts and the practice of purchasing expensive veterinary supplies in large quantities at Irregular intervals. 456 PART THREE INFORMATION FOR MANAGING RESOURCES Tilley has asked you to help design a spreadsheet to help with planning for client consultations, purchases of supplies, cash shortages and cash surpluses for next year. The following data are available: Revenue is as follows: $200 000 225 000 November December January February March 75 000 (actual) (actual) (budget) (budget) (budget) 225 000 200 000 During the past year, 50 per cent of consultation revenue was collected in the month of the veterinary visit, 20 per cent in the following month, 20 per cent in the second month, and 10 per cent was not received. In the budget year, new credit policies are expected to result in collections of 60 per cent, 20 per cent, 10 per cent and 10 per cent, respectively. The cost of veterinary supplies was $75 000 in December and is budgeted as $125 000 in February. Half of the suppliers' accounts are paid in the month they are incurred and half in the following month. Salaries of $100 000 per month and other costs of $75 000 are paid in the month they are incurred. Required: 1. Use Excel to create a spreadsheet to complete a cash budget for January to March of the budget year, using the format below. Cash budget January February March $(200 000) Opening cash balance Cash received from consultations: Two months ago Last month Current month Total cash receipts Cash payment Supplies: Previous month purchases Current month purchases Salaries Other costs Total cash payments Cash budget February March January $(200 000) Opening cash balance Cash received from consultations: Two months ago Last month Current month Total cash receipts Cash payment Supplies: Previous month purchases Current month purchases Salaries Other costs Total cash payments Closing cash balance