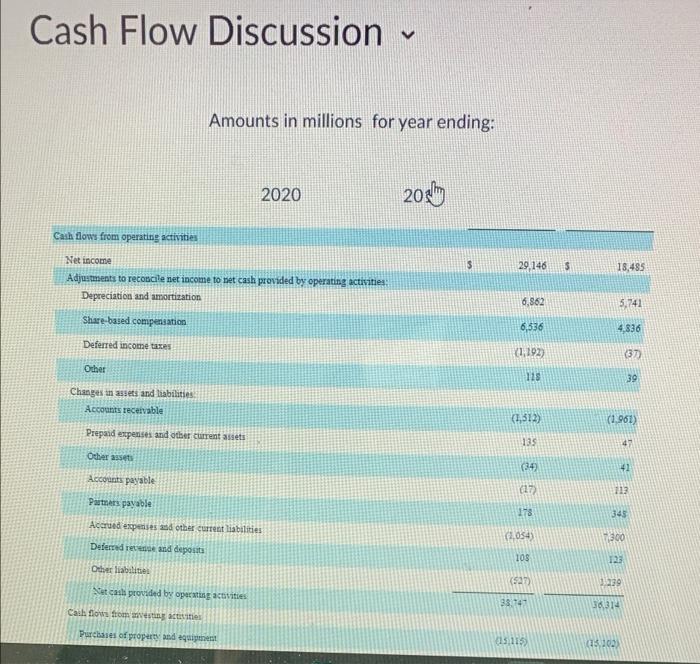

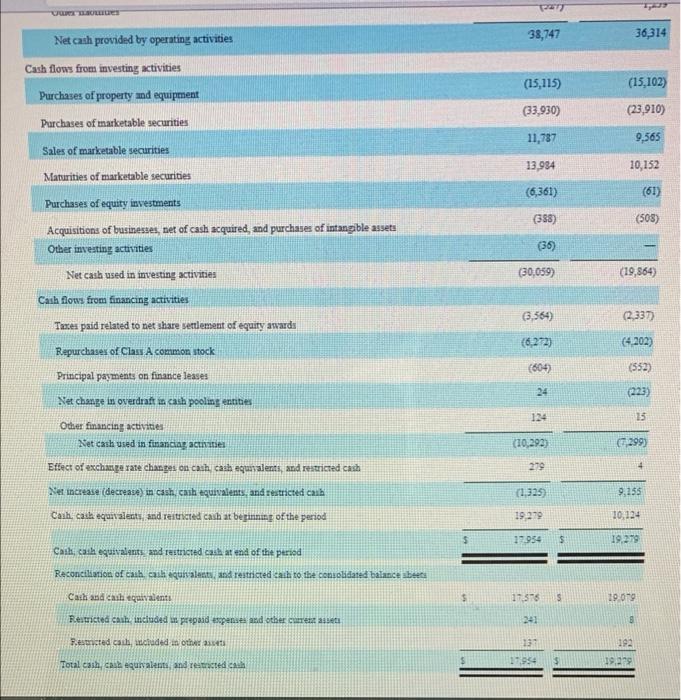

Cash Flow Discussion v Amounts in millions for year ending: 2020 2020 Cash flows from operating activities $ 29,146 5 18,485 Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Share-based compensation 6,862 5,741 6,536 4.836 Deferred income taxes 1,192) (37) Other 118 39 Changes in assets and liabilities Accounts receivable (1,312) (1.961) Prepaid expenses and other current assets 135 4 Other asset (34) 41 Accounts payable (17) 113 Pats payable 13 345 Accrued expensessed other current liabilities (104) 1300 Deferred read deposits 103 125 Other liabalite (52 3239 cals provided by operates activities Cail fons from west 38.147 56314 Purchases of property and again 015115) (13103 38,747 36,314 (15,115) (15,102) Net cash provided by operating activities Cash flows from investing activities Purchases of property and equipment Purchases of marketable securities Sales of marketable securities Maturities of marketable securities (33,930) (23,910) 11,787 9,565 13,934 10,152 (6,361) (61) Purchases of equity investments (388) (508) Acquisitions of businesses, set of cash acquired, and purchases of intangible assets Other investing activities (36) Net cash used in investing activities (30.059) (19,864) 63,564) (2,337) (6,272) (4202) (604 (552) 24 0223 Cash flows from financing activities Taces paid related to net share settlement of equity awards Repurchases of Class A common stock Principal payments on finance leases Net change in overdraft in cash pooling entities Other financing activities Net cash used in financiar activities Effect of exchange rate changes on cash cash equivalents, and restricted cash Mer increase (decrease) in cash cash equivalents, and restricted cash Cail, cak equivalents, and retricted cash at beginning of the period 124 15 (10.292) (299) 279 14 (1325 9.255 19.279 10,124 $ 12954 S 19.279 Call, cath equivalents and restricted cala at end of the period Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance been Cash and cash equivalent 17:35 5 29.019 Restricted cash included is prepaid expenses and other current 241 8 Restricted ca ciuded in other 2011 137 192 19.2 Total cash casequivalents and restricted ca 17.954 $ Looking over the cash flow statement given above - please post what you observe by looking at this statement (all the numbers in millions) that you think would be of interest to potential investors. Where does their cash come from and how do they use it? This original post along with a guess