Answered step by step

Verified Expert Solution

Question

1 Approved Answer

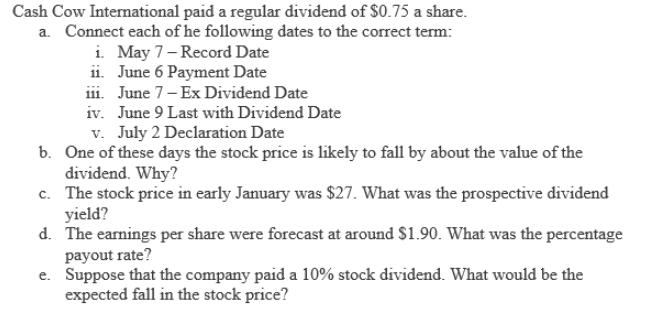

Cash Cow International paid a regular dividend of $0.75 a share. a. Connect each of he following dates to the correct term: i. May

Cash Cow International paid a regular dividend of $0.75 a share. a. Connect each of he following dates to the correct term: i. May 7-Record Date ii. June 6 Payment Date iii. June 7-Ex Dividend Date iv. June 9 Last with Dividend Date v. July 2 Declaration Date b. One of these days the stock price is likely to fall by about the value of the dividend. Why? c. The stock price in early January was $27. What was the prospective dividend yield? d. The earnings per share were forecast at around $1.90. What was the percentage payout rate? e. Suppose that the company paid a 10% stock dividend. What would be the expected fall in the stock price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Matching terms i May 7 Record Date The date when investors who own the stock become eligible for r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started