Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash Flow A: Anne from Fidelity Investments calls you regarding a hot investment. Based upon the graphic below, you would invest $10,000 in Project

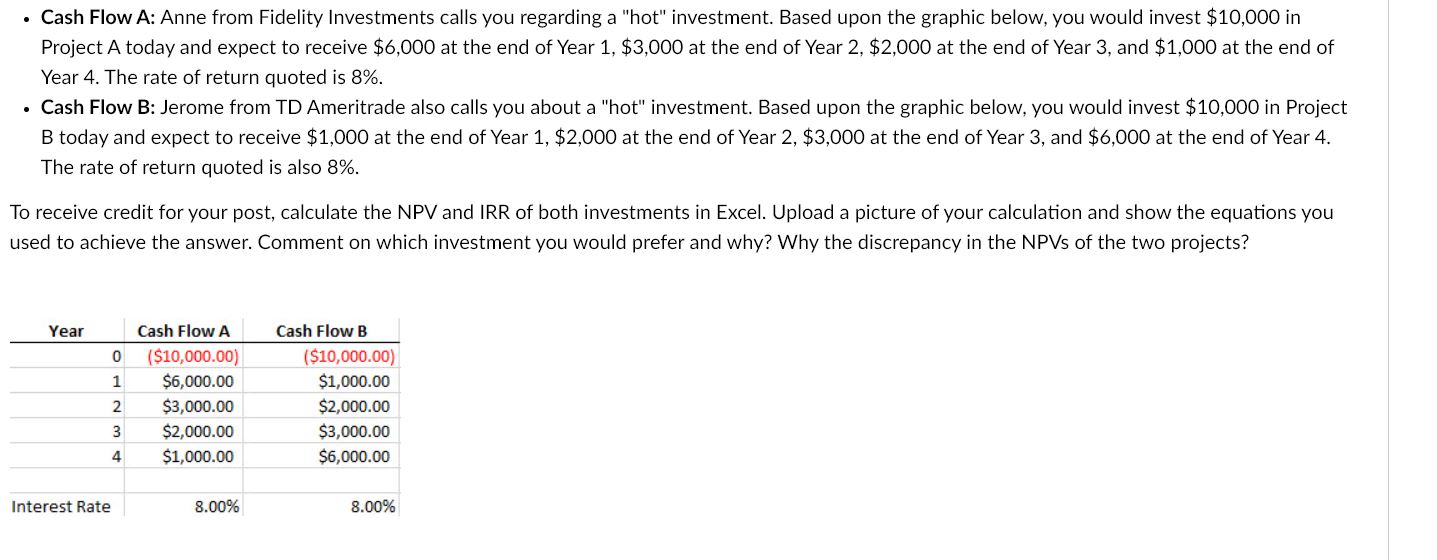

Cash Flow A: Anne from Fidelity Investments calls you regarding a "hot" investment. Based upon the graphic below, you would invest $10,000 in Project A today and expect to receive $6,000 at the end of Year 1, $3,000 at the end of Year 2, $2,000 at the end of Year 3, and $1,000 at the end of Year 4. The rate of return quoted is 8%. Cash Flow B: Jerome from TD Ameritrade also calls you about a "hot" investment. Based upon the graphic below, you would invest $10,000 in Project B today and expect to receive $1,000 at the end of Year 1, $2,000 at the end of Year 2, $3,000 at the end of Year 3, and $6,000 at the end of Year 4. The rate of return quoted is also 8%. To receive credit for your post, calculate the NPV and IRR of both investments in Excel. Upload a picture of your calculation and show the equations you used to achieve the answer. Comment on which investment you would prefer and why? Why the discrepancy in the NPVs of the two projects? Year Cash Flow A 0 ($10,000.00) Cash Flow B ($10,000.00) 1 $6,000.00 $1,000.00 2 $3,000.00 $2,000.00 3 $2,000.00 $3,000.00 4 $1,000.00 $6,000.00 Interest Rate 8.00% 8.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started