Question

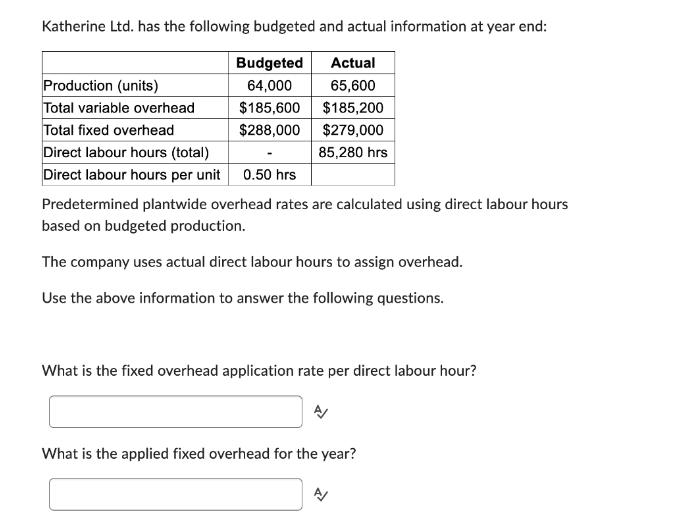

Katherine Ltd. has the following budgeted and actual information at year end: Budgeted Actual Production (units) 64,000 65,600 Total variable overhead $185,600 $185,200 Total

Katherine Ltd. has the following budgeted and actual information at year end: Budgeted Actual Production (units) 64,000 65,600 Total variable overhead $185,600 $185,200 Total fixed overhead $288,000 $279,000 Direct labour hours (total) 85,280 hrs 0.50 hrs Direct labour hours per unit Predetermined plantwide overhead rates are calculated using direct labour hours based on budgeted production. The company uses actual direct labour hours to assign overhead. Use the above information to answer the following questions. What is the fixed overhead application rate per direct labour hour? What is the applied fixed overhead for the year? A/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the fixed overhead application rate per direct labor hour divide the total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Cost Accounting A Managerial Emphasis

Authors: Srikant Datar, Madhav Rajan

17th Global Edition

129236307X, 9781292363073

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App