Answered step by step

Verified Expert Solution

Question

1 Approved Answer

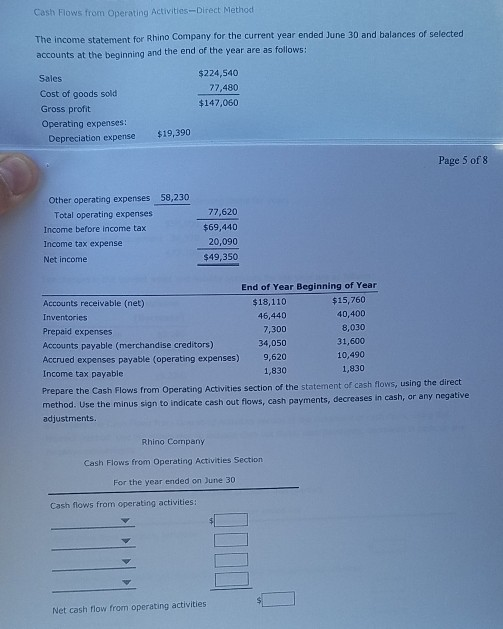

Cash Flows from Operating Activities-Direct Method The income statement for Rhino Company for the current year ended June 30 and balances of selected accounts at

Cash Flows from Operating Activities-Direct Method The income statement for Rhino Company for the current year ended June 30 and balances of selected accounts at the beginning and the end of the year are as follows: $224,540 77,480 $147,060 Sales Cost of goods sold Gross profit Operating expenses: Depreciation expense $19,390 Page 5 of 8 58,230 Other operating expenses Total operating expenses Income before income tax Income tax expense Net income 77,620 $69,440 20,090 $49,350 End of Year Beginning of Year Accounts receivable (net) $18,110 $15,760 Inventories 46,440 40,400 Prepaid expenses 7,300 8,030 Accounts payable (merchandise creditors) 34,050 31,600 Accrued expenses payable (operating expenses) 9,620 10,490 Income tax payable 1,830 1,830 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the direct method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Rhino Company Cash Flows from Operating Activities Section For the year ended on June 30 Cash flows from operating activities: Net cash flow from operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started