Answered step by step

Verified Expert Solution

Question

1 Approved Answer

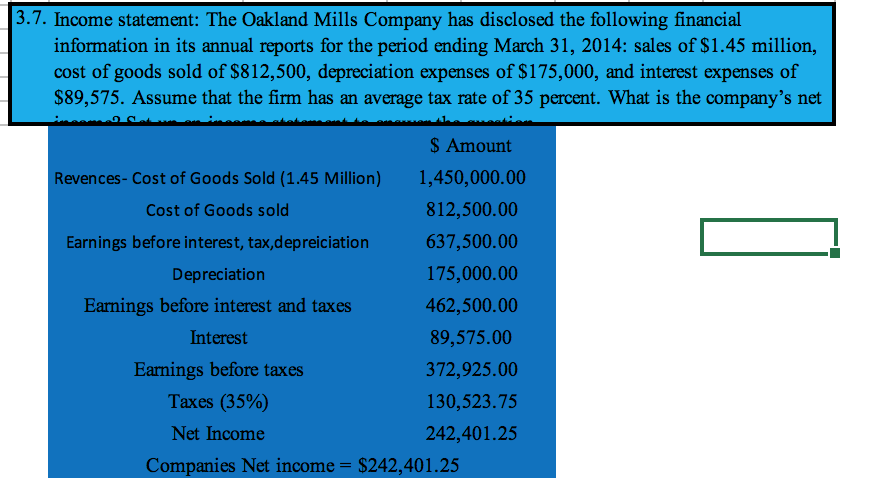

Cash flows: Given the data for Oakland Mills Company in Problem 3.7, compute the cash flows to investors from operating activity. 3.7. Income statement: The

Cash flows: Given the data for Oakland Mills Company in Problem 3.7, compute the cash flows to investors from operating activity.

3.7. Income statement: The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2014: sales of $1.45 million, cost of goods sold of $812,500, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. What is the company's net $ Amount Revences- Cost of Goods Sold (1.45 Million) 1,450,000.00 Cost of Goods sold 812,500.00 Earnings before interest, tax,depreiciation 637,500.00 Depreciation 175,000.00 Earnings before interest and taxes 462,500.00 Interest 89,575.00 Earnings before taxes 372,925.00 Taxes (35%) 130,523.75 Net Income 242,401.25 Companies Net income = $242,401.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started