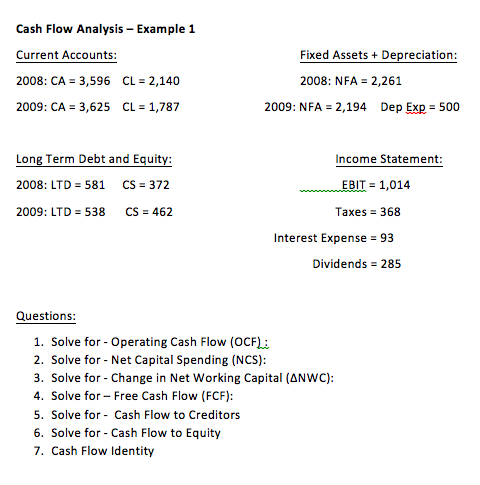

Question: Cash Flow Analysis Cash Flow Analysis-Example 1 Current Accounts: 2008: CA - 3,596 CL 2,140 2009: CA: 3,625 CL=1,787 Fixed Assets+ Depreciation: 2008: NFA: 2,261

Cash Flow Analysis

Cash Flow Analysis-Example 1 Current Accounts: 2008: CA - 3,596 CL 2,140 2009: CA: 3,625 CL=1,787 Fixed Assets+ Depreciation: 2008: NFA: 2,261 2009: NFA 2,194 Dep Exp 500 Long Term Debt and Equity: 2008: LTD-581 CS-372 2009: LTD 538 CS 462 Income Statement: EBIT= 1,014 Taxes 368 Interest Expense 93 Dividends 285 Questions: 1. Solve for - Operating Cash Flow (OCF 2. Solve for - Net Capital Spending (NCS): 3. Solve for - Change in Net Working Capital (ANWC): 4. Solve for- Free Cash Flow (FCF): 5. Solve for - Cash Flow to Creditors 6. Solve for - Cash Flow to Equity 7. Cash Flow Identity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock