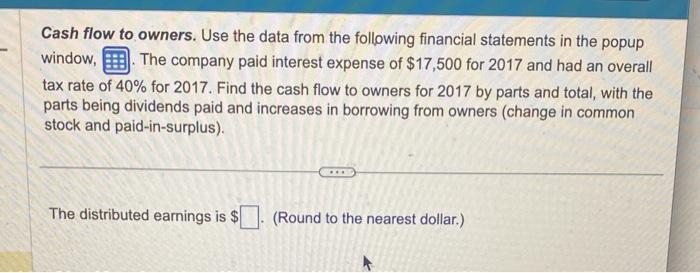

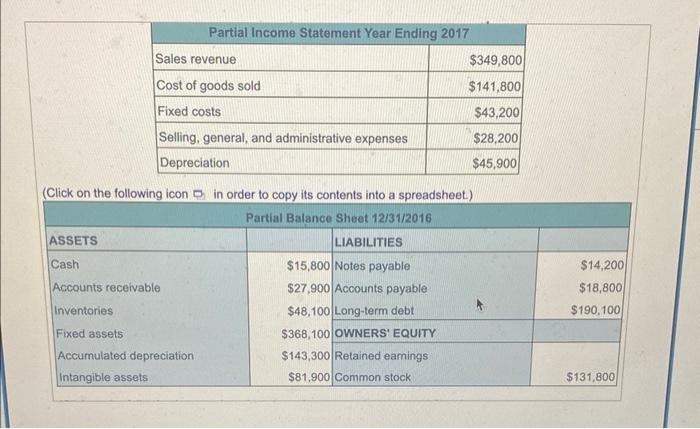

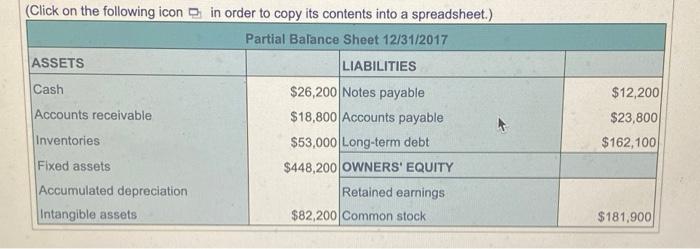

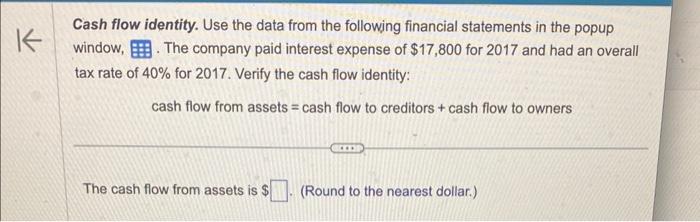

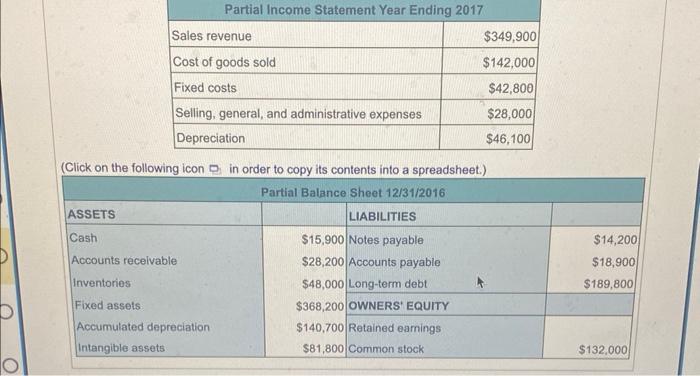

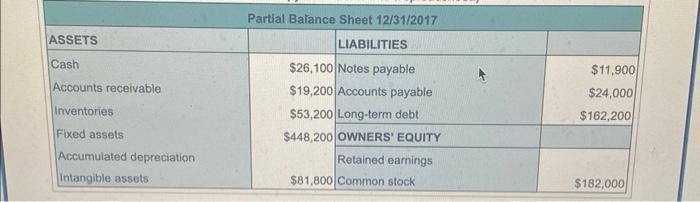

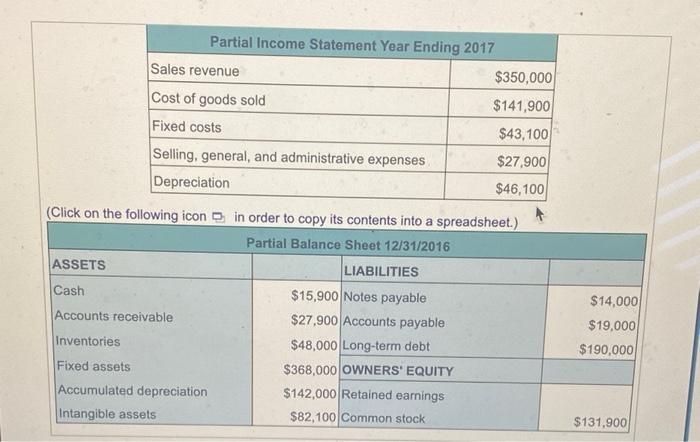

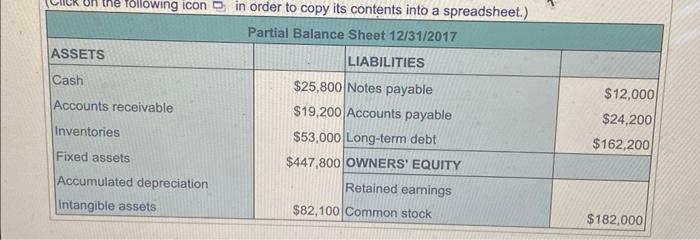

Cash flow to owners. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,500 for 2017 and had an overall tax rate of 40% for 2017 . Find the cash flow to owners for 2017 by parts and total, with the parts being dividends paid and increases in borrowing from owners (change in common stock and paid-in-surplus). The distributed earnings is $. (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 Cash flow identity. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,800 for 2017 and had an overall tax rate of 40% for 2017 . Verify the cash flow identity: cash flow from assets = cash flow to creditors + cash flow to owners The cash flow from assets is $ (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 \begin{tabular}{|l|r|l|r|} \hline ASSETS & \multicolumn{1}{|c|}{ LIABILITIES } & \\ \hline Cash & $26,100 & Notes payable & $11,900 \\ Accounts receivable & $19,200 & Accounts payable & $24,000 \\ Inventories & $53,200 & Long-term debt & $162,200 \\ \cline { 2 - 3 } Fixed assets & $448,200 & OWNERS' EQUITY & \\ \hline Accumulated depreciation & & Retained earnings & $182,000 \\ \hline Intangible assets & $81,800 & Common stock & \\ \hline \end{tabular} Cash flow to creditors. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,000 for 2017 and had an overall tax rate of 40% for 2017 . Find the cash flow to creditors for 2017 by parts and total, with the parts being interest expense and increases or decreases in borrowing (long-term debt). The interest expense for the year is $. (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) Cash flow to owners. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,500 for 2017 and had an overall tax rate of 40% for 2017 . Find the cash flow to owners for 2017 by parts and total, with the parts being dividends paid and increases in borrowing from owners (change in common stock and paid-in-surplus). The distributed earnings is $. (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 Cash flow identity. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,800 for 2017 and had an overall tax rate of 40% for 2017 . Verify the cash flow identity: cash flow from assets = cash flow to creditors + cash flow to owners The cash flow from assets is $ (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 \begin{tabular}{|l|r|l|r|} \hline ASSETS & \multicolumn{1}{|c|}{ LIABILITIES } & \\ \hline Cash & $26,100 & Notes payable & $11,900 \\ Accounts receivable & $19,200 & Accounts payable & $24,000 \\ Inventories & $53,200 & Long-term debt & $162,200 \\ \cline { 2 - 3 } Fixed assets & $448,200 & OWNERS' EQUITY & \\ \hline Accumulated depreciation & & Retained earnings & $182,000 \\ \hline Intangible assets & $81,800 & Common stock & \\ \hline \end{tabular} Cash flow to creditors. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,000 for 2017 and had an overall tax rate of 40% for 2017 . Find the cash flow to creditors for 2017 by parts and total, with the parts being interest expense and increases or decreases in borrowing (long-term debt). The interest expense for the year is $. (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.)