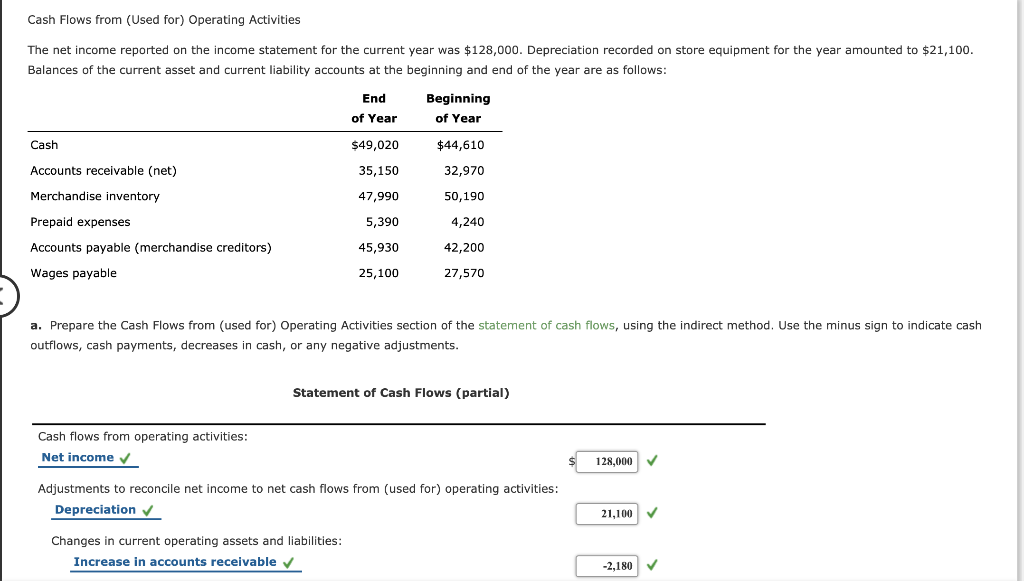

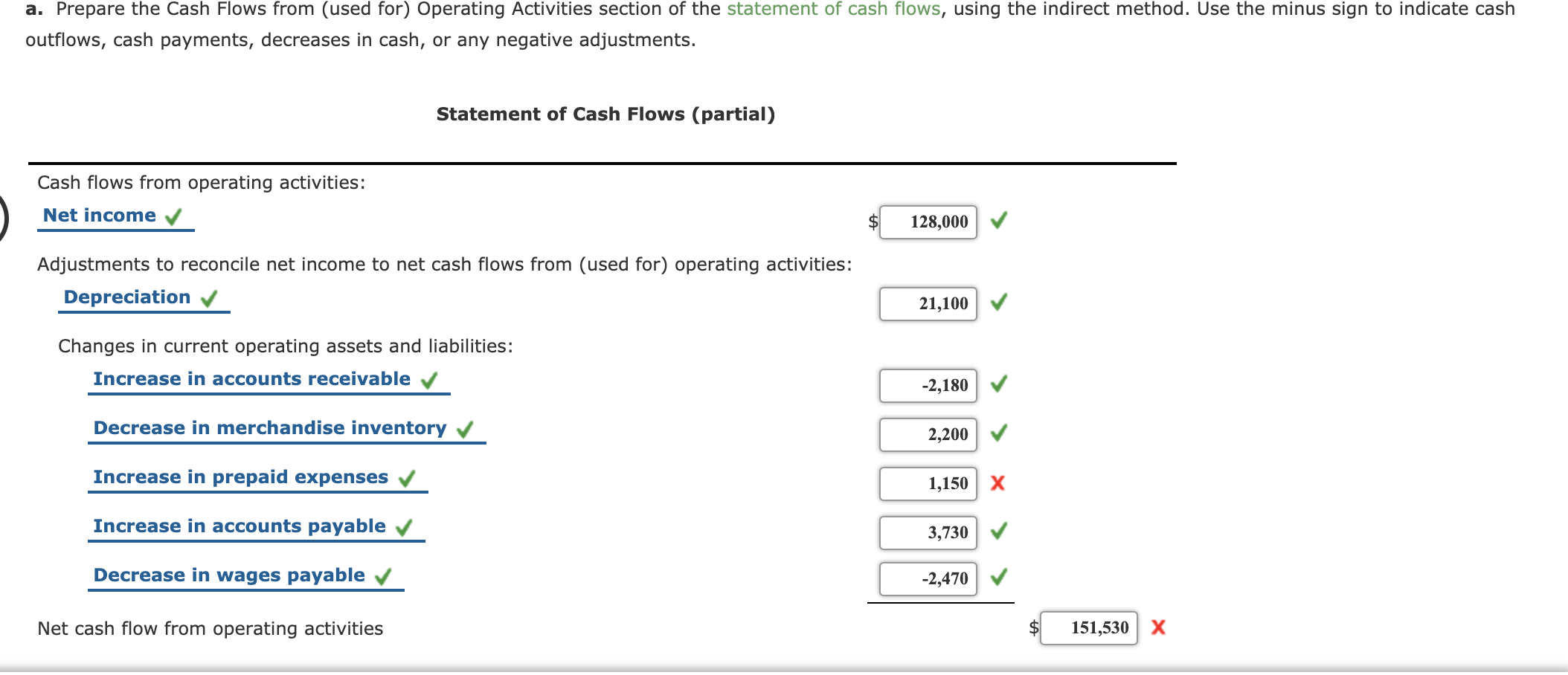

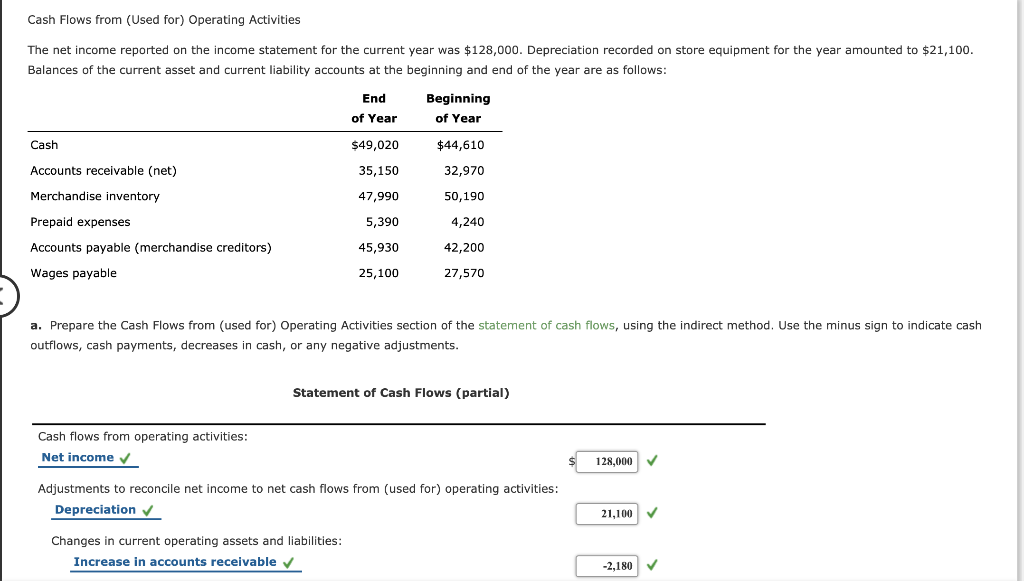

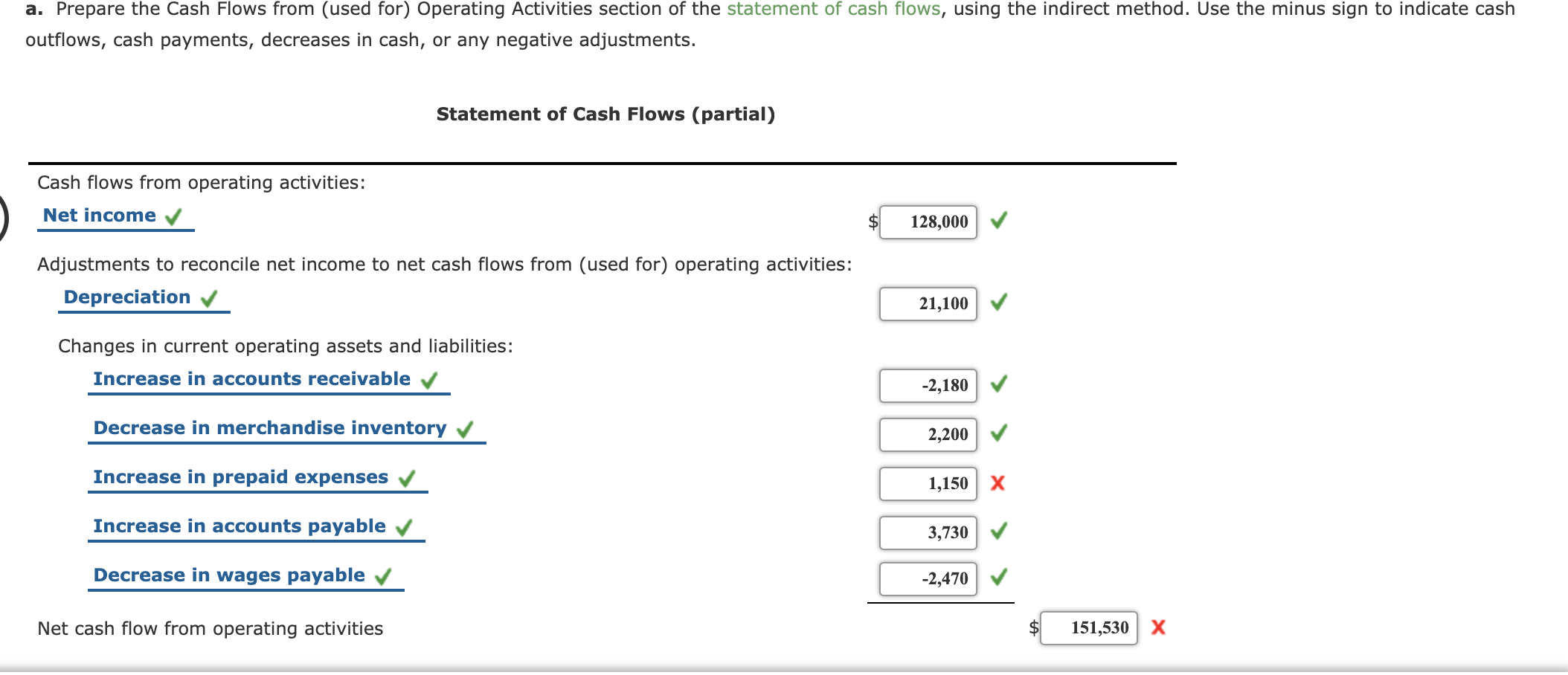

Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $128,000. Depreciation recorded on store equipment for the year amounted to $21,100. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $49,020 $44,610 Accounts receivable (net) 35,150 32,970 Merchandise inventory 47,990 50,190 Prepaid expenses 5,390 4,240 45,930 42,200 Accounts payable (merchandise creditors) Wages payable 25,100 27,570 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Net income 128,000 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation 21,100 Changes in current operating assets and liabilities: Increase in accounts receivable -2,180 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Net income 128,000 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation 21,100 Changes in current operating assets and liabilities: Increase in accounts receivable -2,180 Decrease in merchandise inventory 2,200 Increase in prepaid expenses 1,150 X Increase in accounts payable 3,730 Decrease in wages payable -2,470 Net cash flow from operating activities $ 151,530 Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $128,000. Depreciation recorded on store equipment for the year amounted to $21,100. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $49,020 $44,610 Accounts receivable (net) 35,150 32,970 Merchandise inventory 47,990 50,190 Prepaid expenses 5,390 4,240 45,930 42,200 Accounts payable (merchandise creditors) Wages payable 25,100 27,570 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Net income 128,000 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation 21,100 Changes in current operating assets and liabilities: Increase in accounts receivable -2,180 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Net income 128,000 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation 21,100 Changes in current operating assets and liabilities: Increase in accounts receivable -2,180 Decrease in merchandise inventory 2,200 Increase in prepaid expenses 1,150 X Increase in accounts payable 3,730 Decrease in wages payable -2,470 Net cash flow from operating activities $ 151,530