Answered step by step

Verified Expert Solution

Question

1 Approved Answer

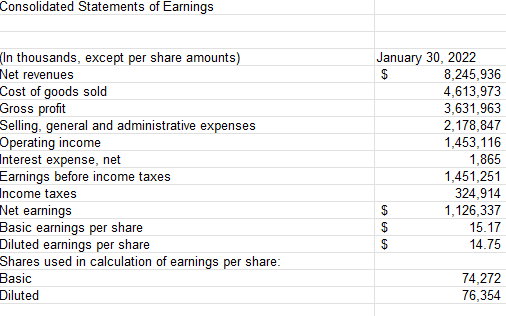

Cash flow Calculate P/E, P/B, ROA, ROIC, EV/ EBITDA, Debt/Total Capital Consolidated Statements of Earnings (In thousands, except per share amounts) Net revenues Cost of

Cash flow

Calculate P/E, P/B, ROA, ROIC, EV/ EBITDA, Debt/Total Capital

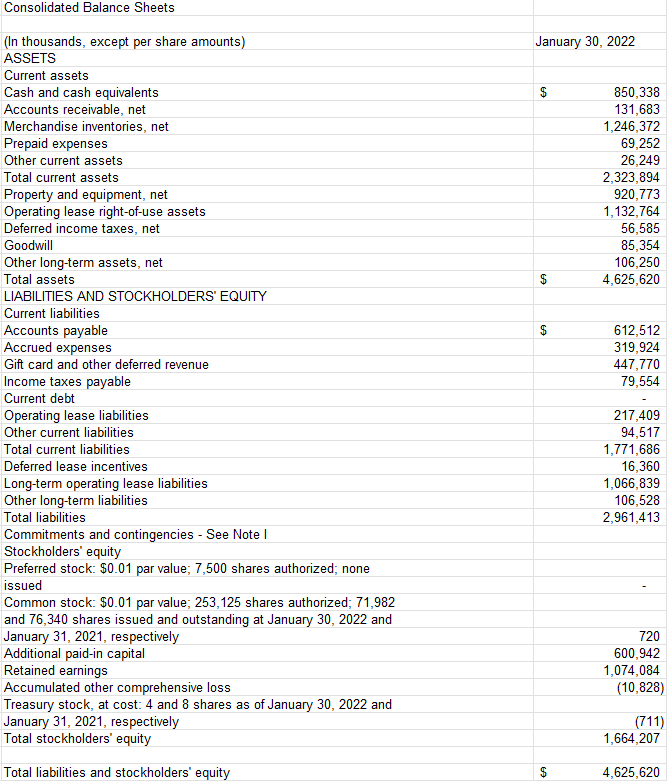

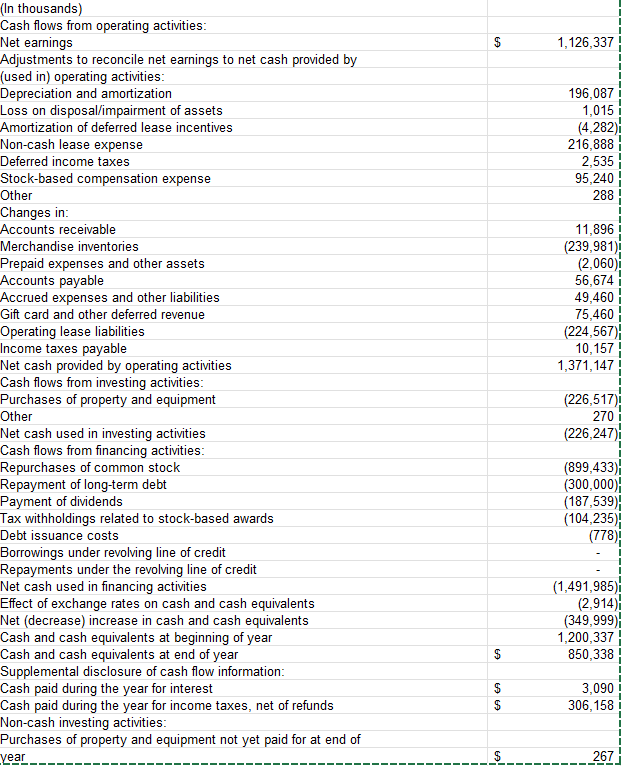

Consolidated Statements of Earnings (In thousands, except per share amounts) Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses Operating income Interest expense, net Earnings before income taxes Income taxes Net earnings Basic earnings per share Diluted earnings per share \begin{tabular}{cr} \multicolumn{2}{c}{ January 30,2022} \\ \hline$ & 8,245,936 \\ & 4,613,973 \\ & 3,631,963 \\ & 2,178,847 \\ & 1,453,116 \\ & 1,865 \\ & 1,451,251 \\ & 324,914 \\ \hline & 1,126,337 \\ $ & 15.17 \\ \hline$ & 14.75 \end{tabular} Shares used in calculation of earnings per share: Basic 74,272 Diluted 76,354 Consolidated Balance Sheets (In thousands, except per share amounts) January 30,2022 ASSETS Current assets Cash and cash equivalents Accounts receivable, net Merchandise inventories, net Prepaid expenses Other current assets Total current assets Property and equipment, net Operating lease right-of-use assets Deferred income taxes, net Goodwill Other long-term assets, net Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable Accrued expenses Gift card and other deferred revenue Income taxes payable Current debt Operating lease liabilities Other current liabilities Total current liabilities Deferred lease incentives Long-term operating lease liabilities Other long-term liabilities Total liabilities Commitments and contingencies - See Note I Stockholders' equity Preferred stock: $0.01 par value; 7,500 shares authorized; none issued Common stock: $0.01 par value; 253,125 shares authorized; 71,982 and 76,340 shares issued and outstanding at January 30,2022 and January 31, 2021, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 4 and 8 shares as of January 30,2022 and January 31,2021 , respectively (711) Total stockholders' equity 1,664,207 Total liabilities and stockholders' equity $4,625,620 (In thousands) Cash flows from operating activities: Net earnings Adjustments to reconcile net earnings to net cash provided by (used in) operating activities: Depreciation and amortization Loss on disposal/impairment of assets Amortization of deferred lease incentives Non-cash lease expense Deferred income taxes Stock-based compensation expense Other Changes in: Accounts receivable Merchandise inventories Prepaid expenses and other assets Accounts payable Accrued expenses and other liabilities Gift card and other deferred revenue Operating lease liabilities Income taxes payable Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Other Net cash used in investing activities Cash flows from financing activities: Repurchases of common stock Repayment of long-term debt Payment of dividends Tax withholdings related to stock-based awards Debt issuance costs Borrowings under revolving line of credit Repayments under the revolving line of credit Net cash used in financing activities Effect of exchange rates on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental disclosure of cash flow information: Cash paid during the year for interest Cash paid during the year for income taxes, net of refunds Non-cash investing activities: Purchases of property and equipment not yet paid for at end of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started