Answered step by step

Verified Expert Solution

Question

1 Approved Answer

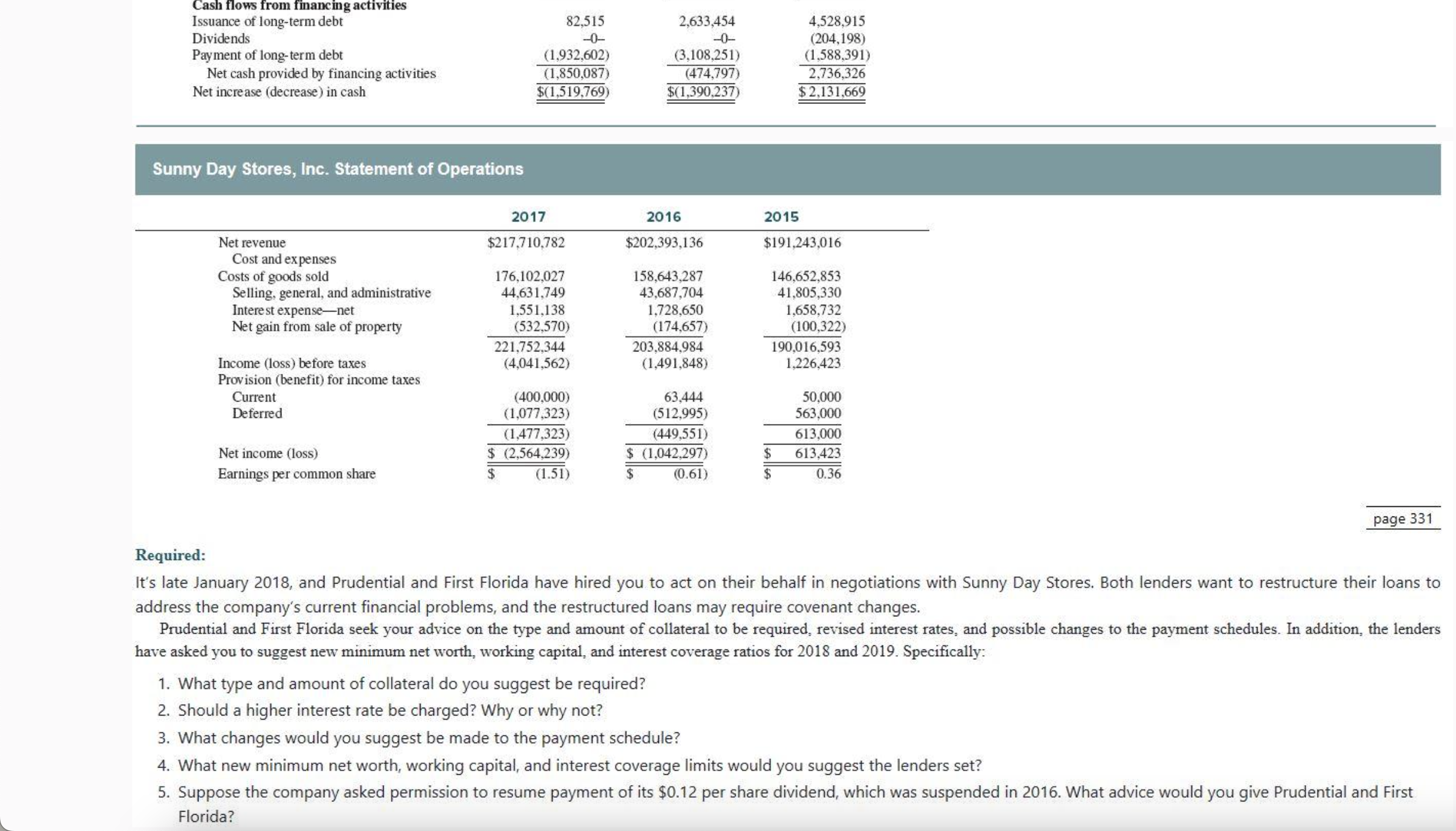

Cash flows from financing activities Issuance of long-term debt Dividends 82,515 2,633,454 -0- -0- Payment of long-term debt (1,932,602) (3,108,251) Net cash provided by

Cash flows from financing activities Issuance of long-term debt Dividends 82,515 2,633,454 -0- -0- Payment of long-term debt (1,932,602) (3,108,251) Net cash provided by financing activities Net increase (decrease) in cash (1,850,087) $(1,519,769) (474,797) $(1.390.237) Sunny Day Stores, Inc. Statement of Operations Required: 4,528,915 (204,198) (1,588,391) 2,736,326 $2,131,669 Net revenue 2017 $217,710,782 2016 $202,393,136 2015 $191,243,016 Cost and expenses Costs of goods sold 176,102,027 158,643,287 146,652,853 Selling, general, and administrative 44,631,749 43,687,704 41,805,330 Interest expense-net 1,551,138 1,728,650 1,658,732 Net gain from sale of property (532,570) (174,657) (100,322) 221,752,344 203,884,984 190,016.593 Income (loss) before taxes (4,041,562) (1,491,848) 1,226,423 Provision (benefit) for income taxes Current (400,000) 63,444 50,000 Deferred Net income (loss) (1,077,323) (512,995) 563,000 (1,477,323) $ (2,564,239) Earnings per common share $ (1.51) (449,551) $ (1,042.297) $ 613,000 $ (0.61) $ 613,423 0.36 page 331 It's late January 2018, and Prudential and First Florida have hired you to act on their behalf in negotiations with Sunny Day Stores. Both lenders want to restructure their loans to address the company's current financial problems, and the restructured loans may require covenant changes. Prudential and First Florida seek your advice on the type and amount of collateral to be required, revised interest rates, and possible changes to the payment schedules. In addition, the lenders have asked you to suggest new minimum net worth, working capital, and interest coverage ratios for 2018 and 2019. Specifically: 1. What type and amount of collateral do you suggest be required? 2. Should a higher interest rate be charged? Why or why not? 3. What changes would you suggest be made to the payment schedule? 4. What new minimum net worth, working capital, and interest coverage limits would you suggest the lenders set? 5. Suppose the company asked permission to resume payment of its $0.12 per share dividend, which was suspended in 2016. What advice would you give Prudential and First Florida?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started