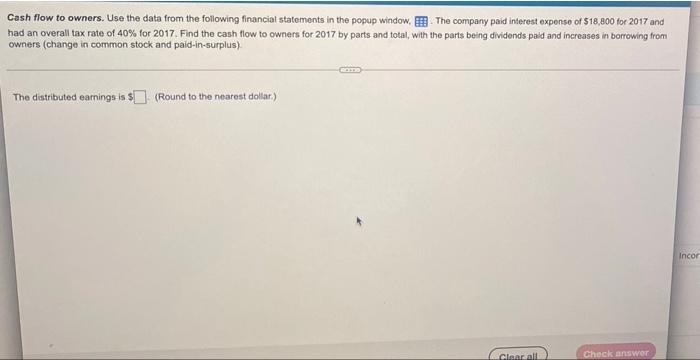

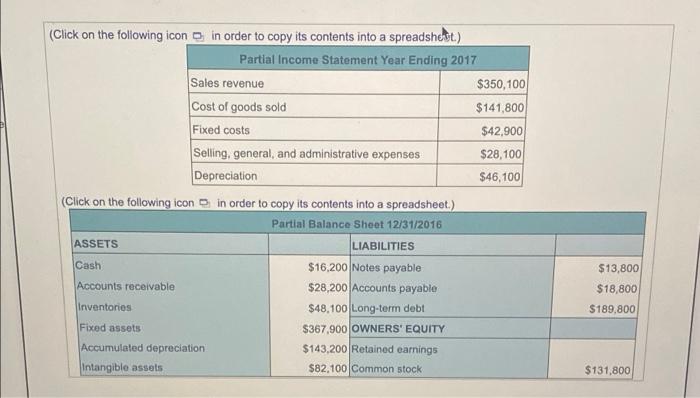

Cash flow to owners. Use the data from the following financial statements in the popup window. The company paid interest expense of $18,800 for 2017 and had an overall tax rate of 40% for 2017. Find the cash flow to owners for 2017 by parts and total, with the parts being dividends paid and increases in borrowing from owners (change in common stock and paid-in-surplus) The distributed earnings is $ (Round to the nearest dollar) Incor clear all Check answer a (Click on the following icon in order to copy its contents into a spreadshest.) Partial Income Statement Year Ending 2017 Sales revenue $350,100 Cost of goods sold $141,800 Fixed costs $42.900 Selling, general, and administrative expenses $28,100 Depreciation $46,100 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2016 ASSETS LIABILITIES Cash $16,200 Notes payable Accounts receivable $28,200 Accounts payable Inventorios $48,100 Long-term debt Fixed assets $367,900 OWNERS' EQUITY Accumulated depreciation $143,200 Retained earnings Intangible assets $82,100 Common stock $13,800 $18,800 $189,800 $131,800 Cash flow to owners. Use the data from the following financial statements in the popup window. The company paid interest expense of $18,800 for 2017 and had an overall tax rate of 40% for 2017. Find the cash flow to owners for 2017 by parts and total, with the parts being dividends paid and increases in borrowing from owners (change in common stock and paid-in-surplus) The distributed earnings is $ (Round to the nearest dollar) Incor clear all Check answer a (Click on the following icon in order to copy its contents into a spreadshest.) Partial Income Statement Year Ending 2017 Sales revenue $350,100 Cost of goods sold $141,800 Fixed costs $42.900 Selling, general, and administrative expenses $28,100 Depreciation $46,100 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2016 ASSETS LIABILITIES Cash $16,200 Notes payable Accounts receivable $28,200 Accounts payable Inventorios $48,100 Long-term debt Fixed assets $367,900 OWNERS' EQUITY Accumulated depreciation $143,200 Retained earnings Intangible assets $82,100 Common stock $13,800 $18,800 $189,800 $131,800