Question

Cash Flow Analysis Case: Refer to the attached Cash Flow Statements for Firm A and Firm B to answer the following questions. Provide all answers

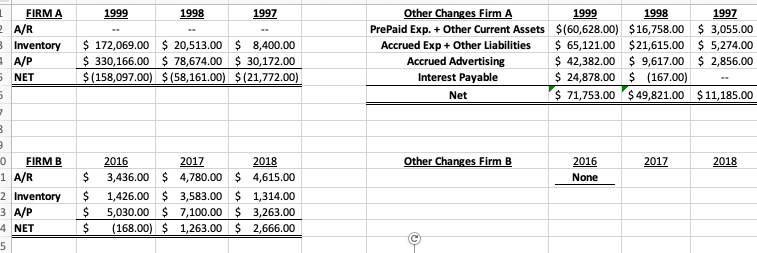

Cash Flow Analysis Case: Refer to the attached Cash Flow Statements for Firm A and Firm B to answer the following questions. Provide all answers for the most recent year unless otherwise specified (the most recent year is on the left for Firm A and on the right for Firm B). Financial statement information other than that provided is not necessary to answer the questions.

Cash Flow Analysis Case: Refer to the attached Cash Flow Statements for Firm A and Firm B to answer the following questions. Provide all answers for the most recent year unless otherwise specified (the most recent year is on the left for Firm A and on the right for Firm B). Financial statement information other than that provided is not necessary to answer the questions.

Basic Concepts:

1)If possible, determine the net change in Accounts Receivable, Inventory, and Accounts Payable over the three-year period presented for each company (you should report only one number for each three-year period). What other working capital accounts have significant changes over the three-year period? Briefly discuss what these changes might imply about working capital management for these firms.

2)What are the significant non-cash or non-operating adjustments these firms made to net income (to derive CFO) during the years presented? Use your judgement to determine what is significant.

3)Identify the major investing and financing transactions for each firm for the three years presented. For each firm, indicate what the primary source of cash flows has been in the years presented. Use your judgement to determine what is major and primary.

PLEASE ANSWER BOLDED PORTIONS

1999 1998 1997 FIRMA 2 A/R B Inventory A/P 5 NET $ 172,069.00 $ 20,513.00 $ 8,400.00 $ 330,166.00 $ 78,674.00 $ 30,172.00 $(158,097.00) $ (58,161.00) $(21,772.00) Other Changes Firm A 1999 1998 1997 Prepaid Exp. + Other Current Assets $(60,628.00) $16,758.00 $ 3,055.00 Accrued Exp+ Other Liabilities $ 65,121.00 $21,615.00 $ 5,274.00 Accrued Advertising $ 42,382.00 $ 9,617.00 $ 2,856.00 Interest Payable $ 24,878.00 $ (167.00) Net $ 71,753.00 $ 49,821.00 $11,185.00 5 3 Other Changes Firm B 2017 2018 2016 None 0 FIRMB 1 A/R 2 Inventory 3 A/P 4 NET 5 $ $ $ $ 2016 2017 2018 3,436.00 $ 4,780.00 $ 4,615.00 1,426.00 $ 3,583.00 $ 1,314.00 5,030.00 $ 7,100.00 $ 3,263.00 (168.00) $ 1,263.00 $ 2,666.00 1999 1998 1997 FIRMA 2 A/R B Inventory A/P 5 NET $ 172,069.00 $ 20,513.00 $ 8,400.00 $ 330,166.00 $ 78,674.00 $ 30,172.00 $(158,097.00) $ (58,161.00) $(21,772.00) Other Changes Firm A 1999 1998 1997 Prepaid Exp. + Other Current Assets $(60,628.00) $16,758.00 $ 3,055.00 Accrued Exp+ Other Liabilities $ 65,121.00 $21,615.00 $ 5,274.00 Accrued Advertising $ 42,382.00 $ 9,617.00 $ 2,856.00 Interest Payable $ 24,878.00 $ (167.00) Net $ 71,753.00 $ 49,821.00 $11,185.00 5 3 Other Changes Firm B 2017 2018 2016 None 0 FIRMB 1 A/R 2 Inventory 3 A/P 4 NET 5 $ $ $ $ 2016 2017 2018 3,436.00 $ 4,780.00 $ 4,615.00 1,426.00 $ 3,583.00 $ 1,314.00 5,030.00 $ 7,100.00 $ 3,263.00 (168.00) $ 1,263.00 $ 2,666.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started