Answered step by step

Verified Expert Solution

Question

1 Approved Answer

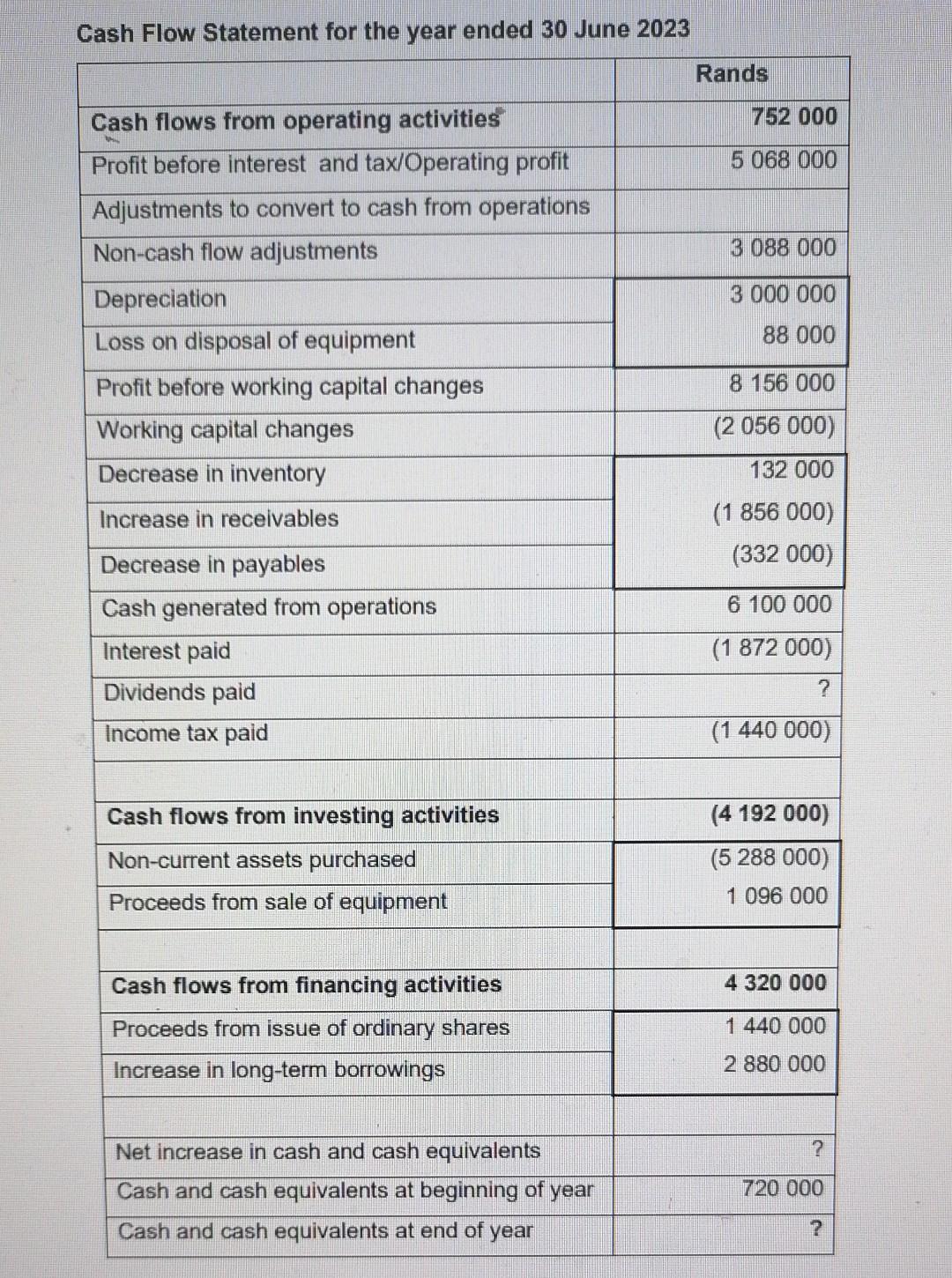

Cash Flow Statement for the year ended 30 June 2023 begin{tabular}{|c|c|} hline & Rands hline Cash flows from operating activities & 752000 hline

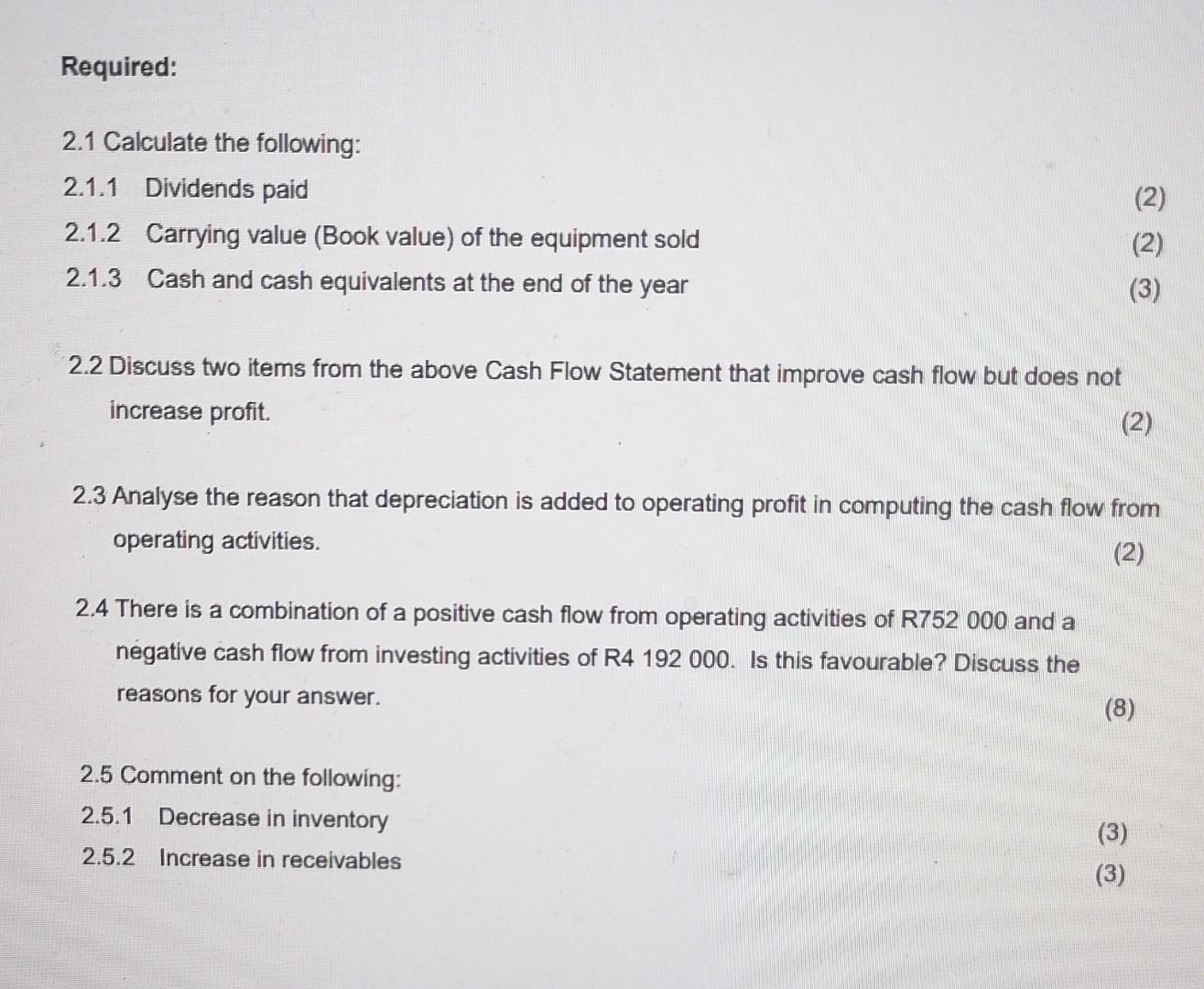

Cash Flow Statement for the year ended 30 June 2023 \begin{tabular}{|c|c|} \hline & Rands \\ \hline Cash flows from operating activities & 752000 \\ \hline Profit before interest and tax/Operating profit & 5068000 \\ \hline \multicolumn{2}{|l|}{ Adjustments to convert to cash from operations } \\ \hline Non-cash flow adjustments & 3088000 \\ \hline Depreciation & 3000000 \\ \hline Loss on disposal of equipment & 88000 \\ \hline Profit before working capital changes & 8156000 \\ \hline Working capital changes & (2056000) \\ \hline Decrease in inventory & \multirow{3}{*}{\begin{tabular}{r} 132000 \\ (1856000) \\ (332000) \end{tabular}} \\ \hline Increase in receivables & \\ \hline Decrease in payables & \\ \hline Cash generated from operations & 6100000 \\ \hline Interest paid & (1872000) \\ \hline Dividends paid & ? \\ \hline Income tax paid & (1440000) \\ \hline Cash flows from investing activities & (4192000) \\ \hline Non-current assets purchased & \multirow{2}{*}{\begin{tabular}{r} (5288000) \\ 1096000 \end{tabular}} \\ \hline Proceeds from sale of equipment & \\ \hline Cash flows from financing activities & 4320000 \\ \hline Proceeds from issue of ordinary shares & \multirow{2}{*}{\begin{tabular}{l} 1440000 \\ 2880000 \end{tabular}} \\ \hline Increase in long-term borrowings & \\ \hline Net increase in cash and cash equivalents & ? \\ \hline Cash and cash equivalents at beginning of year & 720000 \\ \hline Cash and cash equivalents at end of year & ? \\ \hline \end{tabular} 2.1 Calculate the following: 2.1.1 Dividends paid (2) 2.1.2 Carrying value (Book value) of the equipment sold (2) 2.1.3 Cash and cash equivalents at the end of the year (3) 2.2 Discuss two items from the above Cash Flow Statement that improve cash flow but does not increase profit. (2) 2.3 Analyse the reason that depreciation is added to operating profit in computing the cash flow from operating activities. (2) 2.4 There is a combination of a positive cash flow from operating activities of R752 000 and a negative cash flow from investing activities of R4 192000 . Is this favourable? Discuss the reasons for your answer. (8) 2.5 Comment on the following: 2.5.1 Decrease in inventory 2.5.2 Increase in receivables (3) (3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started