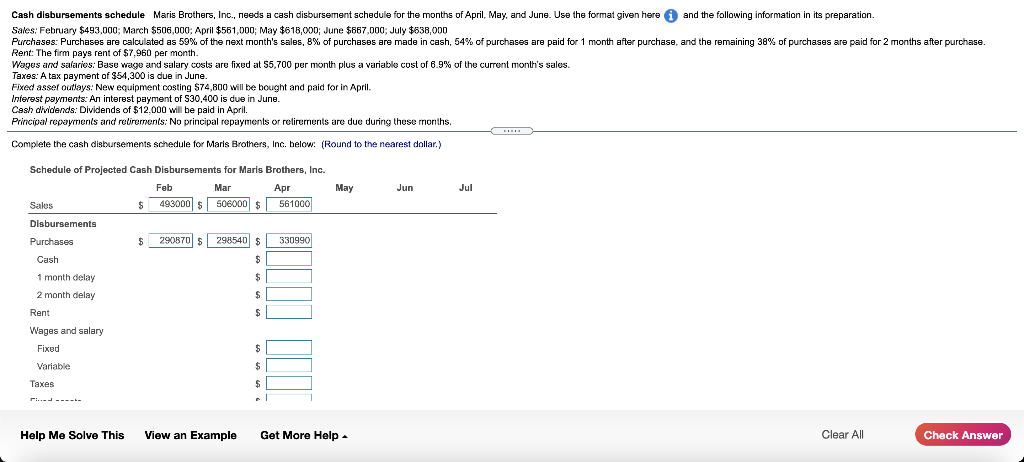

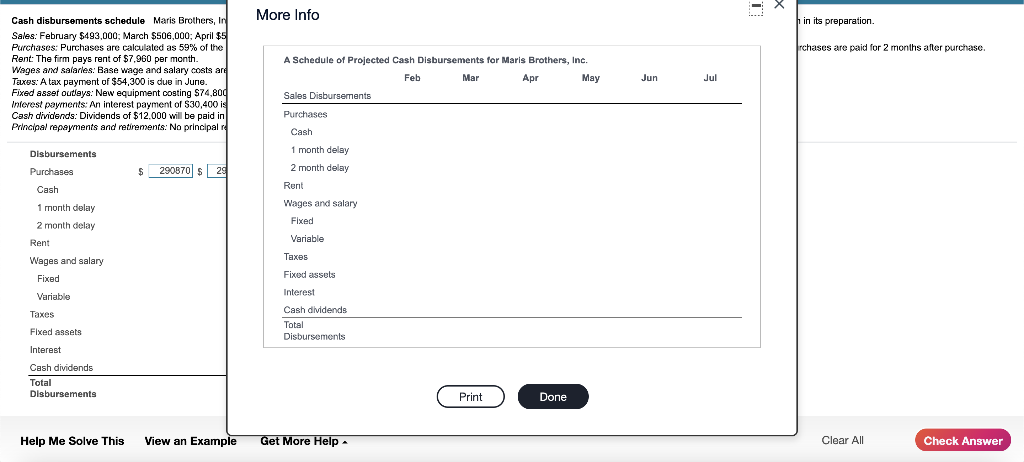

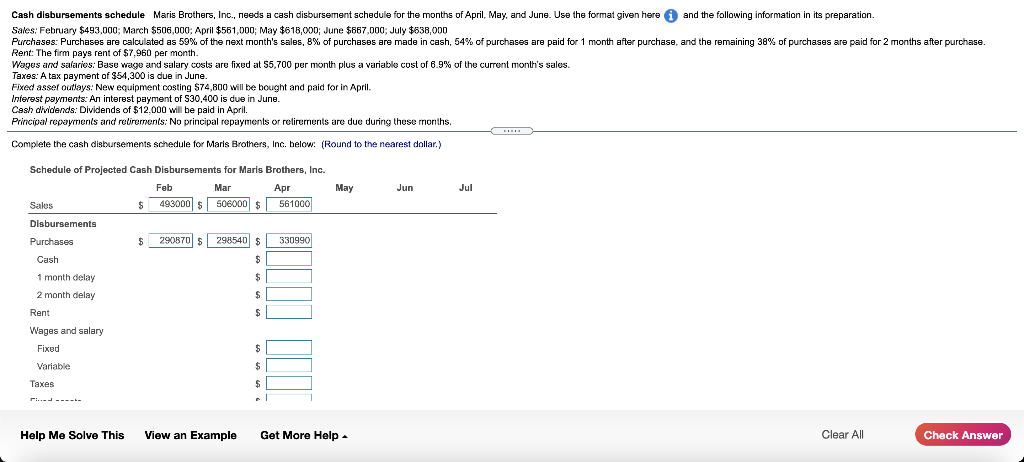

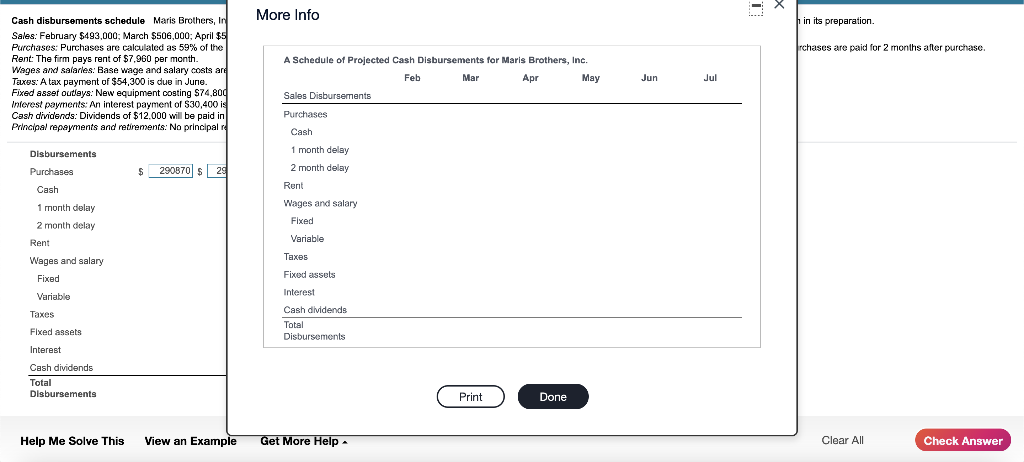

Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May, and June. Use the format given here and the following information in its preparation. Sales: February $493,000; March $506,000: April $561,000; May $618,000; June $667,000; July $638,000 Purchases: Purchases are calculated as 59% of the next month's sales, 8% of purchases are made in cash, 54% of purchases are paid for 1 month after purchase, and the remaining 38% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $7.960 per month Wages and salaries: Base wage and salary costs are fixed at $5,700 per month plus a variable cost of 6.9% of the current month's sales. Taxes: A tax payment of $54,300 is due in June. Fixed asser outays: New equipment costing $74,800 will be bought and paid for in April. Interest payments: An interest payment of S30,400 is due in June. Cash dividends: Dividends of $12.000 will be paid in April. Principal ropayments and retirements: No principal repayments or retirements are due during these months. Complete the cash disbursements schedule for Maris Brothers, Inc. below. (Round to the nearest dollar.) May Jun Jul Schedule of Projected Cash Disbursements for Maris Brothers, Inc. Feb Mar Apr Sales 493000 $ 506000 $561000 Disbursements Purchases S 290670 $ 298540 $ 330990 Cash $ 1 month delay $ 2 month delay $ Rent $ Wages and salary Fixed $ Variable $ Taxes $ rid------ Help Me Solve This View an Example Get More Help Clear All Check Answer More Info in its preparation. rchases are paid for 2 months after purchase. Cash disbursements schedule Maris Brothers, In Sales: February $493,000; March $506,000; April $5 Purchases: Purchases are calculated as 59% of the Rent: The firm pays rent of $7,960 per month Wages and salaries: Base wage and salary costs and Texes: A tax payment of $54,300 is due in June. Fixed asset outleys: New equipment costing $74,800 Interest payments: An interest payment of 530,400 is Cash dividends: Dividends of $12,000 will be paid in Principal repayments and retirements: No principal A Schedule of Projected Cash Disbursements for Maris Brothers, Inc. Feb Mar Apr May Sales Disbursements Jun Jul Purchases Cash Disbursements Purchases Cash 1 month delay 2 month delay $ 290870 29 2 Rent 1 month delay 2 month delay Rent Wages and salary Fixed Variable Taxes Wages and salary Fixed Variable Taxes Fixed assets Interest Cash dividends Total Disbursements Fixed assets Interest Cash dividends Total Disbursements Print Print Done Help Me Solve This View an Example Get More Help Clear All Check