Question

Cash Flow Problem Solving Mr. Justine Yac owns a building in Makati CBD. It's a mid-rise building rented as temporary specialized office; contract is renewable

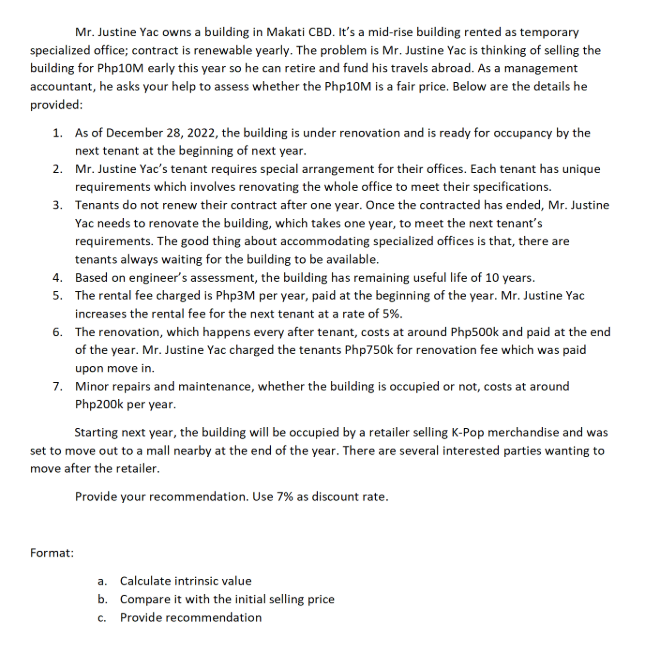

Cash Flow Problem Solving

Mr. Justine Yac owns a building in Makati CBD. It's a mid-rise building rented as temporary specialized office; contract is renewable yearly. The problem is Mr. Justine Yac is thinking of selling the building for Php10M early this year so he can retire and fund his travels abroad. As a management accountant, he asks your help to assess whether the Php10M is a fair price. Below are the details he provided:

1. As of December 28, 2022, the building is under renovation and is ready for occupancy by the next tenant at the beginning of next year.

2. Mr. Justine Yac's tenant requires special arrangement for their offices. Each tenant has unique requirements which involves renovating the whole office to meet their specifications.

3. Tenants do not renew their contract after one year. Once the contracted has ended, Mr. Justine Yac needs to renovate the building, which takes one year, to meet the next tenant's requirements. The good thing about accommodating specialized offices is that, there are tenants always waiting for the building to be available.

4. Based on engineer's assessment, the building has remaining useful life of 10 years.

5. The rental fee charged is Php3M per year, paid at the beginning of the year. Mr. Justine Yac increases the rental fee for the next tenant at a rate of 5%.

6. The renovation, which happens every after tenant, costs at around Php500k and paid at the end of the year. Mr. Justine Yac charged the tenants Php750k for renovation fee which was paid upon move in.

7. Minor repairs and maintenance, whether the building is occupied or not, costs at around Php200k per year.

Starting next year, the building will be occupied by a retailer selling K-Pop merchandise and was set to move out to a mall nearby at the end of the year. There are several interested parties wanting to move after the retailer.

Provide your recommendation. Use 7% as discount rate.

Format:

a. Calculate intrinsic value

b. Compare it with the initial selling price

c. Provide recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started