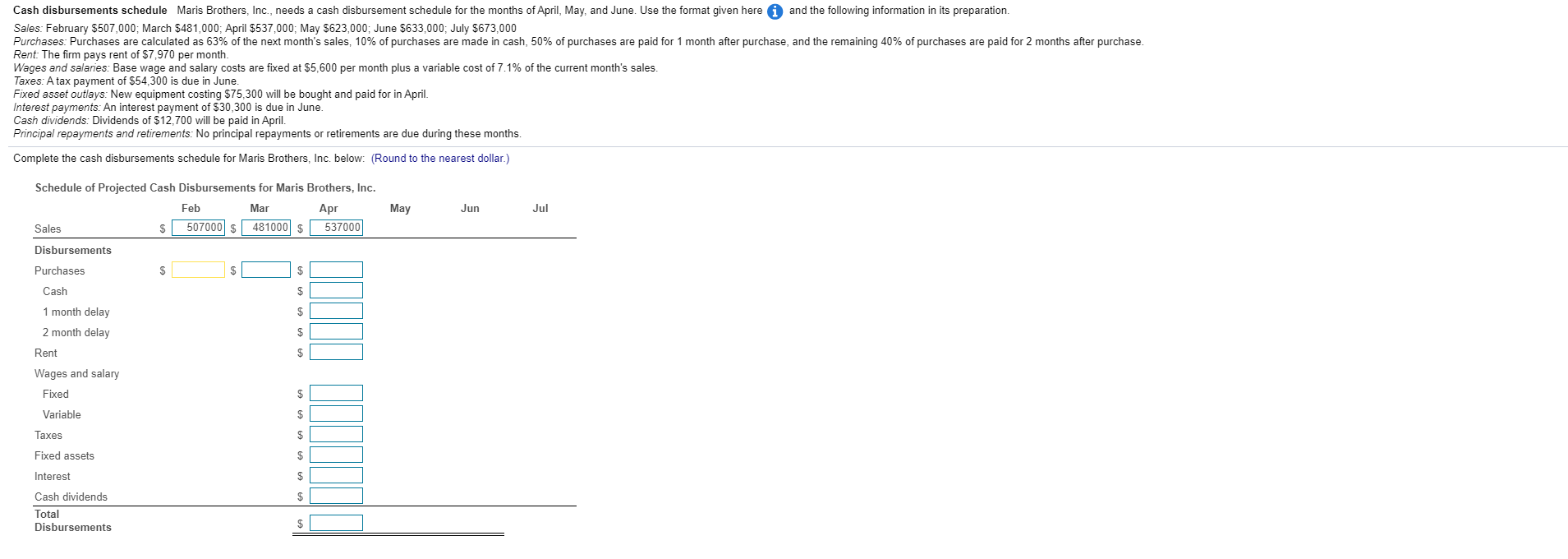

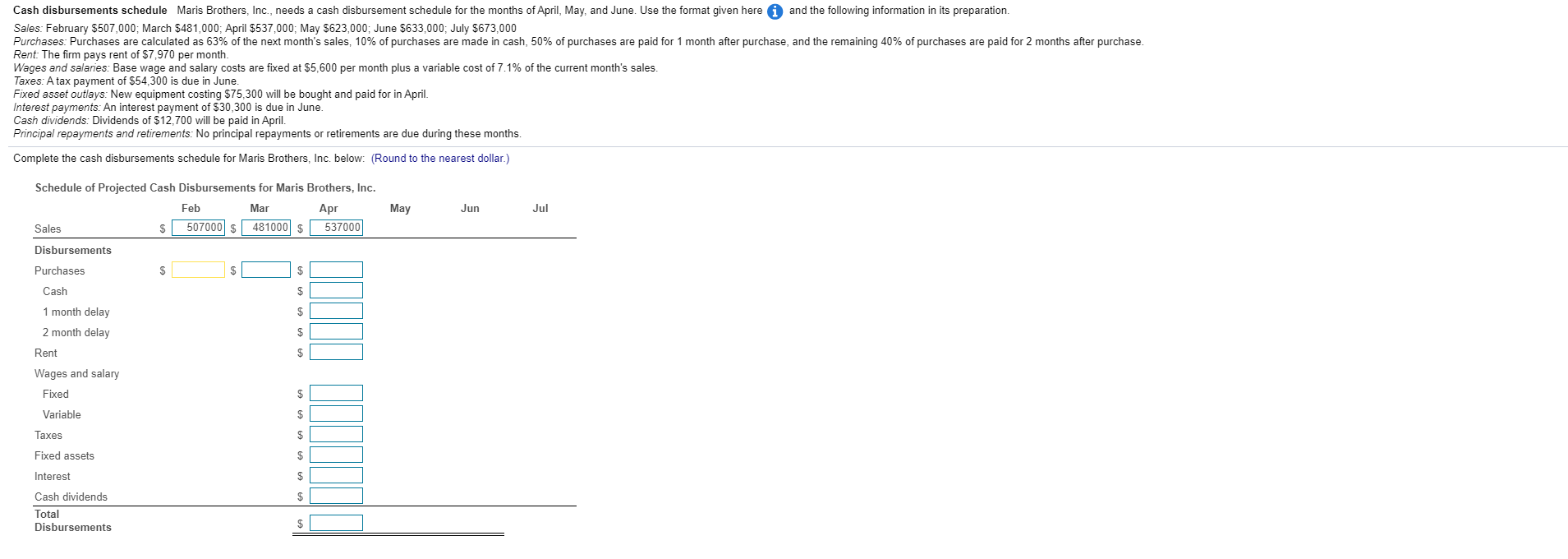

Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May, and June. Use the format given here and the following information in its preparation. Sales: February $507,000; March $481,000; April $537,000; May $623,000; June $633,000; July $673,000 Purchases: Purchases are calculated as 63% of the next month's sales, 10% of purchases are made in cash, 50% of purchases are paid for 1 month after purchase, and the remaining 40% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $7,970 per month. Wages and salaries: Base wage and salary costs are fixed at $5,600 per month plus a variable cost of 7.1% of the current month's sales. Taxes: A tax payment tof is due in June. Fixed asset outlays: New equipment costing $75,300 will be bought and paid for in April. Interest payments: An interest payment of $30,300 is due in June. Cash dividends: Dividends of $12,700 will be paid in April. Principal repayments and retirements: No principal repayments or retirements are due during these months. Complete the cash disbursements schedule for Maris Brothers, Inc. below: (Round to the nearest dollar.) $54,300 is May Jun Jul 481000 $ Schedule of Projected Cash Disbursements for Maris Brothers, Inc. Feb Mar Apr Sales $ 507000 $ 5370001 Disbursements Purchases $ S $ Cash $ $ $ 1 month delay 2 month delay Rent Wages and salary Fixed $ $ Variable $ Taxes $ Fixed assets $ Interest $ $ Cash dividends Total Disbursements $ Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May, and June. Use the format given here and the following information in its preparation. Sales: February $507,000; March $481,000; April $537,000; May $623,000; June $633,000; July $673,000 Purchases: Purchases are calculated as 63% of the next month's sales, 10% of purchases are made in cash, 50% of purchases are paid for 1 month after purchase, and the remaining 40% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $7,970 per month. Wages and salaries: Base wage and salary costs are fixed at $5,600 per month plus a variable cost of 7.1% of the current month's sales. Taxes: A tax payment tof is due in June. Fixed asset outlays: New equipment costing $75,300 will be bought and paid for in April. Interest payments: An interest payment of $30,300 is due in June. Cash dividends: Dividends of $12,700 will be paid in April. Principal repayments and retirements: No principal repayments or retirements are due during these months. Complete the cash disbursements schedule for Maris Brothers, Inc. below: (Round to the nearest dollar.) $54,300 is May Jun Jul 481000 $ Schedule of Projected Cash Disbursements for Maris Brothers, Inc. Feb Mar Apr Sales $ 507000 $ 5370001 Disbursements Purchases $ S $ Cash $ $ $ 1 month delay 2 month delay Rent Wages and salary Fixed $ $ Variable $ Taxes $ Fixed assets $ Interest $ $ Cash dividends Total Disbursements $