Answered step by step

Verified Expert Solution

Question

1 Approved Answer

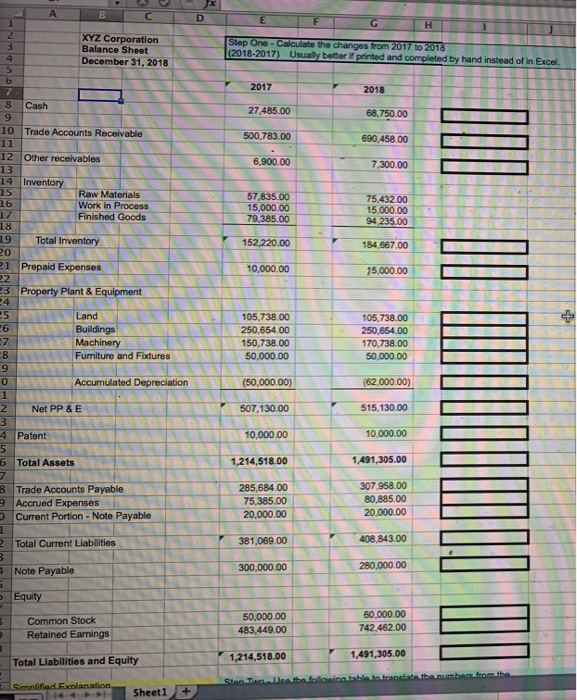

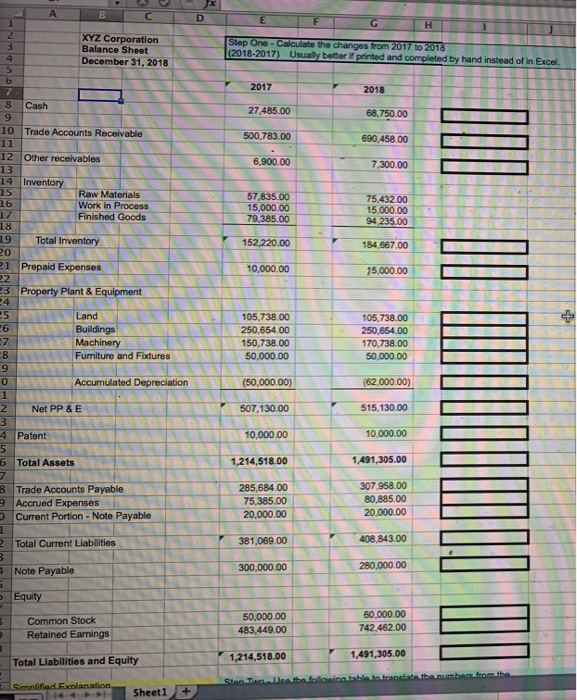

cash flow B D F H 1 2 3 4 5 XYZ Corporation Balance Sheet December 31, 2018 Step One - Calculate the changes from

cash flow

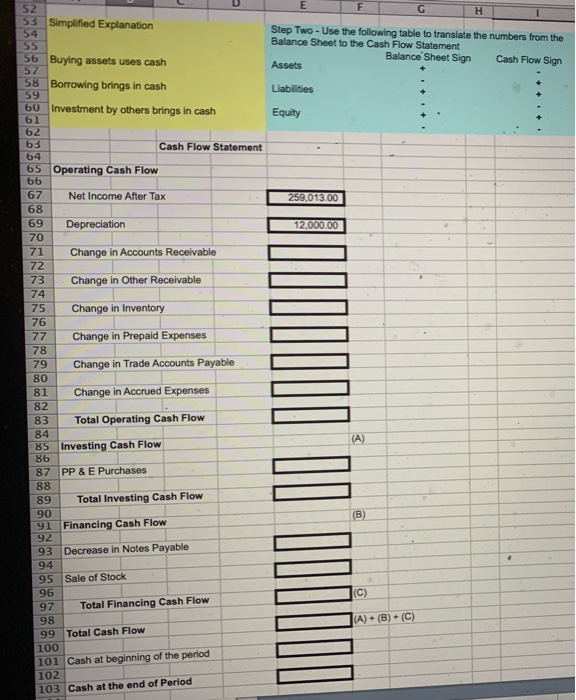

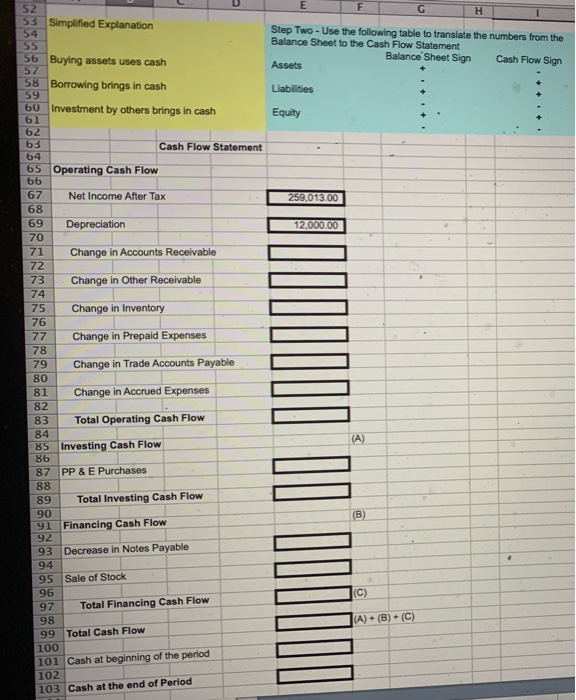

B D F H 1 2 3 4 5 XYZ Corporation Balance Sheet December 31, 2018 Step One - Calculate the changes from 2017 to 2018 (2013-2017) Usually better if printed and completed by hand instead of in Excel 2017 F 2018 27.485.00 68,750.00 500,783.00 690,458.00 6,900.00 7,300.00 7 8 Cash 9 10 Trade Accounts Receivable 11 12 Other receivables 13 14 Inventory 15 Raw Materials 16 Work in Process 17 Finished Goods 18 19 Total Inventory 20 21 Prepaid Expenses 22 23 Property Plant & Equipment 57,835.00 15,000.00 79,385.00 75.432.00 15.000.00 94 235.00 152,220.00 184,667.00 10,000.00 15,000.00 105,738.00 250.654.00 150,738.00 50,000.00 105,738.00 250,654.00 170.738.00 50,000.00 (50,000.00) (62.000.00) 25 Land 26 Buildings 27 Machinery 8 Furniture and Fixtures 9 0 Accumulated Depreciation 1 2 Net PP & E 3 4 Patent 5 6 Total Assets 507,130.00 515,130.00 10,000.00 10.000.00 1,214,518.00 1,491,305.00 8 Trade Accounts Payable 9 Accrued Expenses Current Portion - Note Payable 285,684.00 75,385.00 20,000.00 307.958.00 80,885.00 20,000.00 1 2 Total Current Liabilities 381,069.00 408.843.00 300,000.00 Note Payable 280,000.00 Equity 3 Common Stock Retained Earnings 50,000.00 483,449.00 60.000.00 742.462.00 1,214,518.00 1,491,305.00 Total Liabilities and Equity SonNO ble to translate the numbers from the Simplified Explanation Sheet1 + E F H 52 53 Simplified Explanation 54 55 56 Buying assets uses cash 58 Borrowing brings in cash 59 60 Investment by others brings in cash 61 Step Two-Use the following table to translate the numbers from the Balance Sheet to the Cash Flow Statement Balance Sheet Sign Cash Flow Sign Assets 57 Liabilities Equity 62 63 Cash Flow Statement 64 65 Operating Cash Flow 66 67 Net Income After Tax 68 69 Depreciation 70 71 Change in Accounts Receivable 259.013.00 12,000.00 72 Change in Other Receivable Change in Inventory 73 74 75 76 77 78 79 80 81 Change in Prepaid Expenses Change in Trade Accounts Payable Change in Accrued Expenses 82 (A) 83 Total Operating Cash Flow 84 85 Investing Cash Flow 86 87 PP & E Purchases 88 89 Total Investing Cash Flow 90 91 Financing Cash Flow 92 93 Decrease in Notes Payable 94 95 Sale of Stock 96 97 Total Financing Cash Flow 98 99 Total Cash Flow 100 101 Cash at beginning of the period 102 103 Cash at the end of Period e DDDDDD DD (C) (A) + (B)+(C)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started